How to tame the elephant in the economy

The RBI expects inflation to peak by the quarter ending March, but that may depend on a clutch of imponderables

The rise in core inflation—which excludes food and fuel—is a big concern. The central bank largely uses consumer surveys to gauge inflation, and expects CPI or retail inflation to peak at 5.7 percent in the fourth quarter of the current fiscal. Illustration: Chaitanya Dinesh Surpur

The rise in core inflation—which excludes food and fuel—is a big concern. The central bank largely uses consumer surveys to gauge inflation, and expects CPI or retail inflation to peak at 5.7 percent in the fourth quarter of the current fiscal. Illustration: Chaitanya Dinesh Surpur

"Price stability remains the cardinal principle for monetary policy. Our motto is to ensure a soft landing that is well timed."

- Shaktikanta Das, RBI governor

This statement reflects the unrest in the minds of most global central bankers as they precariously tackle 'stubborn inflation' and focus on the 'overarching priority at this juncture to broaden the growth impulses’. In this spirit, Reserve Bank of India (RBI) Governor Shaktikanta Das checked all the boxes in his earnest attempt to assure the Street that the central bank would remain 'accommodative as long as necessary to revive and sustain growth on a durable basis', even though 'the monetary policy is reaching an inflection point’.

In line with this, on Wednesday, the Monetary Policy Committee (MPC) decided to retain its accommodative stance, and the benchmark rate was left unchanged at a historic low of 4 percent. The status-quo policy outcome was on expected lines despite mounting inflationary concerns. Indira Rajaraman, veteran economist and former director, RBI Central Board, says, "The situation right now is extremely difficult, and one cannot justify a rate cut at all. But, given the uncertainty around the omicron variant, RBI cannot justify a rate hike either."

Reining in inflation

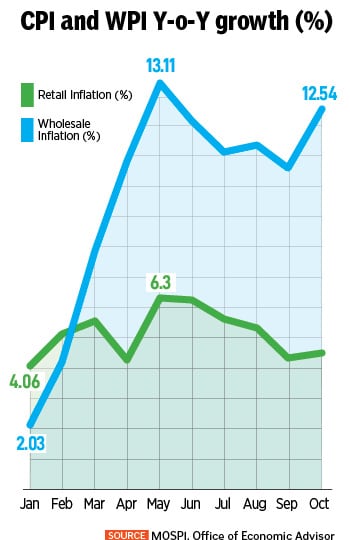

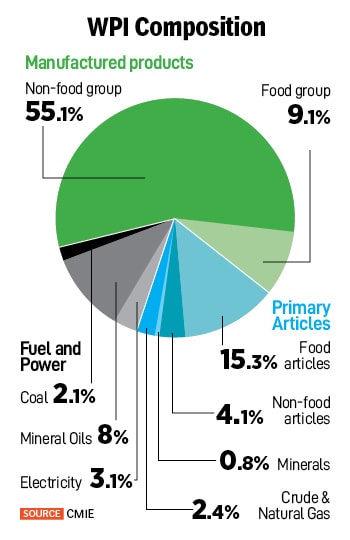

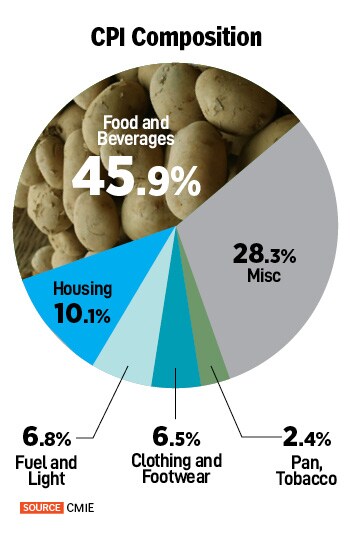

On the face of it, inflation seems to be aligned with the MPC's target of 4 percent [with a +/- margin of 2 percent]. But many economists are wary of underlying dynamics masking the 'real' inflationary pressure, given the overall composition of the consumer price index (CPI) basket [Exhibit 1]. The cost of 131 out of 293 (or 45 percent) low-weightage items in the CPI basket rose by over 6 percent. So, the headline inflation at 4.5 percent in October could have been higher if not for the recent moderation in food prices (which was largely due to statistical reasons), says Madan Sabnavis, chief economist, Care Ratings. The rise in core inflation—which excludes food and fuel—is a big concern. The central bank largely uses consumer surveys to gauge inflation, and expects CPI or retail inflation to peak at 5.7 percent in the fourth quarter of the current fiscal [Exhibit 2]. But, the wholesale price index (WPI) basket [Exhibit 3]—comprising over 55 percent non-food items—was burning red hot at 12.5 percent in October, and crossed the double-digit barrier for the first time in April [Exhibit 4]. Raghuram Rajan, former RBI governor, had replaced the use of the WPI with the CPI for setting the benchmark rate.

The rise in core inflation—which excludes food and fuel—is a big concern. The central bank largely uses consumer surveys to gauge inflation, and expects CPI or retail inflation to peak at 5.7 percent in the fourth quarter of the current fiscal [Exhibit 2]. But, the wholesale price index (WPI) basket [Exhibit 3]—comprising over 55 percent non-food items—was burning red hot at 12.5 percent in October, and crossed the double-digit barrier for the first time in April [Exhibit 4]. Raghuram Rajan, former RBI governor, had replaced the use of the WPI with the CPI for setting the benchmark rate.

To be sure there are several factors in play that could considerably push inflation in the coming months, and RBI's projection of inflation peaking in March could be optimistic at this point. For example, with state elections round the corner, there is the likelihood of populist measures, like an increase in minimum support prices (MSP) which could add to inflation woes. Similarly, telecom companies have hiked or are looking to hike tariffs to boost ARPUs (average revenue per user), and this could potentially offset any benefits from duty reductions on oil. In fact, Nandi sees room for a rate hike of 100 basis points in calendar year 2022.

To be sure there are several factors in play that could considerably push inflation in the coming months, and RBI's projection of inflation peaking in March could be optimistic at this point. For example, with state elections round the corner, there is the likelihood of populist measures, like an increase in minimum support prices (MSP) which could add to inflation woes. Similarly, telecom companies have hiked or are looking to hike tariffs to boost ARPUs (average revenue per user), and this could potentially offset any benefits from duty reductions on oil. In fact, Nandi sees room for a rate hike of 100 basis points in calendar year 2022.  There has been some “fine-tuning” as the RBI governor elaborated a 14-day VRRR (Variable Rate Reverse Repo) auction as the primary mode to mop up excess liquidity from January 1, 2022. This is in addition to tools like OMOs (Open Market Operations) to manage liquidity operations. In essence, this is as effective as a reverse repo hike, according to market participants. They see this in line with the central bank’s objective “to ensure that financial conditions are rebalanced in a systemic, calibrated and well-telegraphed manner while preventing build-up of financial stability risks.”

There has been some “fine-tuning” as the RBI governor elaborated a 14-day VRRR (Variable Rate Reverse Repo) auction as the primary mode to mop up excess liquidity from January 1, 2022. This is in addition to tools like OMOs (Open Market Operations) to manage liquidity operations. In essence, this is as effective as a reverse repo hike, according to market participants. They see this in line with the central bank’s objective “to ensure that financial conditions are rebalanced in a systemic, calibrated and well-telegraphed manner while preventing build-up of financial stability risks.”