First the pandemic, then war affect markets, economy but all is not lost

Rising fuel prices and inflationary pressures have led economists and analysts to lower growth and earning forecasts. However, they are bullish there will be pockets of growth and long-term fundamentals will remain intact, providing a cushion to long-term investors

Already hurt by foreign fund outflows since October 2021, Indian equities continue to slide

Illustration: Chaitanya Dinesh Surpur

Already hurt by foreign fund outflows since October 2021, Indian equities continue to slide

Illustration: Chaitanya Dinesh Surpur

The start of FY23 will, for the third year in a row, be a tricky one for investors. The debate of hedging for inflation has intensified rapidly in the past few weeks, as global crude oil and commodity prices have surged after Russia’s attack on Ukraine. The year had started with growing murmurs of how central banks across the world will start to raise interest rates to tackle rising inflation as their economies grew out of sluggish business activity during the pandemic.

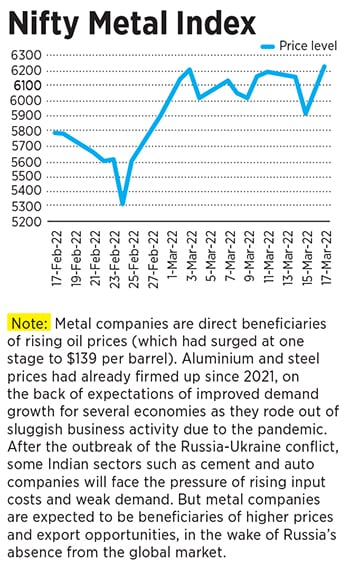

Global supply chains have been disrupted because of the Russia-Ukraine conflict, with economic sanctions against Russia. This has started to impact global trade, since Russia is a leader across several industrial and agro commodities: It accounts for nearly 17 percent of global natural gas production, 10 percent of global crude oil production, 9 percent of global aluminum trade and is the largest exporter of wheat, commanding 18 percent of international exports.

Already hurt by foreign fund outflows since October 2021, Indian equities continue to slide. India’s Nifty 50 has corrected about 4.5 percent since the Ukraine invasion, but is down by about 12 percent from its October-peak. The India VIX, the volatility index based on the Nifty 50 index, hit a 15-month-high of 31.98 on March 4, largely due to the weakening macroeconomic news.

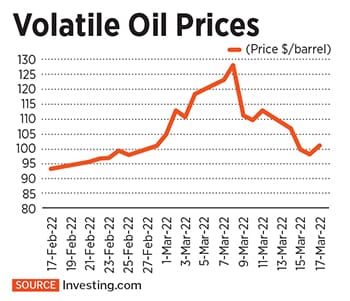

In March, Brent oil hit a 14-year high of $139 per barrel and retail inflation in India—based on the Consumer Price Index—stood at an eight-month high of 6.07 percent in February, data on March 15 showed. This is well above the 4.5 percent inflation which the Reserve Bank of India (RBI) has projected for FY23.

Several financial institutions have started to revise downwards their FY23 growth forecast. Citi projects India to grow at 8 percent in FY23 from an earlier 8.3 percent, while Nomura forecasts, in a worst case scenario, 6.5 percent.

It also means that central banks will need to walk the tightrope, managing

It also means that central banks will need to walk the tightrope, managing

He has also lowered the Sensex target for December 2022 by 11 percent, which works out to 62,000 in a best-case scenario. It assumes that the

He has also lowered the Sensex target for December 2022 by 11 percent, which works out to 62,000 in a best-case scenario. It assumes that the