We do not wait for the house to catch fire and then act: RBI Governor Shaktikanta Das

The RBI governor says policymakers have to be mindful of the risk of being carried away with a few months of good data and also be watchful of the risk of overtightening

RBI Governor Shaktikanta Das

Image: Reuters/Susana Vera

RBI Governor Shaktikanta Das

Image: Reuters/Susana Vera

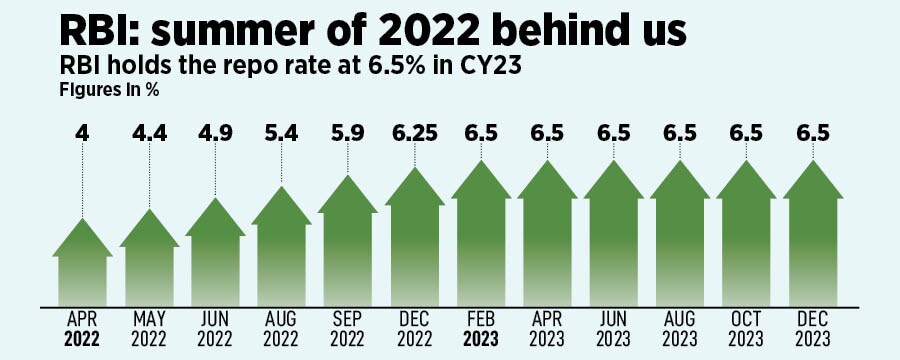

In the last policy meeting of this calendar year, the Reserve Bank of India’s (RBI) six-member rate-setting panel voted unanimously to keep the repo rate unchanged at 6.5 percent and five of the six members voted to remain focussed on the withdrawal of accommodation. The central bank raised its GDP growth forecast from 6.5 percent to 7 percent for FY24. It held its inflation projection at 5.4 percent for the current fiscal year.

“The fundamentals of the Indian economy remain strong with banks and corporates showing healthier balance sheets; fiscal consolidation on course; external balance remaining eminently manageable; and forex reserves providing cushion against external shocks. These factors, combined with consumer and business optimism, create congenial conditions for sustained growth of the Indian economy,” RBI Governor Shaktikanta Das said.

The central bank was not as hawkish as anticipated by markets. Between May 2022 and February 2023, the monetary policy committee (MPC) increased the benchmark lending rate by 250 basis points from a historic low of 4 percent. Since its first credit policy meeting this calendar year, the MPC has held the repo rate at 6.5 percent (see table).

“Our policy of prioritising inflation over growth, hiking policy rate by 250 basis points in a calibrated manner and draining out excess liquidity have worked well, alongside supply-side measures taken by the government, to bring about this disinflation,” Das added.