Curious case of SME IPOs in India

Latest investment trends provide a strong indication that investors are looking to cash in the quick and handsome gains from SME IPOs and are disregarding the red flags and risks altogether

High market liquidity, fear of missing out (FOMO) on SME jackpots, and substantial returns in the short term are luring retail investors to SME IPOs.

Image: Shutterstock

High market liquidity, fear of missing out (FOMO) on SME jackpots, and substantial returns in the short term are luring retail investors to SME IPOs.

Image: Shutterstock

IPOs have always been a trusted way for retail investors to make money in the short term. Retail investors have shown enigmatic euphoria in the SME IPO market in the past few months. High market liquidity, fear of missing out (FOMO) on SME jackpots, and substantial returns in the short term are luring retail investors to SME IPOs. The news of smaller companies with questionable fundamentals and eye-popping valuation garnering very high subscriptions is becoming quite common. Recently, the news about Resourceful Automobile and Boss Packaging Solutions created a buzz on social media due to extraordinary subscription numbers while having a very modest business.

SME IPO of Resourceful Automobile, a dealer for Yamaha bikes in Delhi, was subscribed more than 400 times on August 26, 2024. It received bids for Rs4800 crore against issue size of Rs12 crore. This led to a lot of sarcastic commentary about how opening a bike dealership may become a road to raising a few thousand crore. Likewise, the SME IPO of Boss Packaging Solutions, which supplies packaging machines, labelling, capping, and filling equipment, was ridiculed with pictures of its dilapidated office while getting more than 135x subscriptions.

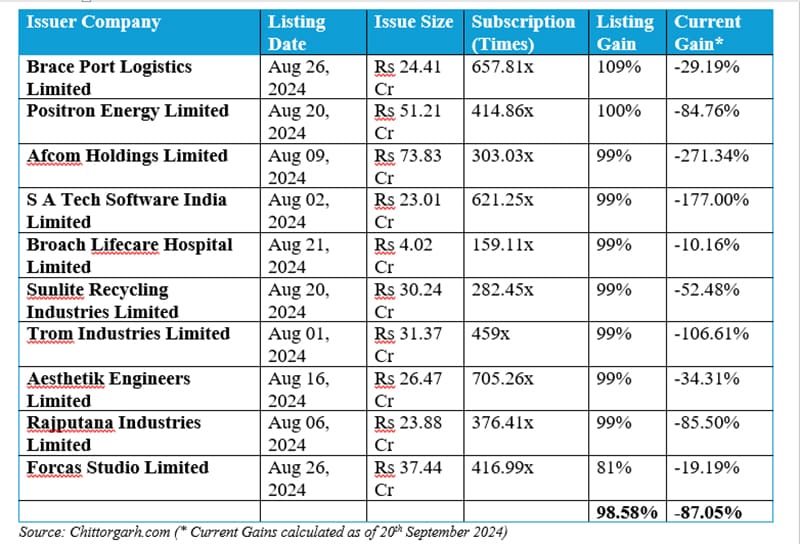

The market regulator SEBI also took note of such increased subscriptions in the recent SME IPOs and warned investors about the risks SME IPOs entail. SEBI also capped the listing day price to curtain gains to a maximum of 90 percent on listing day. Despite these, investors flock to the latest issues as if they are the golden ticket.

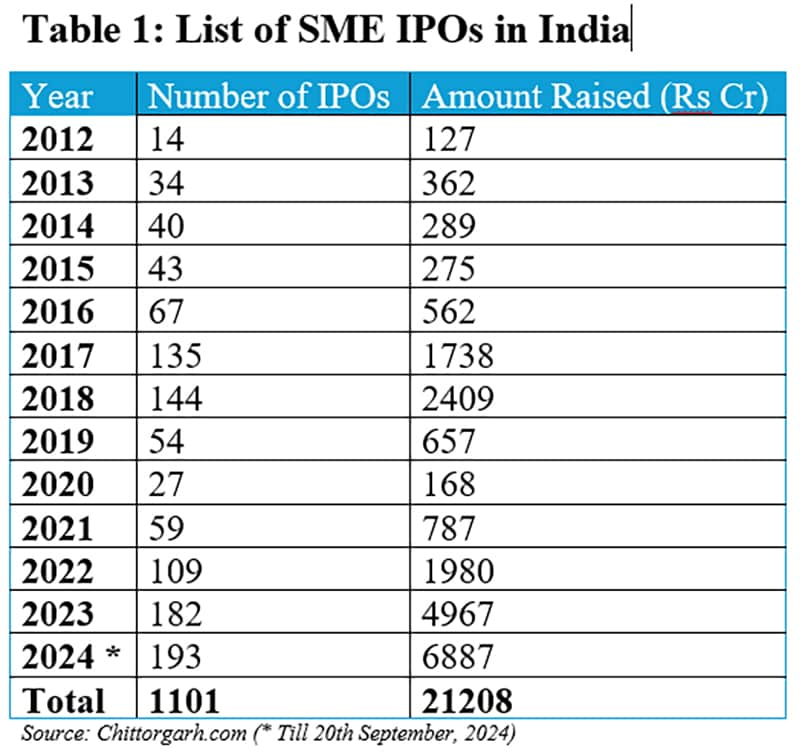

The SME IPO segment in India was introduced in 2012, with NSE and BSE launching their SME platforms BSE SME and NSE Emerge, respectively. The rationale was to provide the prospects for SME companies to access the primary market for fundraising, offering an alternative to relying solely on debt for expansion. Till September 20, 2024, 1101 SME IPOs have been done, raising over Rs21,000 crore (See Table 1). More than half of this amount was raised in the last two years. These trends provide a strong indication that investors are looking to cash in the quick and handsome gains from SME IPOs and are disregarding the red flags and risks altogether. The most important numbers they consider are not the fundamentals or financial performance metrics but the grey market premium (GMP).

[This article was published with permission from <a href="https://www.imi.edu/" target="_blank">International Management Institute.</a>]