Bull or bear, long-term stock market investors win

Conserve some cash, but don't be afraid to make staggered investments in blue-chip stocks in current times of high uncertainty and market volatility

The phenomenal equity returns in the summer of 2020 and 2021 have given investors a strong reason to keep the spirit up, as they try hard to match steps with the beats of this highly volatile market

Image: Chaitanya Dinesh Surpur

The phenomenal equity returns in the summer of 2020 and 2021 have given investors a strong reason to keep the spirit up, as they try hard to match steps with the beats of this highly volatile market

Image: Chaitanya Dinesh Surpur

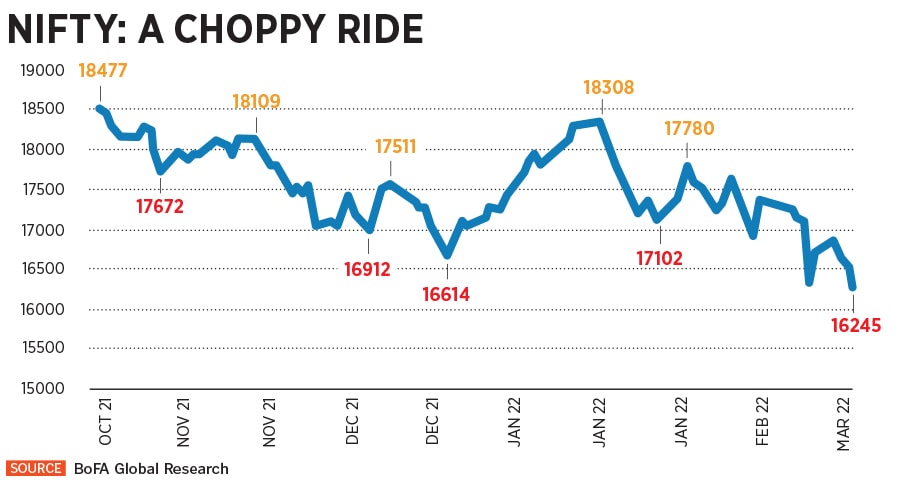

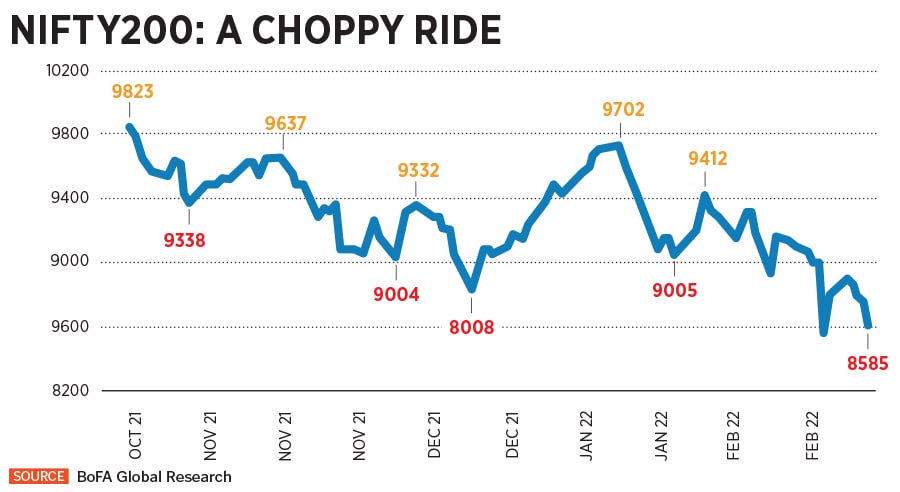

Rock and roll of the bulls, or jazz of the bears, seemingly, stock investors are unwilling to leave the party yet. The phenomenal equity returns in the summer of 2020 and 2021 have given investors a strong reason to keep the spirit up, as they try hard to match steps with the beats of this highly volatile market.

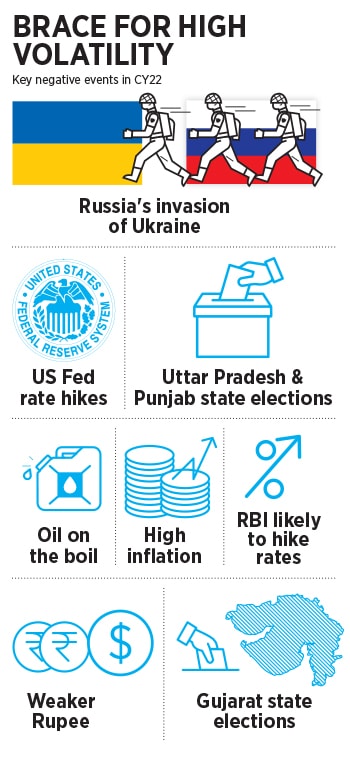

However, there are signs of fatigue setting in as risks increase and uncertainty takes a toll on outlook for returns.

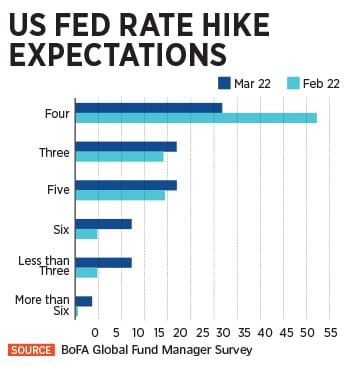

Central banks have been preparing to turn off the liquidity tap as they wrestle inflation. After nearly four years, the US Federal Reserve hiked interest rates by 25 basis points on March 16, as it expects inflation to remain elevated above 4 percent. The US Fed has indicated series of rate hikes to bring the benchmark rate to 2.8 percent (see chart).

“I think the US Fed rate hike has pretty much been discounted,” says Hiren Ved, founder, director, and CIO at Alchemy Capital Management.

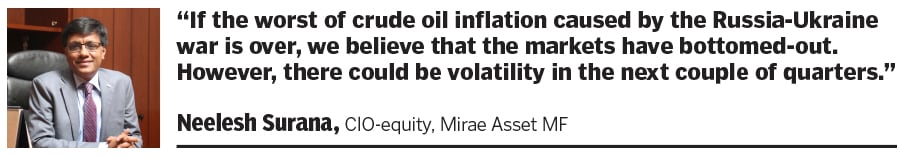

Neelesh Surana, CIO-equity, Mirae Asset Investment Managers, says the stability of crude prices is more important than the pace of interest rate increase in the US, which has been anticipated for some time. “It’s the end-of-an-era of low interest rate and under the new regime, global equities would behave differently. Pockets of froth created due to low interest rates would normalise,” he adds.

Furthermore, it remains to be seen if the

Furthermore, it remains to be seen if the

In times of such volatility, Surana advises investors to consider staggered investments in equities through SIPs or STPs. “Investors who are underweight equities should buy the dip and go equal weight. We believe that India has strong and sustainable drivers for secular growth, and thus our view on equities is constructive. In this context, we would advise investors not to time the market and invest in equities in a disciplined way for the long term,” he adds.

In times of such volatility, Surana advises investors to consider staggered investments in equities through SIPs or STPs. “Investors who are underweight equities should buy the dip and go equal weight. We believe that India has strong and sustainable drivers for secular growth, and thus our view on equities is constructive. In this context, we would advise investors not to time the market and invest in equities in a disciplined way for the long term,” he adds.

The market momentum will closely hinge on the trajectory of oil prices in the coming months. “I don't see more than a 10 percent downside on the markets from the current levels unless oil prices increase to $200 a barrel—in which case all bets are off. As things stand today, it would be fair to say that our upside is capped at 17,500-18,000 at least for the next three to four quarters. The situation is very dynamic and it is very difficult to say what will happen for the full year,” points out Ved.

The market momentum will closely hinge on the trajectory of oil prices in the coming months. “I don't see more than a 10 percent downside on the markets from the current levels unless oil prices increase to $200 a barrel—in which case all bets are off. As things stand today, it would be fair to say that our upside is capped at 17,500-18,000 at least for the next three to four quarters. The situation is very dynamic and it is very difficult to say what will happen for the full year,” points out Ved.