The comeback is stronger than the setback: Byju's founder to employees

Under public scrutiny for losses, layoffs and a toxic work culture, the edtech unicorn says last fiscal the strongest, FY21 losses cut down to half

Byju’s has been under great public scrutiny from quite some time. From the allegations of miss-selling courses to parents to having a toxic sales culture and also laying off employees, it’s in a turmoil

Illustration: Chaitanya Dinesh Surpur

Byju’s has been under great public scrutiny from quite some time. From the allegations of miss-selling courses to parents to having a toxic sales culture and also laying off employees, it’s in a turmoil

Illustration: Chaitanya Dinesh Surpur

In an email that he sent to 50,000 employees on Monday, Byju Raveendran borrowed a quote from the movie Rocky Balboa and said the year hasn’t been “all sunshine and rainbows” for the company. After an over-a-year wait, on September 14, Byju’s revealed the company’s FY21 (2020-21) financials: The world’s most-valued edtech company Think & Learn Pvt Ltd, which runs the education platform, has now become the world’s most expensive edtech company for investors after a decline in its FY21 revenue that led to an increase in its revenue multiple.

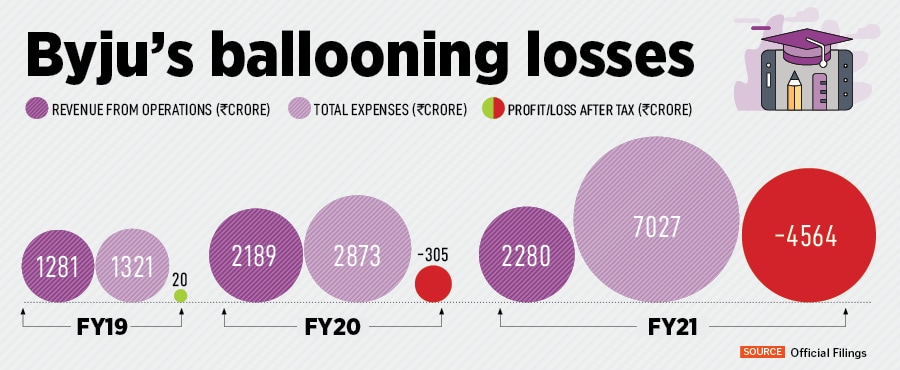

The company incurred a total loss of Rs 4,589 crore for FY21, a 20x jump from Rs 232 crore in FY20. Their total income on a consolidated basis declined by 3.3 percent to Rs 2,428.3 crore in FY21 from Rs 2,511.7 crore in the previous year. Byju’s, which has seen a degrowth in FY21, claims that much of the losses are due to changes in the way it recognises multi-year revenue such as that earned from its streaming services for recorded classes. The edtech giant readjusted its unaudited revenues for FY21 following two key changes sought by its official audit firm Deloitte Haskins & Sells.

For instance, the learner pays Rs 50,000 for a two-year course to prepare for an entrance exam. Earlier, the company would recognise the entire Rs 50,000 as revenue at the time it was paid. Now it is spread over two years, taking the period of contract into account. Because of this, Raveendran said, around 40 percent of the revenue collected in FY21 got deferred, which would have otherwise seen revenue growth in the region of 60-65 percent.

The company claims to have received a clean and unqualified audit report for FY21. Around 40 percent of their pre-audit revenue for FY21 has been ‘deferred’ to subsequent years but the incurred costs have all been subsumed in the same year. “It means this entire deferred revenue will be directly contributing to our profits in FY22 and FY23. The change in our accounting methodology and the high cost of multiple acquisitions reflected in the ₹4,500 crore loss figure for FY21.”

Byju’s has been under great public scrutiny from quite some time. From the allegations of miss-selling courses to parents to having a toxic sales culture and also laying off employees, it’s in a turmoil. But the founder and CEO is quite optimistic about the company’s growth, as he writes to his employees, “The last financial year (FY22, ending March 2022) was our best year so far and 2022-23 is set to be an even stronger year. The comeback, as they say, is always stronger than the setback. Going forward in FY23 and beyond, we will combine growth with efficiency to ensure sustainability. We have already started shifting our focus towards profitable growth. The overall idea is to allocate resources effectively in order to maximise impact.”