Super apps have never really worked in India. Can Tata Neu change that?

Tata group is banking on its large network of companies and getting its war chest ready for the long battle. Experts see potential in bringing all brands under one umbrella, but warn that on-boarding new users and retaining them won't be easy

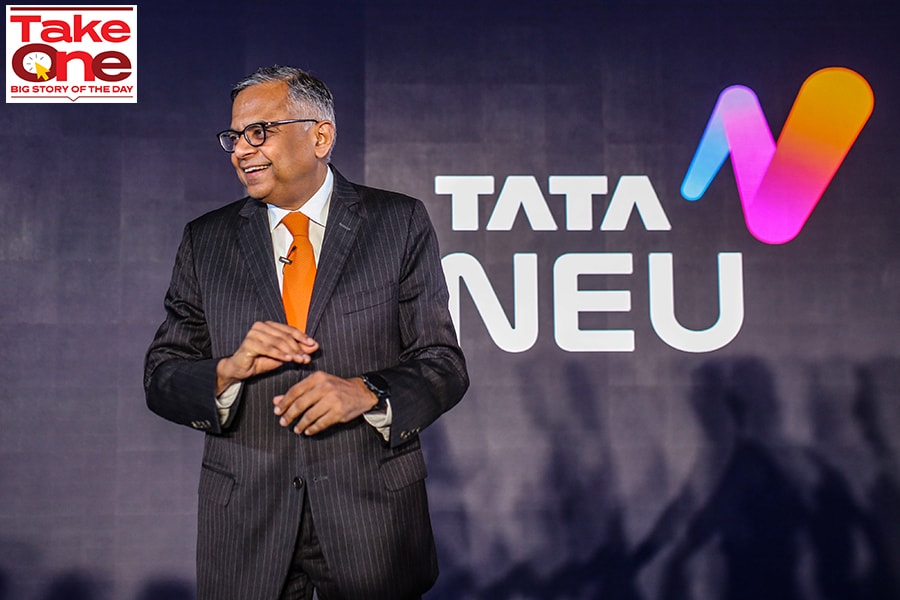

Natarajan Chandrasekaran, chairman of Tata Sons Ltd., during a news conference in Mumbai, India, on Thursday, April 14, 2022. Tata Digital Pvt.'s digital services platform, Tata Neu, will have in-house brands including Croma, Westside, AirAsia India, the Taj chain of luxury hotels and BigBasket, according to the group's website.

Image: Dhiraj Singh/Bloomberg via Getty Images

Natarajan Chandrasekaran, chairman of Tata Sons Ltd., during a news conference in Mumbai, India, on Thursday, April 14, 2022. Tata Digital Pvt.'s digital services platform, Tata Neu, will have in-house brands including Croma, Westside, AirAsia India, the Taj chain of luxury hotels and BigBasket, according to the group's website.

Image: Dhiraj Singh/Bloomberg via Getty Images

India’s tryst with super apps isn’t something new. From the likes of the Kavin Mittal-promoted Hike to Vijay Shekar Sharma-owned Paytm, numerous unicorns in India have tried their hand at building a super app without much success. A super app is a single app that clubs a bunch of services. Among the world’s biggest success stories is China-based WeChat, an app that offers a mash-up of WhatsApp, Facebook, Instagram, Yelp, Paypal, Twitter, Uber, Kindle, and many more under one platform.

In India, among others, super apps have tried offering everything from travel bookings to groceries, lifestyle items, and making payments under one platform. Yet, unlike China where WeChat alone has over a billion users, India’s smartphone user base with some 750 million users has largely denounced turning to super apps, and instead focussed on using multiple apps for their daily use. Perhaps that had to do largely with an Indian mindset akin to the physical world, where buyers tend to often try out numerous stores or shops before finalising a purchase.

For instance, despite its humongous presence in the ecommerce space in India, Amazon is yet to find similar success with its payment platform, Amazon Pay, housed within the app. Amazon offers services such as travel bookings and insurance on that platform, but is yet to find many takers. India’s instant real-time payments are led currently by the likes of PhonePe and Google Pay.

“With practically unlimited 4G and smartphones getting very good, the smartphone could now handle 50 apps, and there was no need for a super app,” Kavin Mittal, founder of Hike, had told Forbes India earlier on why the company decided to pivot from its super app plans in 2019.

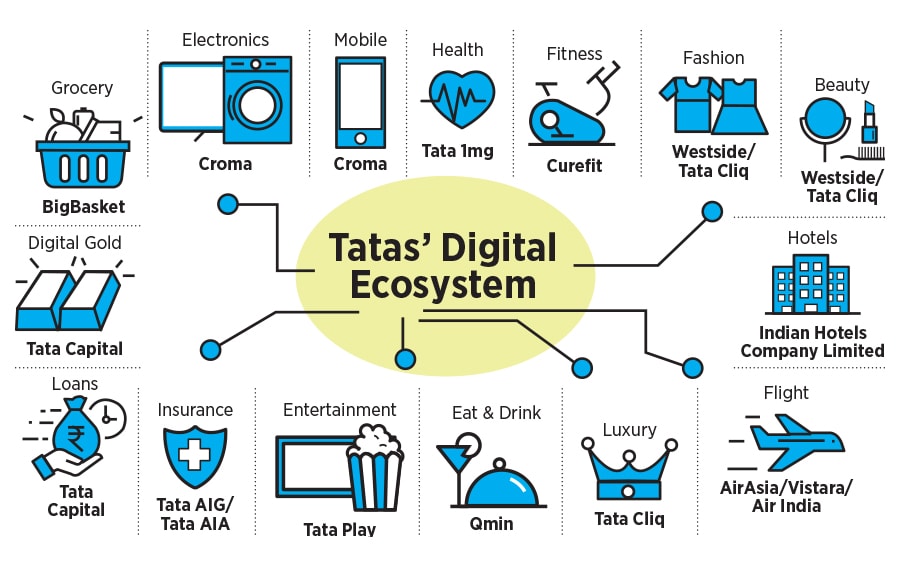

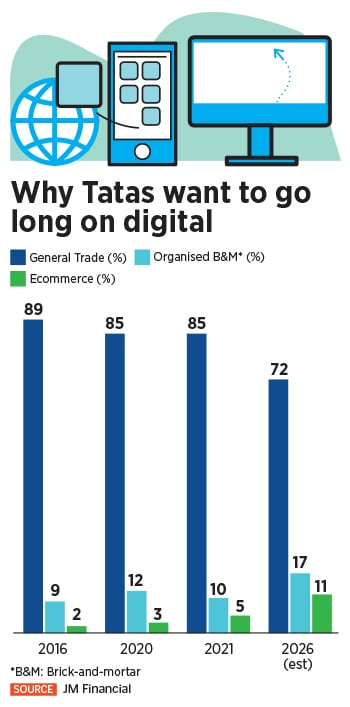

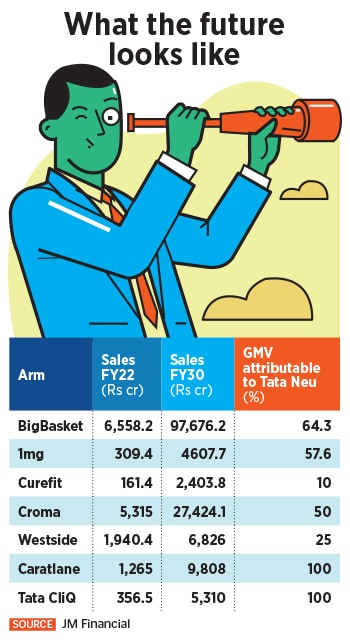

Yet, despite the limited success, super apps are slowly beginning to catch the fancy of numerous conglomerates, and leading that pack is the salt-to-steel conglomerate Tata group which had in April launched Tata Neu. Developed by Tata Digital, Tata Neu brings users a unified platform offering an omnichannel experience with loyalty at the centre of it, according to the group. The group had built up a war chest of some $2 billion to be deployed into the app that offers everything from shopping to a suite of financial offerings, including UPI, bill payments, loans and insurance.

Much of the differentiating factor that Tata Neu offers is its loyalty programme, a single reward points programme for all the brands. For example, points earned by spending on a hotel can be used by consumer appliances in Croma which gives consumers a lot more flexibility and incentive to transact through the app.

Much of the differentiating factor that Tata Neu offers is its loyalty programme, a single reward points programme for all the brands. For example, points earned by spending on a hotel can be used by consumer appliances in Croma which gives consumers a lot more flexibility and incentive to transact through the app. “Tata Neu is not just a mosaic of various consumer brands in one app,” the JM Financial report adds. “It is an ecosystem binding various Tata brands to one platform. More than stitching together various brands, it is trying to stitch together data of these disjointed customers. This is further evidenced by the fact that NeuPass—Tata Neu’s reward programme—allows users to earn and burn NeuCoins across channels, thus binding them to the Tata ecosystem rather than the Tata Neu app.” The rewards programme also has the potential to tie the customer to the Tata ecosystem in the long run, rather than on the app alone.

“Tata Neu is not just a mosaic of various consumer brands in one app,” the JM Financial report adds. “It is an ecosystem binding various Tata brands to one platform. More than stitching together various brands, it is trying to stitch together data of these disjointed customers. This is further evidenced by the fact that NeuPass—Tata Neu’s reward programme—allows users to earn and burn NeuCoins across channels, thus binding them to the Tata ecosystem rather than the Tata Neu app.” The rewards programme also has the potential to tie the customer to the Tata ecosystem in the long run, rather than on the app alone.