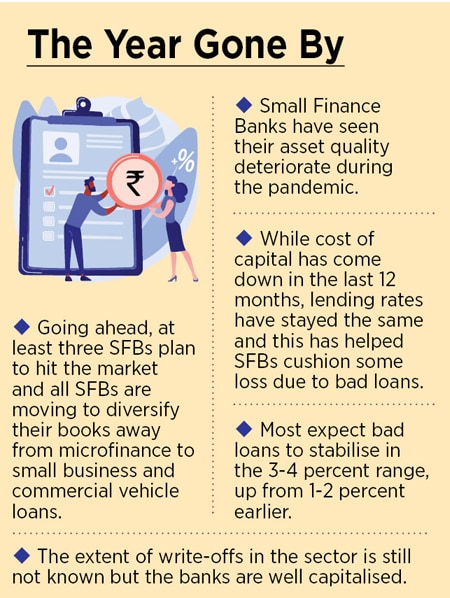

Small finance banks: Hurt but not out

The banks have seen their asset quality deteriorate due to the pandemic, but high capital buffers and lower cost of funds should help cushion the sector

Illustration: Chaitanya Surpur

Illustration: Chaitanya Surpur

Kheda, an hour away from Ahmedabad, has for long been a testing ground for Fincare Small Finance Bank. Kiran Babubhai Chauhan, 42, and his wife Rina, 40, low-income farmers in Parsantaj village in Kheda district, were keen to boost their income but lacked the means to do so. In 2009 Chauhan started borrowing from Fincare, when it was still a microlender (Disha Microfin). The Chauhans started small, with a Rs8000 loan in 2009 for dairy farming. They now borrow Rs45,000 a year.

“Ame aa loan lidho che pashu-palan ane kheti mate. (We have taken this loan for both the dairy business and the agriculture business),” says Chauhan, speaking in Gujarati. The couple sells the vegetables they grow, tindli (ivy gourd), galka (sponge gourd) and lilva dana (a type of bean), at the local regional market in Kheda town. “Corona na vakte amne shaak-bhaji vechvani takleef thi hati, jyare mothi market bandh hathi. Vyapar mandi maan hati and dheere dheere sudri rayuch. (During Covid-19 we had trouble selling vegetables at the local market as it often used to be shut, which hurt income. Business was sluggish and is just slowly starting to improve),” he says. The dairy business has been less impacted by the pandemic and is faring better, he adds.

Without disclosing his monthly income, Chauhan says he earns a profit of Rs 10,000 per month, enough for him to pay his monthly loan instalments of Rs 2,400.

“Aama aagar jata aa banne business maa sudhar karsoon, toh loan aagar jata joise. (We plan to expand these businesses further, so may take more loans),” Chauhan says. Business, he adds, is starting to pick up again after months of sluggishness and his loan installments are now current.

Rising NPAs and write-offs

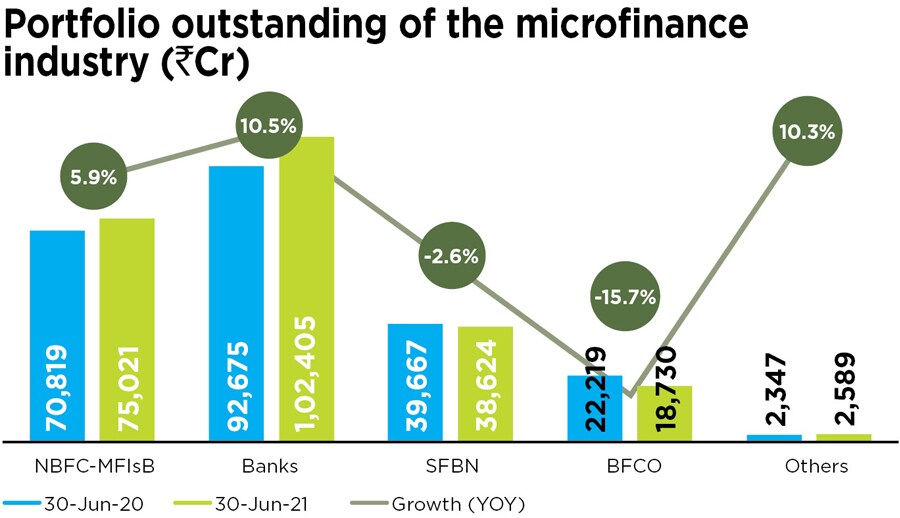

Chauhan’s experience is hardly unique. And as businesses were shut during the two lockdowns since March 2020 a host of small finance banks, which have a total of Rs38,624 crore in microfinance loans according to industry association Microfinance Network, were hit.