Why boosting bank deposit growth is an arduous challenge

The window for banks to continue to hike deposit rates—to attract customers when returns from other asset classes is higher—is starting to shut, with easing of interest rates looming. New age small financial banks appear to have taken the lead

Shaktikanta Das, Governor, Reserve Bank of India (RBI)

Image: Punit Paranjpe / AFP

Shaktikanta Das, Governor, Reserve Bank of India (RBI)

Image: Punit Paranjpe / AFP

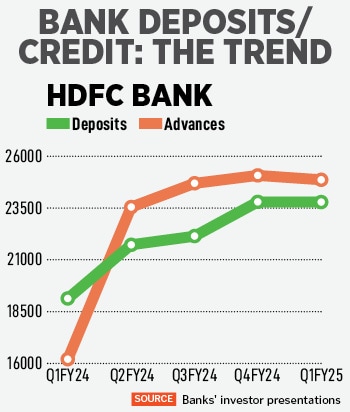

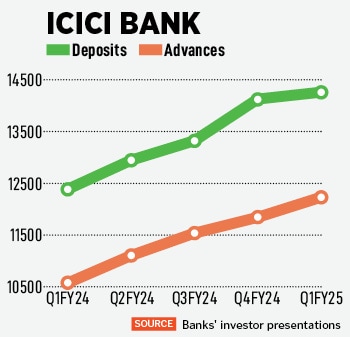

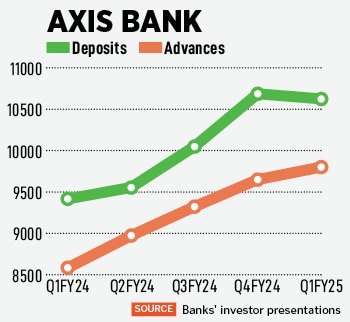

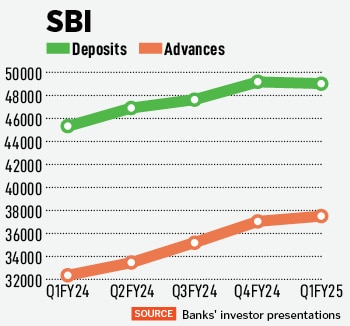

Finance Minister Nirmala Sitharaman and Reserve Bank of India (RBI) Governor Shaktikanta Das have laid out a tough assignment for banks, to bulk up bank deposits. The financial health of banks appears to be in order, with aggressive lending both in the form of secured and unsecured, as corporates and individuals seek more capital to meet their business or personal needs. For most banks, credit growth, in terms of advances, has continued to outpace the growth in deposits in recent quarters, which has become a matter of concern for the RBI governor Shaktikanta Das.

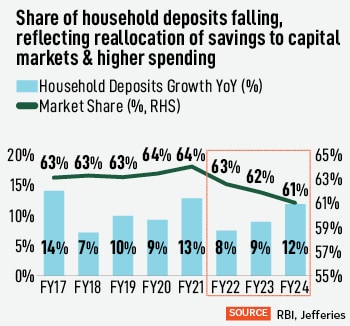

Sitharaman, in a meeting with bankers last week, called them on to focus on smaller deposits that may come in “trickles” but are the “bread and butter” of the banking system, according to media reports.

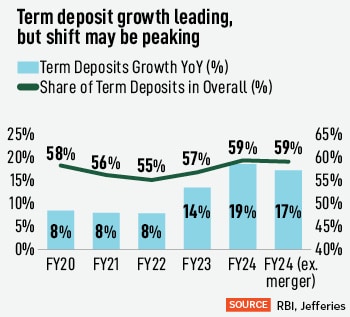

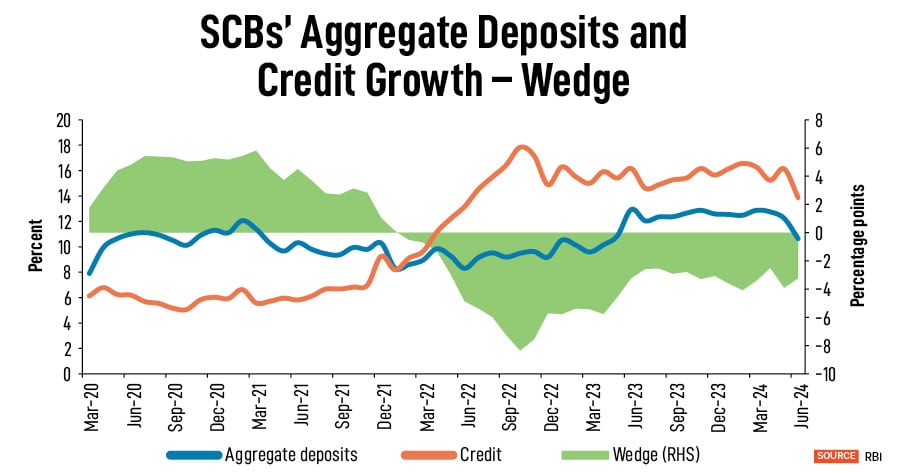

In his latest speech, Das expressed the need for banks to “focus more on mobilisation of household financial savings through innovative products and service offerings and by leveraging fully on their vast branch network.” As equities, real estate, gold and alternatives have offered better returns to individuals; banks have been facing challenges to lend, as loan growth continues to trail bank deposits (see chart).

Credit growth of all commercial banks expanded 13.7 percent as of July 26, from a year earlier, outpacing deposits which rose 10.6 percent in the same period.

Credit growth of all commercial banks expanded 13.7 percent as of July 26, from a year earlier, outpacing deposits which rose 10.6 percent in the same period.

The RBI has in recent months has explained their zero-tolerance policy towards compliance and regulatory lapses to heads of banks. The regulator wants banks to have clarity about income recognition, bad loans and making provision for the same, particularly since banks have been lending aggressively in recent years.

So while an asset-liability mismatch may not happen, the one problem which banks face will be an impact on margins and profitability. They will have to borrow at a higher cost which might impact profitability in coming quarters.

So while an asset-liability mismatch may not happen, the one problem which banks face will be an impact on margins and profitability. They will have to borrow at a higher cost which might impact profitability in coming quarters. For investors who rode the Indian equities journey late, passive and exchange traded funds (ETFs) have been amongst the most popular in the last few years. Those with a higher risk-taking ability have ventured into F&O (Future and Options) trade, where the regulator Securities and Exchange Board of India (Sebi) has already clamped down, due to massive intraday losses which traders have suffered in the past two years.

For investors who rode the Indian equities journey late, passive and exchange traded funds (ETFs) have been amongst the most popular in the last few years. Those with a higher risk-taking ability have ventured into F&O (Future and Options) trade, where the regulator Securities and Exchange Board of India (Sebi) has already clamped down, due to massive intraday losses which traders have suffered in the past two years.

“The second option is what banks have been doing for some time which is issuing loans against fixed deposits. They may consider offer a higher limit, in some cases even higher than the underlying deposit in select cases to meet requirements for credit,” Hathi tells Forbes India.

“The second option is what banks have been doing for some time which is issuing loans against fixed deposits. They may consider offer a higher limit, in some cases even higher than the underlying deposit in select cases to meet requirements for credit,” Hathi tells Forbes India. Camotra says the bank is “happy to share the interest spread (of high single digits) with the depositors. “ Being a retail bank, it lends to micro, small and medium enterprises (MSMEs), SMEs and micro-finance groups, where the interest returns are anywhere between 12 to 21 percent. “We manage our book well and keep costs down,” he tells Forbes India.

Camotra says the bank is “happy to share the interest spread (of high single digits) with the depositors. “ Being a retail bank, it lends to micro, small and medium enterprises (MSMEs), SMEs and micro-finance groups, where the interest returns are anywhere between 12 to 21 percent. “We manage our book well and keep costs down,” he tells Forbes India.

Once interest rates start to decline—possibly by the year end in India—banks are unlikely to keep increasing deposit rates. At best, banks which could have tight liquidity concerns, it could be between 5 to 15 basis points, analysts say.

Once interest rates start to decline—possibly by the year end in India—banks are unlikely to keep increasing deposit rates. At best, banks which could have tight liquidity concerns, it could be between 5 to 15 basis points, analysts say.