Will raging bulls of IPO survive markets storm

The surge in primary markets in India appears unstoppable as the IPO rush gains fresh momentum

![Will raging bulls of IPO survive markets storm In the last two months [August and September], 22 companies collectively raised ₹28,135 crore via IPOs, shows a Forbes India analysis based on data provided by Prime Database.

Image: Shutterstock](https://images.forbesindia.com/media/images/2024/Oct/img_239487_ipo.jpg) In the last two months [August and September], 22 companies collectively raised ₹28,135 crore via IPOs, shows a Forbes India analysis based on data provided by Prime Database.

Image: Shutterstock

In the last two months [August and September], 22 companies collectively raised ₹28,135 crore via IPOs, shows a Forbes India analysis based on data provided by Prime Database.

Image: Shutterstock

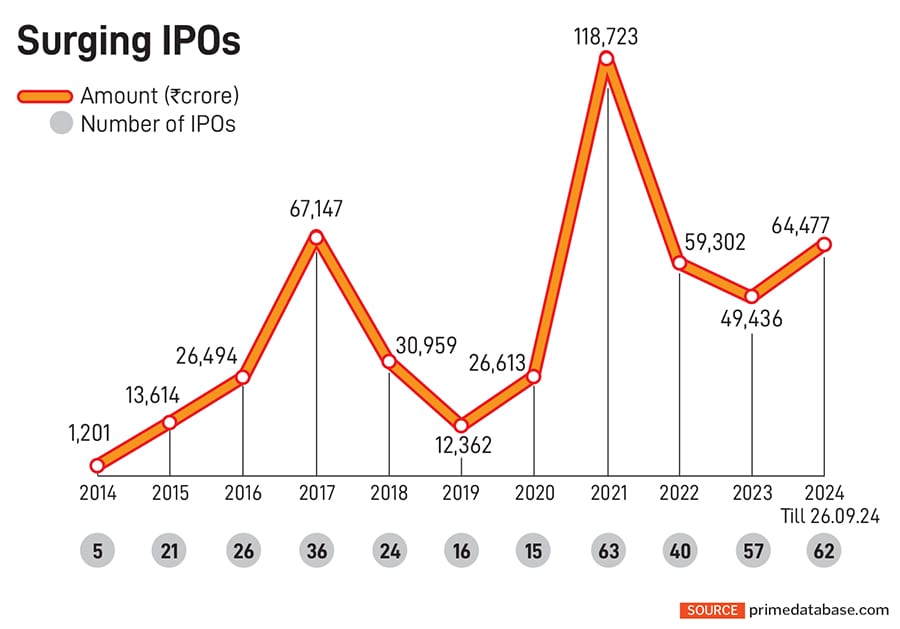

Companies are raising funds through initial public offerings (IPOs) in Indian capital markets at a tearing hurry despite inflationary pressures and monetary tightening. The run to the stock markets by companies for money is no surprise, however, as funds from private equity and venture capitalists are getting squeezed out.

Adding to the overall exuberance for IPOs in India is the super performance of equities with both the benchmark indices, Sensex and Nifty, surging around 18 to 20 percent, while BSE mid and small cap jumped around 34 percent from January. Primary markets activities in India accelerated in the last two months with some of the biggest issues going public, contrasting with the global scenario where there was a mild slowdown.

In the last two months [August and September], 22 companies collectively raised ₹28,135 crore via IPOs, shows a Forbes India analysis based on data provided by Prime Database. Except two [Ceigall India and Western Carriers], shares of all companies that made their stock market debut in the last two months closed at higher returns compared to their respective issue price.

The large issues launched in August and September include Bajaj Housing Finance (₹6,560 crore), Ola Electric Mobility (₹6,146 crore), FirstCry owner Brainbees Solutions (₹4,194 crore), Premier Energies (₹2,830 crore) and PN Gadgil Jewellers (₹1,100 crore). All the companies that launched their IPOs during this period saw an overwhelming response from investors with high subscriptions. The surprise in the pack was Bajaj Housing Finance which received an overall subscription of over 65 times despite being a large-sized IPO. Total bids worth ₹3 lakh crore were placed for Bajaj Housing Finance, the highest ever for any IPO in India.

In the global context, primary markets activities saw a mild slowdown from the beginning of 2024, with market participants adopting a cautious approach in the face of escalating uncertainties, says EY. IPO activity in the Asia-Pacific region picked up over the last quarter, contributing to stabilisation of global IPO figures. Despite a slow IPO quarter overall, the US and India were among the few markets that continued to witness heightened listing activity.

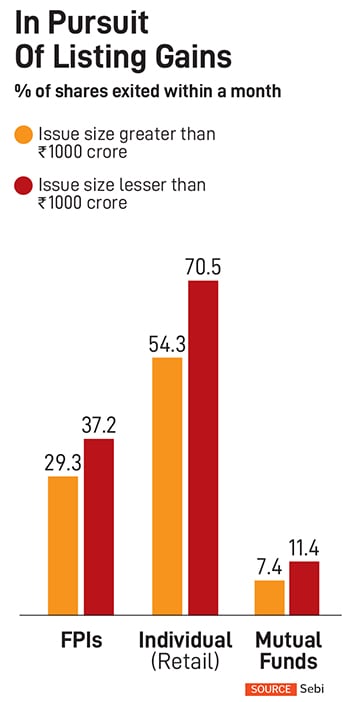

In the global context, primary markets activities saw a mild slowdown from the beginning of 2024, with market participants adopting a cautious approach in the face of escalating uncertainties, says EY. IPO activity in the Asia-Pacific region picked up over the last quarter, contributing to stabilisation of global IPO figures. Despite a slow IPO quarter overall, the US and India were among the few markets that continued to witness heightened listing activity. However, the selling spree by retail investors is severe if returns are higher in any new listings. When returns were high, exits by retail, non-institutional investors (NII) and qualified institutional buyer category investors were higher than their respective averages. Individuals exited 67.6 percent shares within a week, when returns were extremely high and exited just about 23.3 percent, when they were negative.

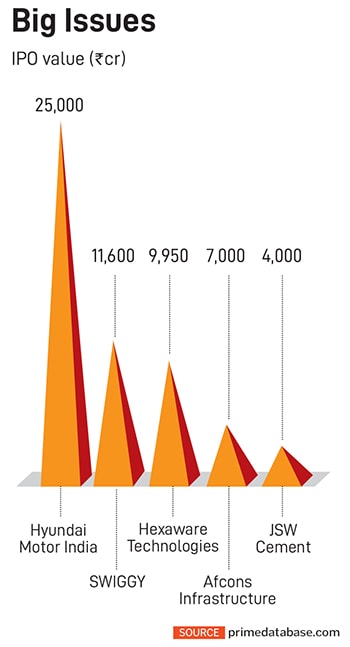

However, the selling spree by retail investors is severe if returns are higher in any new listings. When returns were high, exits by retail, non-institutional investors (NII) and qualified institutional buyer category investors were higher than their respective averages. Individuals exited 67.6 percent shares within a week, when returns were extremely high and exited just about 23.3 percent, when they were negative. The robust IPO primary market in India is expected to expand manifold with over 26 companies that have received Sebi approval to go public raising a collective sum of ₹71,150 crore. The biggest ever IPO that will hit the Indian markets is Hyundai Motor India which has received Sebi approval in September to raise ₹25,000 crore.

The robust IPO primary market in India is expected to expand manifold with over 26 companies that have received Sebi approval to go public raising a collective sum of ₹71,150 crore. The biggest ever IPO that will hit the Indian markets is Hyundai Motor India which has received Sebi approval in September to raise ₹25,000 crore.