The valuations conundrum and hullabaloo around Mamaearth

Amid speculation, analysts say it is fair to question how valuations can double in a few months. The company that became profitable in FY22 maintains that its draft red herring prospectus has no mention of valuation

MamaEarth cofounder Ghazal Alagh (centre) at their exclusive brand outlet in Mumbai

Image: Courtesy MamaEarth

MamaEarth cofounder Ghazal Alagh (centre) at their exclusive brand outlet in Mumbai

Image: Courtesy MamaEarth

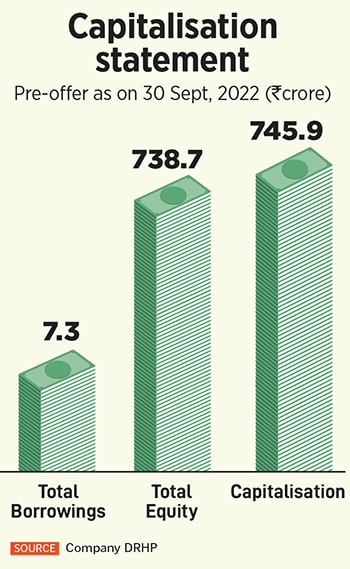

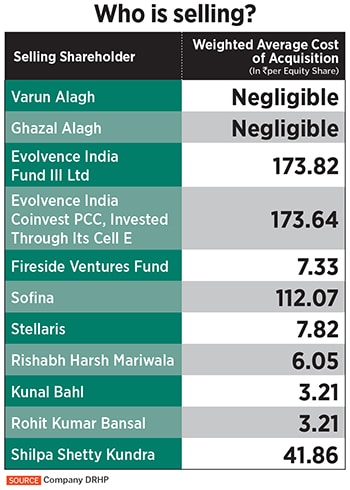

It's a draft red herring prospectus (DRHP) and a valuation—one that the founders disown—that have stirred a hornet's nest. Last fortnight, Honasa Consumer, which runs popular personal skincare brand Mamaearth, filed its DRHP to get listed on the stock markets via an initial public offering (IPO). The company is looking to raise Rs400 crore through fresh issue of shares, apart from an offer for sale (OFS) of around 4.7 crore shares, according to the DRHP documents.

Though neither the company nor its book running lead managers have confirmed its current valuation, a Reuters report in June had said that the Sequoia- and Sofina-backed company’s valuation is pegged at $3 billion or roughly Rs24,000 crore. That would make Mamaearth one of the most expensive companies in terms of valuations. Based on a net profit of Rs14 crore in FY22, its price-to-earnings (PE) ratio works out to 1,714.28 times. PE ratio or price multiple or the earnings multiple is a metric meant for valuing companies and to find out whether they are overvalued or undervalued. A higher PE ratio indicates a stock or company is overvalued.

In its last round of fundraising in January 2022, the company was valued at $1.2 billion. That sparked questions on how a company’s valuation can more than double to $3 billion in less than a year. In the last round, the company co-founded by the husband-wife duo of Ghazal Alagh and Varun Alagh had received investments of $52 million led by Sequoia, making it the first unicorn of 2022. Unicorn refers to a privately held company valued at over $1 billion.

“The company may argue that the turnaround in its financials in the second half of FY22 and first half of FY23 allows it to value itself higher. Valuations are decided by the promoters/selling shareholders based on advice from investment bankers, peer valuations, past valuations and the growth potential envisaged,” says Deepak Jasani, head of retail research, HDFC Securities.

The company became profitable in FY22 with net profit of Rs14 crore compared to losses of Rs1,332 crore in FY21 and Rs428 crore in FY20. In the first half of FY23, its net profit stood at Rs3.67 crore.

Marico, for instance, which has strong portfolio of personal care brands, has been able grow its profit at 15 percent compound annual growth rate (CAGR) over the last 10 years; yet it is trading at trailing-12-months (TTM) PE of 53 times.

Marico, for instance, which has strong portfolio of personal care brands, has been able grow its profit at 15 percent compound annual growth rate (CAGR) over the last 10 years; yet it is trading at trailing-12-months (TTM) PE of 53 times. “Definitely it is fair to question how valuations can double in a few months. Stock market and, in particular, the IPO market are ‘buyers beware’ markets. Investors need to exercise due caution and diligence before investing their money,” Pranav Haldea, managing director, Prime Database Group, says.

“Definitely it is fair to question how valuations can double in a few months. Stock market and, in particular, the IPO market are ‘buyers beware’ markets. Investors need to exercise due caution and diligence before investing their money,” Pranav Haldea, managing director, Prime Database Group, says. The launch of new brands or products that prove to be unsuccessful could affect our growth plans which could adversely affect our business, financial condition, cash flows. And results of operations are also flagged off as risk factors in the DRHP.

The launch of new brands or products that prove to be unsuccessful could affect our growth plans which could adversely affect our business, financial condition, cash flows. And results of operations are also flagged off as risk factors in the DRHP.