Unsecured loans surge but no default risks, yet

The demand for unsecured loans continues to rise and has come to the attention of the RBI, again. The credit uptick signals buoyancy in the ecosystem on improved consumption and spending but the risk of high defaults is not being seen, experts say

Unsecured loans for most of the big banks in India have been growing rapidly

Image: Niharika Kulkarni / Reuters

Unsecured loans for most of the big banks in India have been growing rapidly

Image: Niharika Kulkarni / Reuters

There has been much good news in India’s economic growth story recently: Better-than-expected GDP growth, early signs of a recovery in domestic consumption demand and financial institutions that are aggressively lending. This last, however, is not necessarily great news for the traditionally cautious regulator Reserve Bank of India.

It has, both in informal discussions with banks, and formal publications (half-yearly) Financial Stability Report released in June this year highlighted the rapid pace of growth of unsecured loans in India’s retail loans segment over the past two years. Unsecured loans—largely personal loans, loans on credit cards and some forms of consumer durables and student education loans—do not have collateral and thus are considered riskier than secured loans (auto, home, loan against property). Add to that a still high interest rate regime and it raises risks to the lending system.

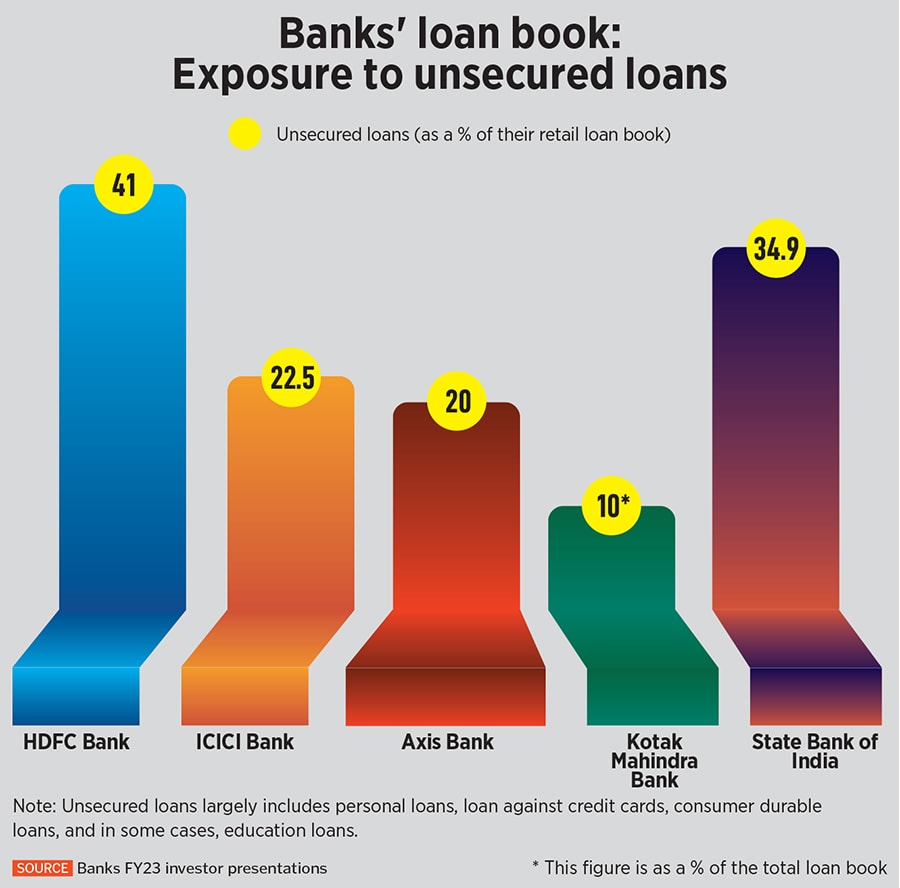

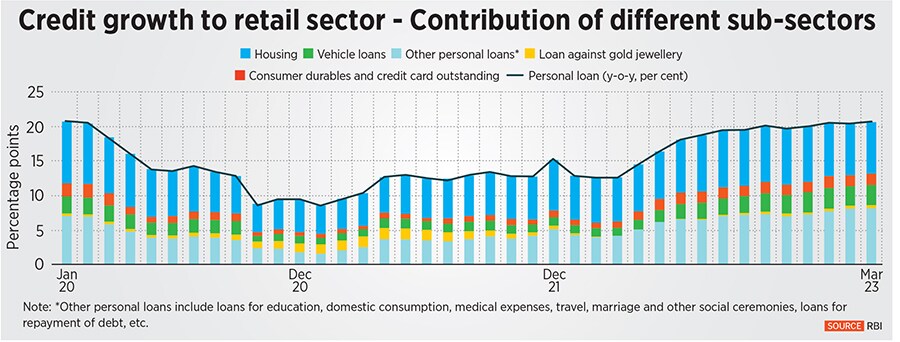

Unsecured loans for most of the big banks in India have been growing rapidly (see chart). Retail grew at a CAGR of 24.8 percent from March 2021 to March 2023, almost double the CAGR of 13.8 percent for gross advances during the same period. It formed around one-third of the total banking system’s gross loans and advances.

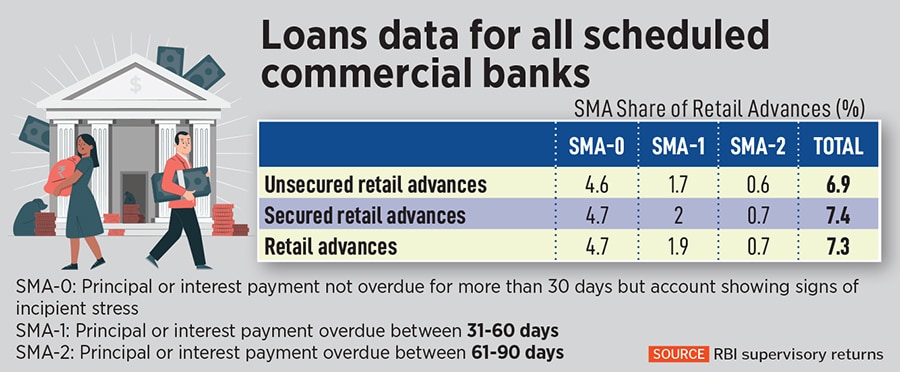

In this same period, unsecured retail loans increased from 22.9 percent to 25.2 percent and secured loans declined from 77.1 percent to 74.8 percent, the RBI Financial Stability Report for June 2023 showed. Although the Gross NPA ratio of retail loans at the system level was low at 1.4 per cent in March 2023, the share of special mention accounts (SMA) was relatively high at 7.4 per cent for all scheduled commercial banks (see table) and it accounted for a tenth of the retail assets portfolio of PSBs.

In the past year, credit card outstanding in terms of bank credit has risen near 26 percent to Rs 1,94,282 crore as on March 24, 2023, compared to levels a year earlier. The credit towards personal loans has risen 22 percent to Rs 11,00,404 crore in the same period.