Why the real estate index is an outperformer

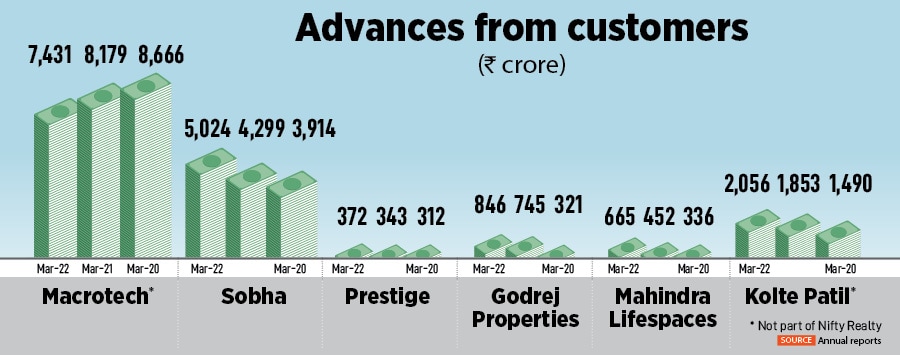

Real estate buyer advances have increased during the pandemic resulting in improved balance sheets of listed developers

For well-established real estate players the last two years have seen a revival of sorts. Pre-sales have increased as buyers have flocked to buy apartments with the purpose of living in them

Image: Shutterstock

For well-established real estate players the last two years have seen a revival of sorts. Pre-sales have increased as buyers have flocked to buy apartments with the purpose of living in them

Image: Shutterstock

A real estate company that can sell in advance of construction is in a good position. Even better is when the company can collect money from buyers in advance of construction.

For well-established real estate players the last two years have seen a revival of sorts. Pre-sales have increased as buyers have flocked to buy apartments with the purpose of living in them. A large part of this is on account of stable prices that have driven speculators out of the market.

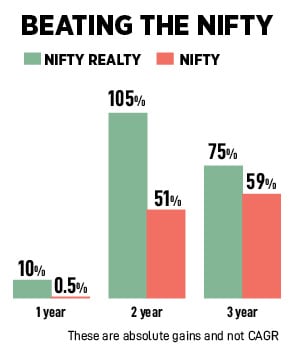

The improving balance sheets of listed developers have not gone unnoticed by investors. The Nifty Realty Index is positive across the last one, two and three years with gains of 10 percent, 105 percent and 75 percent respectively. (These are not CAGR numbers; Macrotech and Kolte Patil are not part of Nifty Realty). Compare this with 0.5 percent, 51 percent and 59 percent for the Nifty and the outperformance is stark.

The improving balance sheets of listed developers have not gone unnoticed by investors. The Nifty Realty Index is positive across the last one, two and three years with gains of 10 percent, 105 percent and 75 percent respectively. (These are not CAGR numbers; Macrotech and Kolte Patil are not part of Nifty Realty). Compare this with 0.5 percent, 51 percent and 59 percent for the Nifty and the outperformance is stark.