The good, bad and ugly of stock trade training courses

The Indian stock market has witnessed an increase in traders becoming trainers, but there are both profits and pitfalls in the business

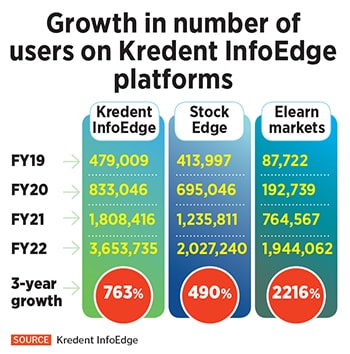

Vivek Bajaj cofounder of Elearnmarkets

Image: Debarshi Sarkar for Forbes India

Vivek Bajaj cofounder of Elearnmarkets

Image: Debarshi Sarkar for Forbes India

PR Sundar grew up in a middle-class household. After he moved to Gujarat for a teaching job, he found himself surrounded by stock market experts, and he too decided to invest in the stock market. Due to a lack of capital and knowledge, he was only active in the primary markets, applying for initial public offerings (IPOs) and selling them for a small profit. He received a fantastic offer to teach in Singapore when he was 29 years old, where his first month's salary was roughly 20 times higher than in India.

Sundar returned to India at the age of 44 and decided to re-enter the capital markets, this time with more money saved. He decided to pursue a career in option selling, after dabbling in the cash and futures markets. “I trade based on probability because I am a mathematician. The winning probability in the cash and futures markets is 50 percent. It is much higher in option selling,” he says.

Around the time Sundar arrived in India, a lot was going for options trading. Following the Lehman Brothers bankruptcy, people began to recognise the value of options, and the volume of options began to rise. This, combined with the Securities and Exchange Board of India's (Sebi) lower taxation and the introduction of discount brokerage in India, made option selling a very profitable business. The National Stock Exchange (NSE) is now the world's largest derivatives exchange, and Nifty Bank, which debuted around the same time, has grown to become the most traded index option.

Sundar's passion for teaching resurfaced around 2013-14, when his broker recognised him as one of the few clients with consistent profits. Sundar went from being a trader to a trainer after he was approached by his broker to teach others. “My first few trainings were free, and the broker initially covered the basic costs associated with training. Eventually, I began to appear as an expert on a local television station, Sun TV,” he says.

People began contacting him for workshops, for which he charged Rs 3,000 each. He has built a name for himself over the years, and his two-day workshop now costs Rs 60,000, while his mentorship costs Rs 20 lakh. His mentorship programme, which began in 2019, cost Rs 3 lakh-plus GST back then. Sundar recommends a capital of Rs 10 lakh and Rs 25 lakh for one-day and two-day workshops, respectively, and a minimum capital of Rs 2 crore for mentorship. “Mentorship is like a practical training programme where people come to my office and stay with me for a month or two to watch me trade.” He typically attracts high net worth individuals (HNIs) as clients due to the high minimum capital requirements. His growth has been phenomenal over the last two years, both of his courses and his YouTube channel.

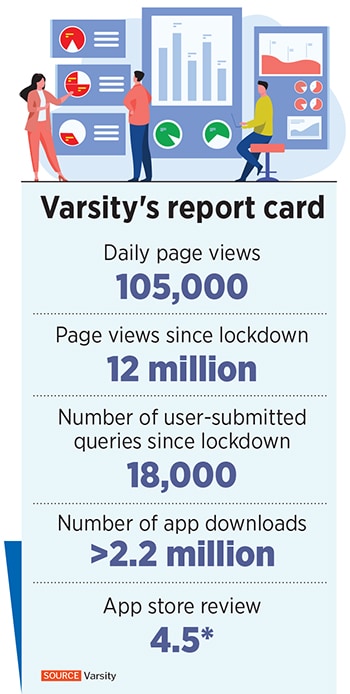

Varsity offers content on everything from the fundamentals of the

Varsity offers content on everything from the fundamentals of the

On December 1, Rangappa posted a video on Twitter showing how simple it is to create fake profit and loss screenshots on Zerodha's trading platform.

On December 1, Rangappa posted a video on Twitter showing how simple it is to create fake profit and loss screenshots on Zerodha's trading platform.  Following completion of training courses, newbie trainers are typically added to a Telegram group where the trainer suggests stocks to buy or sell. “These groups could be used to pump-and-dump stocks, which is when you find an illiquid stock and buy it before suggesting it to others. You can drive up the price of that stock even if 100 people buy it,” says the anonymous trainer. The Telegram group operator then sells the stock at a higher price, accomplishing two goals. Firstly, they make money, and then they can share screenshots of their stock picks and how their group members made money, which helps them recruit more trainees.

Following completion of training courses, newbie trainers are typically added to a Telegram group where the trainer suggests stocks to buy or sell. “These groups could be used to pump-and-dump stocks, which is when you find an illiquid stock and buy it before suggesting it to others. You can drive up the price of that stock even if 100 people buy it,” says the anonymous trainer. The Telegram group operator then sells the stock at a higher price, accomplishing two goals. Firstly, they make money, and then they can share screenshots of their stock picks and how their group members made money, which helps them recruit more trainees.