The curious case of the Paytm buyback

Though buybacks reduce the number of shares in the market and so increase the price of the remaining shares, since the day of Paytm's buyback announcement the stock price has slipped over 10 percent

Since listing, investors in the IPO of One97 Communications have lost almost 75 percent of their investment. Illustration: Chaitanya Surpur

Since listing, investors in the IPO of One97 Communications have lost almost 75 percent of their investment. Illustration: Chaitanya Surpur

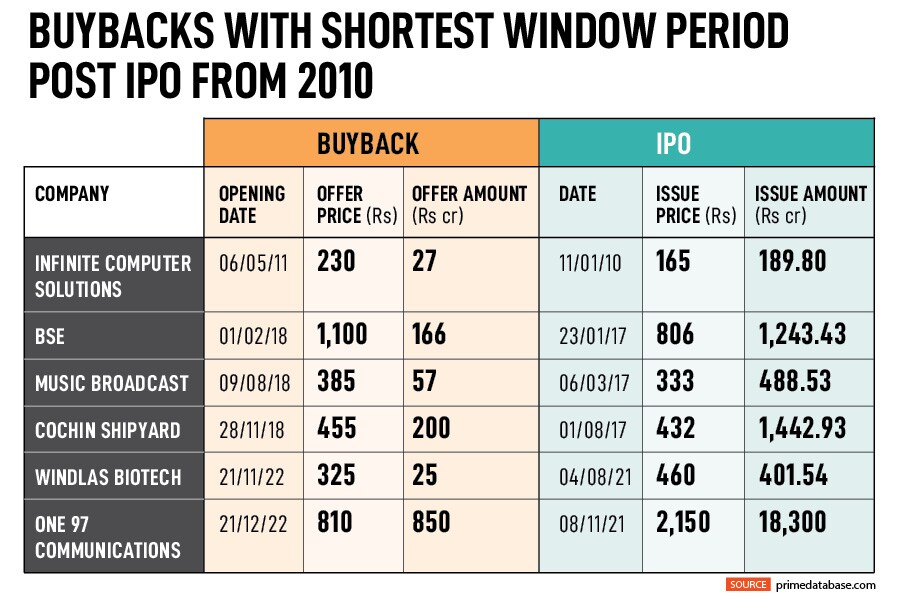

On December 13, new age fintech company One97 Communications which operates Paytm, announced the board’s approval for share buyback worth Rs 850 crore, just a year after the company went public on November 18, 2021. The company will be buying back shares at a price not exceeding Rs 810, a 50 percent premium over that day’s closing price of Rs 539.50. The company’s directors as well as key management personnel will not sell any shares during the buyback period.

On December 8, Paytm had announced a proposal for buyback of its shares saying “prevailing liquidity/ financial position, a buyback may be beneficial for our shareholders”. That raised concerns among investors while the stock has been on a downward slope.

The initial public offering (IPO) of Paytm worth Rs 18,300 crore had priced its issue at Rs 2,150 a piece. The issue, subscribed 1.89 times, was a mix of offer-for-sale (OFS) and fresh issuance of shares. Since listing, investors in the IPO of One97 Communications have lost almost 75 percent of their investment.