The long and short of the stock market rally. How far can the bulls run?

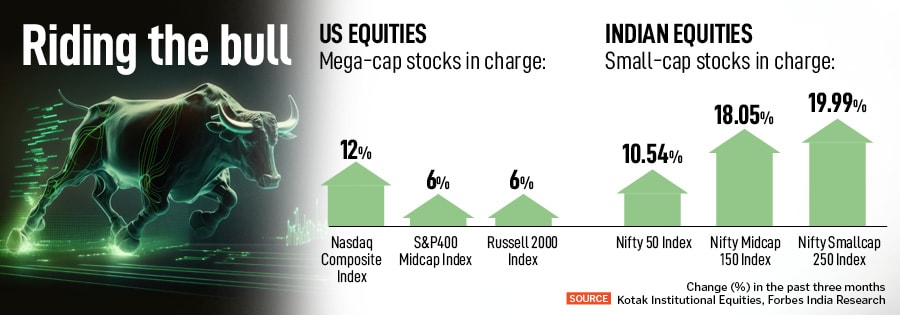

Small-cap stocks in India and mega-cap stocks in the US are leading the charge of the bulls. But veteran investors caution both equity markets could be testing their limits. Here's why

Unlike most bull-runs in the past, the current rally in stock prices is not being driven by the large-cap stocks.

Image: Shutterstock

Unlike most bull-runs in the past, the current rally in stock prices is not being driven by the large-cap stocks.

Image: Shutterstock

The bulls on Dalal Street have been on a rampage: Benchmark indices hit fresh highs and the recent macroeconomic indicators suggest domestic growth is holding up even though the world economy is struggling. Many see this as the start of a multi-year bull-run. Some are cautious of the lurking dangers and have fastened their seat belts. But all are optimistic and quite confident of India’s long-term growth potential and superior market returns in the coming years.

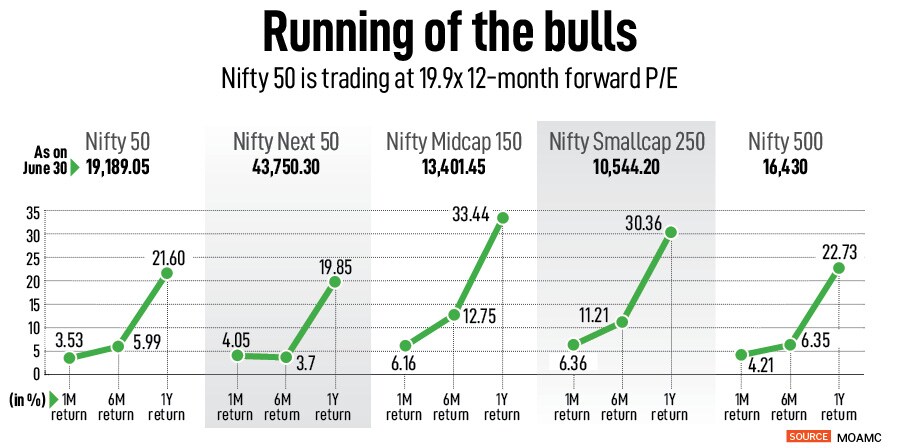

Confoundingly, unlike most bull-runs in the past, the current rally in stock prices is not being driven by the large-cap stocks. Consider this: The top 10 Nifty 50 stocks contributed 41 percent of the index returns in the past three months. While Nifty 50 stocks returned 21.6 percent over a one-year period, Nifty Smallcap 250 rose over 30 percent during the same period (see table).

Sanjeev Prasad, managing director and co-head, Kotak Institutional Equities, notes, “We are not sure how to explain or interpret the odd movement in the Indian stock market. Large-cap stocks typically lead mid and small-cap stocks in bull-market rallies, but the current rally is the other way around.”

Though investors may argue the performance of the small caps is due to liquidity, Prasad isn’t convinced. “That presumably reflects bullish sentiment among domestic institutional and retail investors. Foreign institutional investors are unlikely to chase smaller stocks and passive retail investors will deploy money into ETFs with a disproportionate weight of large-cap stocks,” he states.

The lacklustre performance of several large-cap stocks in the last three to six months has been a drag on the market. However, there is a recent pick-up in a few large caps as investors seek safety should there be a correction. In fact, many market mavens believe the market has topped out.