US rate hike cycle nears end: One done, one more to go, maybe

US Fed Chairman Jerome Powell refrained from giving a forward guidance on rates and said the Committee would evaluate the implications of incoming data on a meeting-by-meeting basis

Federal Reserve Board Chairman Jerome Powell speaks during a news conference following a Federal Open Market Committee meeting, at the Federal Reserve in Washington, DC, on July 26, 2023.

Image: Saul Loeb / AFP

Federal Reserve Board Chairman Jerome Powell speaks during a news conference following a Federal Open Market Committee meeting, at the Federal Reserve in Washington, DC, on July 26, 2023.

Image: Saul Loeb / AFP

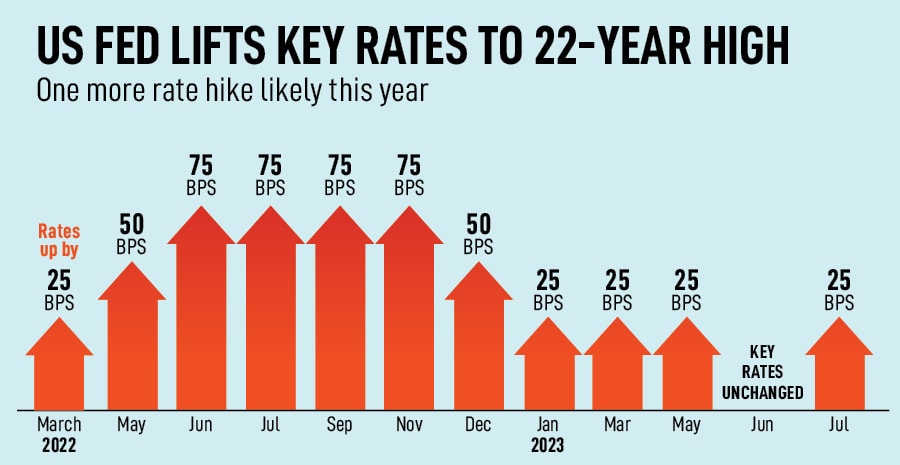

In a widely expected move, the Federal Open Market Committee (FOMC) hiked key rates by 25 basis points to a 22-year high at 5.25 percent to 5.5 percent. Global markets had priced in the rate action, but the lack of forward guidance on the rate trajectory weighed on market sentiments. More specifically, markets were hoping for a clear signal from the US Federal Reserve that rates had peaked. However, the central bank’s chairman Jerome Powell burst the bubble.

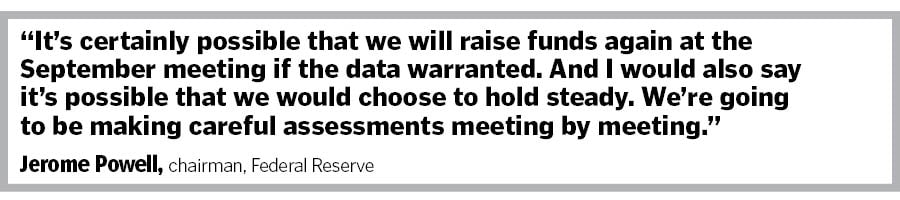

“It’s certainly possible that we will raise funds again at the September meeting if the data warranted. And I would also say it’s possible that we would choose to hold steady. We’re going to be making careful assessments meeting by meeting,” Powell said.

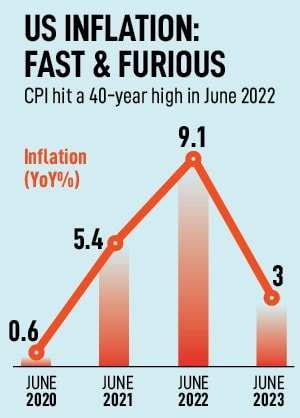

This wasn’t music to the ears of investors, although FOMC members had indicated in the previous meeting that two more rate hikes are likely this year. Since March 2022, the US Fed has lifted rates by 525 points to rein in soaring price levels. In June, inflation cooled to 3 percent year-on-year (y-o-y) from 9.1 percent y-o-y in the same period last year. But the central bank believes there’s a long road ahead as it aims to pin inflation to 2 percent. Monetary policy tightening has pushed the economy to the brink of a recession.

There are upside risks to inflation as global food prices are under pressure in an uncertain and volatile macroeconomic environment with escalating geopolitical tension between the US and China and a war in Ukraine. “We need to stay on task and we think we’ll need to hold policy at restrictive levels for some time, and we need to be prepared to raise rates further if we think that’s appropriate… it’s not an environment where we want to provide a lot of forward guidance," Powell said at a press conference. Most central banks have adopted a stance of assessing incoming data of inflation and economic activity and its implications for monetary policy on a meeting-by-meeting basis.

“As anyone can see, not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate. It will be appropriate to cut rates at such time as inflation is coming down really significantly. And again, we’re talking about a couple of years out,” Powell had said in June.

“As anyone can see, not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate. It will be appropriate to cut rates at such time as inflation is coming down really significantly. And again, we’re talking about a couple of years out,” Powell had said in June.