Torque of the town: Meet the transformer man from Kadapa

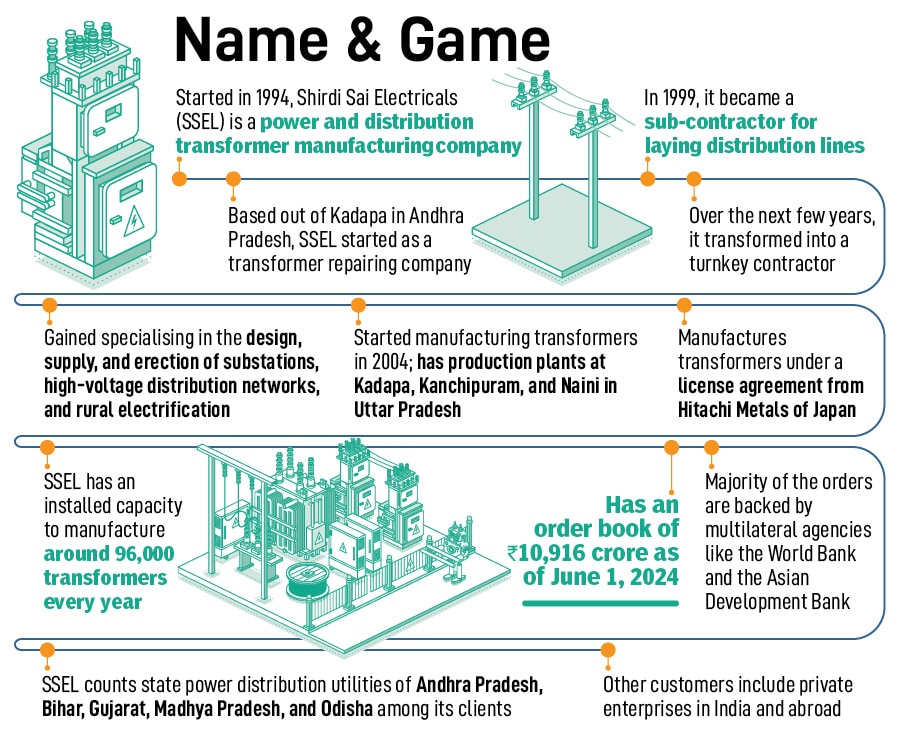

In 1994, N Visweswara Reddy made a modest beginning by repairing transformers. Three decades later, his company Shirdi Sai Electricals has morphed into India's second-biggest transformer maker. Can the man from Kadapa now reap rich dividends with his audacious solar gambit?

Mr. Visweswara Reddy, Chairman & Managing Director, Shirdi Sai Electricals Limited at Kadapa, Andhra Pradesh.

Image: Vikas Chandra Pureti for Forbes India

Mr. Visweswara Reddy, Chairman & Managing Director, Shirdi Sai Electricals Limited at Kadapa, Andhra Pradesh.

Image: Vikas Chandra Pureti for Forbes India

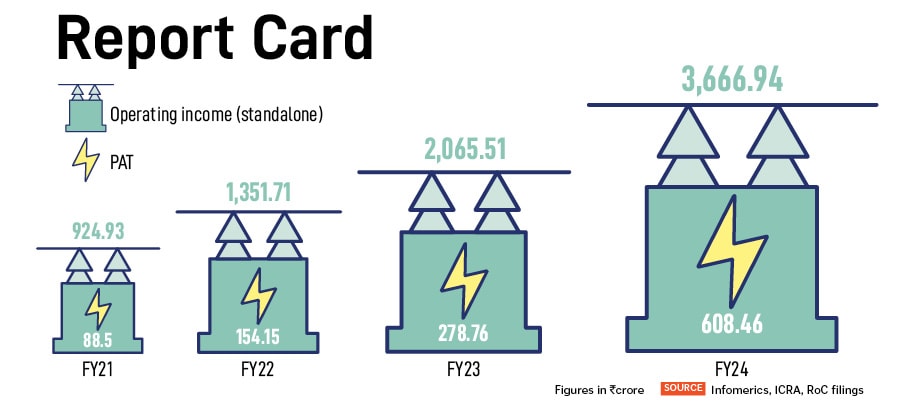

August 2018. It was a rude and unexpected jolt, but what hurt N Visweswara Reddy the most was his assessment of the setback. “It was an unfair jolt,” recalls the mechanical engineer, alluding to a rating downgrade of Shirdi Sai Electricals (SSEL) by Crisil in August 2018. The downgrade, the rating agency underlined in its report, reflected the pressure on SSEL's financial risk profile, particularly liquidity due to an unprecedented stretch in receivables, ongoing capital expenditure, inadequate bank guarantee limits, and geographical concentration of revenue—around 70 percent came from discoms (distribution companies) of Andhra Pradesh. Though there were enough red flags for a downgrade, it disconcerted the first-generation entrepreneur. “We closed FY18 with over Rs1,000 crore in operating revenue and a decent PAT [profit after tax],” recounts Reddy. “Still a downgrade…I was shocked beyond words.” For a moment, he felt that somebody had taken the sheen of his gruelling journey.

Back in 1994, Reddy started his entrepreneurial career by default. Born in a nondescript village, some 60 kilometres from Kadapa in Andhra Pradesh, Reddy was the first in his farming family to complete engineering in 1991. After three years of stints at a slew of engineering companies, the young graduate was steamrolled by his communist father to start repairing transformers in his village and nearby areas. Crippled by regular power shortages, his father was overwhelmed with a compassionate urge to help farmers who were at the receiving end of an erratic electricity supply and frequent outages.

His mechanical engineer son was best suited to solve the problem. Reddy reluctantly yielded to his father’s wishes and started repairing transformers. One village at a time, Reddy moved into adjoining districts and expanded his network. After five years, he entered the business of engineering, procurement, and construction (EPC) contracts in 1999, and became a sub-contractor for laying down distribution lines. He dabbled into a turnkey contractor, and gained experience in design, supply, and erection of substations, high-voltage distribution networks, and rural electrification. In 2004, Reddy started manufacturing transformers, and by early 2018, SSEL had built a sizeable power, distribution, and transformer manufacturing empire, which boasted Rs1,001 crore in revenue and Rs72 crore in PAT (profit after tax).

By 2018, after over two decades in operations, SSEL’s high-torque performance started getting acknowledged. The company has been undertaking EPC contracts since 1999 and has an established market position in this business, Crisil noted in one of its rating reviews in 2018. “SSEL is backed by strong execution capability, healthy relationship with customers, and a robust order book of Rs2,518 crore as of June 30, 2018,” it underlined, adding that the company from Kadapa benefited from the technological tie-up with America’s Metglas, a subsidiary of Hitachi Metals of Japan, for manufacturing of amorphous core-based transformers. Shirdi Sai Electricals had emerged as a force to reckon with in the transformer industry, and Reddy was enjoying his high-voltage journey.