The charge of the great Indian SaaS brigade

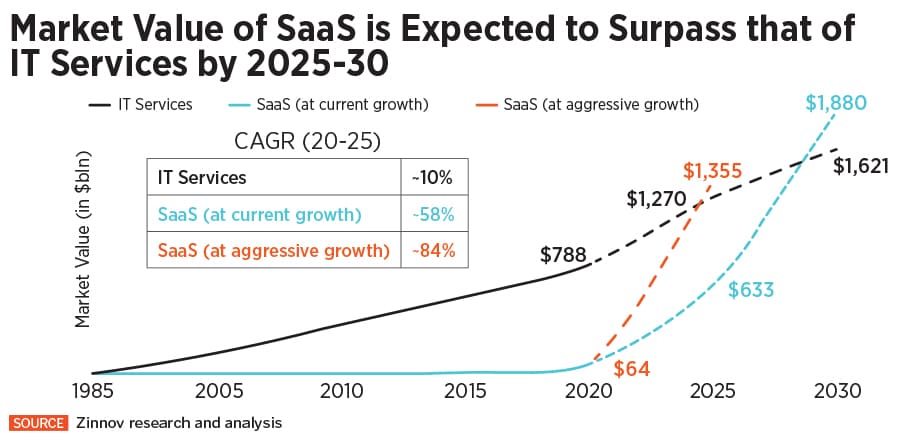

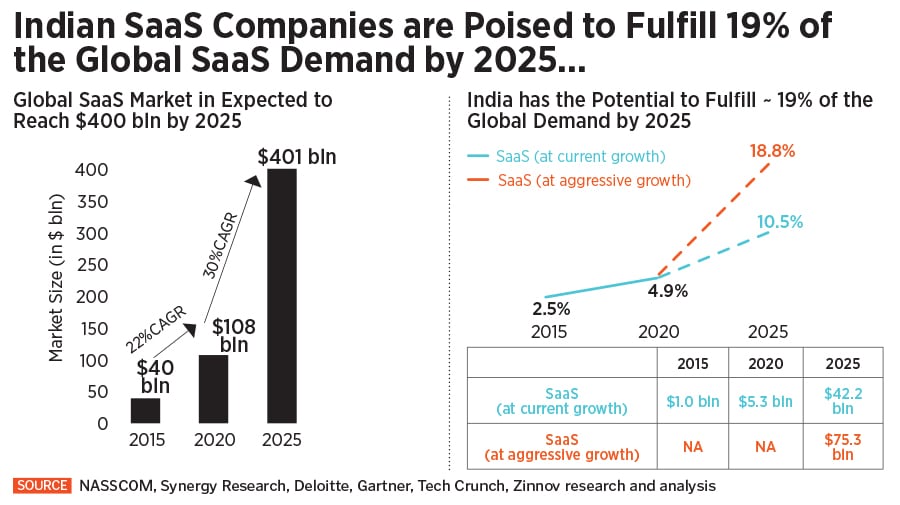

Freshworks's Nasdaq IPO brings global credibility to the India-to-Silicon-Valley playbook and, sooner or later, a $100-billion-market-cap company will emerge from the Indian SaaS ecosystem

Freshworks became the first Indian-founder-led cloud software venture to publicly list in the US, on September 22, after a successful initial public offering on the Nasdaq stock exchange

Freshworks became the first Indian-founder-led cloud software venture to publicly list in the US, on September 22, after a successful initial public offering on the Nasdaq stock exchange

When Manav Garg and Girish Mathrubootham teamed up to start a venture capital firm that would identify and support emerging entrepreneurs, they were coming full circle. It is also one illustration of how India’s software-as-a-service (SaaS) sector is ready for its next phase of growth.

Garg, co-founder and CEO of Eka Software Solutions, and Mathrubootham, co-founder and CEO of Freshworks, had started out at a time when startups weren’t particularly fashionable in India and cloud software even less so.

They had tackled many of their challenges on their own, without the Bengaluru-Chennai-Pune-to-Silicon-Valley playbook that has become the standard today. The one US-India role model that did exist, in the form of Zoho, was fiercely privately held by founders Sridhar Vembu and his family, whereas India’s startup ecosystem decidedly evolved around the VC-funding-led model.

Accel, which gave Freshworks its first million dollars, and continued to invest in the company, will now reap an outsized return on its investments with Freshworks going public on the Nasdaq and promptly surging more than 30 percent on Day 1 as the world recognised the value of its operating model.

And founders like Garg and Mathrubootham—who have already been investing in other startups as angel investors in their personal capacities, with a combined portfolio of over 100 startups today—are now ready to scale up and institutionalise their efforts to pay it forward.