Raymond Lifestyle listing: Will the big bet on Indian weddings pay off?

As Raymond splits into three businesses with specialised core areas, shareholders will watch out if these opportunities create value. The company has been a dominant player in the wedding apparel industry for the last 100 years

Gautam Singhania, chairman and managing director, Raymond Group. Image: INDRANIL MUKHERJEE / AFP

Gautam Singhania, chairman and managing director, Raymond Group. Image: INDRANIL MUKHERJEE / AFP

With the listing of shares of Raymond Lifestyle as a separate entity on the stock markets, the 100-year-old parent company is getting a fresh coat of paint, splitting its focus into three major businesses: Apparel, real estate and engineering. The demerger expected to be value accretive for shareholders is part of a long-drawn plan of Raymond, as the company turned around from major setbacks led by Covid with lower sales and large piling debt.

However, the debut of the new kid-on-the-block Raymond Lifestyle on the exchanges on Thursday does not seem to have won the confidence of stock market investors. The shares of Raymond Lifestyle were listed at Rs3,000 on the BSE. Soon after, its shares were locked at 5 percent lower circuit at Rs2,850, while its parent Raymond lost 4 percent during the day.

The company had announced a share exchange ratio of 4:5, which means four shares of Raymond Lifestyle would be allotted to shareholders for every five shares of Raymond that they held.

Shares of Raymond have been galloping in the last few weeks, hitting a high of Rs3,493 apiece in July. Raymond shares were trading ex-lifestyle business from July 11.

“It is a proud achievement for me personally. At the time of Covid everyone had written us off, stating ‘these guys will never come back’… never is a word that doesn't exist for me. I am very happy and proud to see this moment of demerger. Next year you will see the demerger of the real estate business. At the core of these is real shareholder value creation,” Gautam Singhania, chairman and managing director, Raymond Group, said in a media address.

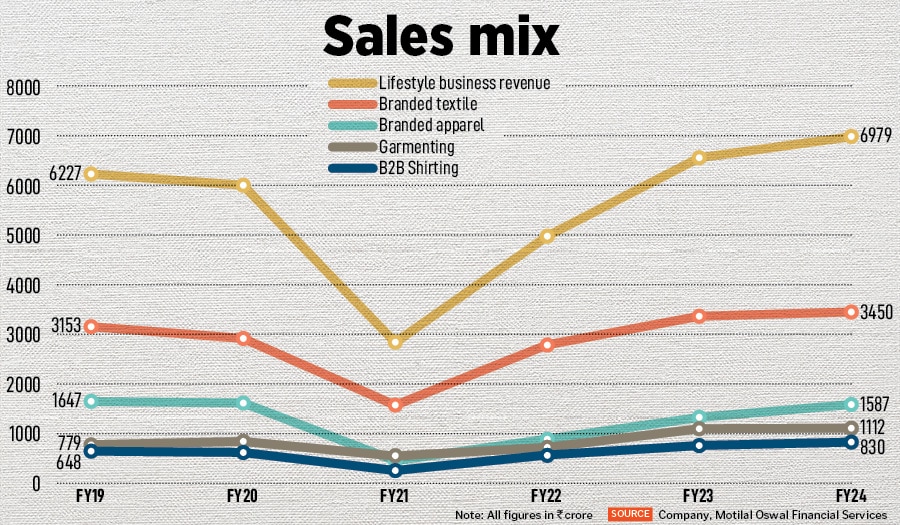

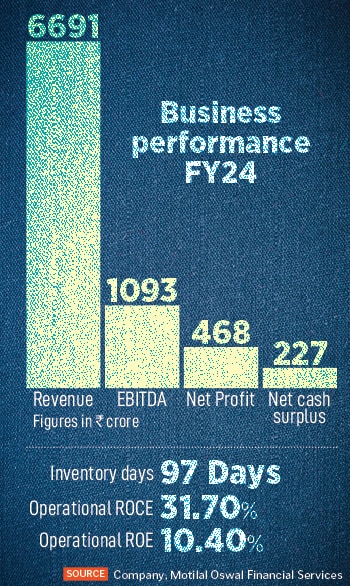

Gupta estimates 6 percent revenue and Ebitda growth for FY24-26 of Raymond Lifestyle, led by branded apparel and garmenting segments, and cash flow supported by branded textiles. “We ascribe EV/Ebitda of 15 times on FY26 to arrive at a valuation of Rs15,900 crore (per share price of Rs2,610),” he adds.

Gupta estimates 6 percent revenue and Ebitda growth for FY24-26 of Raymond Lifestyle, led by branded apparel and garmenting segments, and cash flow supported by branded textiles. “We ascribe EV/Ebitda of 15 times on FY26 to arrive at a valuation of Rs15,900 crore (per share price of Rs2,610),” he adds. Bansal explains that Raymond Lifestyle holds high aspirations—of 10 times scale in ‘Ethnix’ with 400 stores versus Rs100 crore from 114 stores in FY24. “Given a Rs200 crore capex toward garmenting, Raymond Lifestyle would stand among the global top three in our view, with a 10 million capacity. Garmenting enjoys macro tailwinds backed by diversification of global supply chains and potential free trade agreements. Despite faster growth in the relatively lower-margin non-textile businesses, Raymod Lifestyle sees steady margin gain, with branded apparel/garmenting scale-up,” he adds.

Bansal explains that Raymond Lifestyle holds high aspirations—of 10 times scale in ‘Ethnix’ with 400 stores versus Rs100 crore from 114 stores in FY24. “Given a Rs200 crore capex toward garmenting, Raymond Lifestyle would stand among the global top three in our view, with a 10 million capacity. Garmenting enjoys macro tailwinds backed by diversification of global supply chains and potential free trade agreements. Despite faster growth in the relatively lower-margin non-textile businesses, Raymod Lifestyle sees steady margin gain, with branded apparel/garmenting scale-up,” he adds.