Hyundai zooms fast, furious and electric, amid auto slowdown

Hyundai Motor India, the country's second-largest carmaker, is pushing new launches, tech innovations and electric vehicles amid a slowdown, while affiliate Kia Motors bolsters its growth journey

SS Kim, Hyundai Motor India’s managing director and CEO, expects more growth after the automobile market sees a revival

SS Kim, Hyundai Motor India’s managing director and CEO, expects more growth after the automobile market sees a revivalImage: Madhu Kapparath

This year has been rather strenuous for the country’s carmakers.

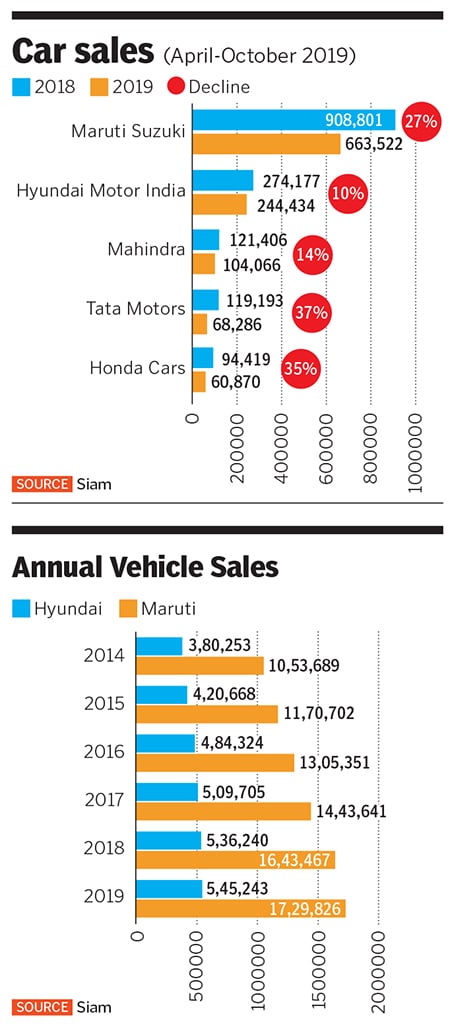

Car sales have plummeted nearly 25 percent in India—the world’s fourth-largest automobile industry—and conservative estimates suggest that a recovery could take another year. A mix of several factors—like India’s plans to endorse new emission norms, a financial crunch in the rural market and slowing income growth—has hit the automobile industry, and the Indian economy, severely.

By October 2019, automobile sales—which contribute nearly 7 percent to the country’s gross domestic product in an industry that employs millions of people—had plummeted for 11 months in a row, making it the worst slump in two decades. The slowdown also meant that companies such as Maruti Suzuki, Tata Motors and Mahindra & Mahindra cut production and laid-off workers.

Yet, the Hyundai Motor Company has remained unperturbed.

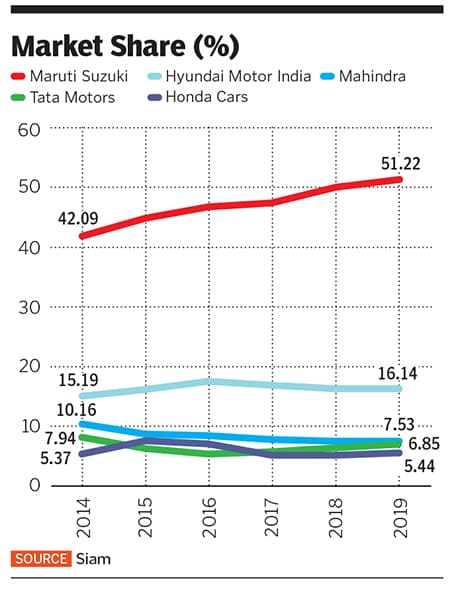

First, the South Korean company launched three new models in 2019, including the wildly successful sub-compact SUV, Venue, the electric SUV, Kona, and the hatchback, Nios. Then, during the course of the year, Hyundai increased its market share from nearly 15.5 percent to almost 18.4 percent, after cornering 19.4 percent of the market in August alone.

In the process, Hyundai also saw the lowest decline (10 percent) in car sales among its competitors between April and September. During the same time, Maruti Suzuki had a sales decline of 27 percent, while Tata Motors and Honda Motors saw a 35 percent decline.

“Considering how well we have survived through these tough times, we might have much more growth potential once the market revival happens,” SS Kim, Hyundai Motors India’s managing director and CEO, tells Forbes India. “That is our expectation and our strategy.” Kim, a soft-spoken industry veteran, was brought in late last year as the new managing director of the Indian subsidiary. He flung into action after the automobile industry in the country fell into a deep mess.

“At the time of market downturn and low customer sentiment, every company needs some breakthrough,” says Kim. “The first step is to make the customer confident about the company and infuse trust. From the beginning of the year, our focus has been on driving the message across about our emphasis on technology, particularly connected driving and customer service. We also managed to keep the excitement running with frequent launches.”

The Jumpstarts

Next year, the company plans to launch as many as five vehicles and introduce some facelifts. This will include the next generation of its popular SUV, Creta, and a facelifted version of its sedan, Verna. “We expect the industry to pick up in the second half of 2020,” says Kim. The company is betting on three key areas: Along with new launches and facelifts underway, Hyundai believes that its focus on connected driving and shared mobility will give it a much-needed boost in the coming years.

Already, the sub compact SUV Venue—launched in May—offers connected driving features and has seen bookings for over 72,000 units. These features include SOS and panic alert, auto crash notification, roadside assistance, stolen vehicle tracking and immobilisation, location-based map and call centre services, speed alert and geo-fencing.

At Hyundai’s Chennai plant, the carmaker has localised the manufacturing processes

At Hyundai’s Chennai plant, the carmaker has localised the manufacturing processes“We are now able to better understand user behaviour, using customer data, and what a driver wants, as data becomes increasingly available to us through connected driving services,” says Vikas Jain, national head of sales at Hyundai Motors India.

The company is also reworking its ownership models, offering a subscription model of owning the vehicle. “We have over 1,250 customers who have opted for the scheme that was launched in March,” adds Jain. According to the scheme, in partnership with self-drive car rental company Revv, customers can opt for a monthly or yearly subscription. The fee will differ for each option and according to the car as well. The flat monthly fee includes maintenance and insurance charges. In August 2018, Hyundai had invested an undisclosed amount in Revv.

Hyundai is also capitalising on the government’s increased focus on electric vehicles (EV). In October, the company’s electric SUV Kona was selected by the Energy Efficiency Services Ltd (EESL), a government agency mandated with procuring electric vehicles for the government. The Kona comes with a 39.2 kWh lithium-ion battery pack and can go up to 400 km on a single charge. The EV, which was launched this July, can go at a top speed of 167 km per hour, and has already received over 300 orders.

“The current charging infrastructure is almost nothing,” says Kim. “Even 1,000 charging stations will only cover a small pie. I expect the government to play a substantial role in extending charging infrastructure. But we are developing more low-cost cars and vehicles with more range.”

Riding through Troughs

Another factor that sets Hyundai apart from its peers is that the company is not ready to let go of its diesel ambitions even as it ramps up the play on electric mobility.

In India, almost 35 percent of Hyundai cars sold are diesel, with petrol engines contributing the rest. Kim explains that diesel cars of today have low emissions and strong power. “Of course, because of the dieselgate issues [the National Green Tribunal in March slapped a ₹500 crore fine on Volkswagen for allegedly violating emission norms, although the Supreme Court stayed the order], diesel has been affected. But we are always looking to provide Indian consumers with an affordable solution. They want diesel technology and we will continue to manufacture,” he says. “We can see diesel mania remaining strong and if the vehicles are Euro-complaint, they will stay within the government norms.”

This move from Hyundai comes at a time when, earlier this year, Maruti Suzuki’s announcement of phasing out all models with diesel engines less than 1.5 litres from April 2020 sent the Indian automobile industry into turmoil. That decision was largely due to having to pay a higher royalty for the 1.3-litre diesel engines.

“The new emission norms are much more threatening for Maruti,” says Puneet Gupta, associate director of Automotive Forecasting at IHS Markit. “Hyundai has an edge because it has been offering these solutions in developed markets, and will certainly hold an edge in terms of the technology it offers here.”

Helping Hyundai capture the Indian market is its sister concern Kia Motors, which has cemented its position in the SUV segment by selling 7,554 units of its SUV Seltos in September. Between August, when the company launched its India operations, and September, Kia has sold nearly 14,000 units. Bookings for Seltos have crossed 50,000 units, as of October 2019.

“It [Hyundai] is certainly going to benefit from the scale [of Kia],” says Vinay Piparsania, consulting director at Counterpoint Technology Market Research, and a former executive director at Ford India. “It will be able to use a common supply chain, logistics, and in the process, keep costs down.”

That said, Kim clarifies that both are largely independent entities. “We are competing against each other, but if we could bring some original values or benefit to the customer, we can collaborate in that area. This could be commonisation of components that will reduce costs and promote efficiency. But product planning, sales and production will be independent.”

In March, Hyundai and Kia Motors came together to invest $300 million (₹2,100 crore) in India’s ride-hailing giant Ola. According to the deal, the three companies will jointly work towards developing fleet and mobility solutions in addition to building India-specific EVs and infrastructure.

“India is the centrepiece of Hyundai Motor Group’s strategy to gain leadership in the global mobility market and our partnership with Ola will certainly accelerate our efforts to transform into a smart mobility solutions provider,” Euisun Chung, executive vice chairman of Hyundai Motor Group, said at the time of the announcement.

Such a Long Journey

Much of Hyundai’s success story in India was scripted by its first car, the Santro.

When the Seoul-headquartered company decided to launch in India in 1997, Indians were only beginning to acquiesce with Korean brands. Apart from consumer products companies Samsung and LG, foreign carmakers like Ford, General Motors and Mercedes-Benz were thronging the Indian shores to capitalise on the potential of an economy that was liberalised only a few years ago, in 1991.

Hyundai did not waste any time in developing a made-for-India car, which offered many firsts to the Indian consumer. For example, a multi-port fuel injection engine with three valves in the entry-level segment instead of carburetors, power steering and seat belts at the rear. At its plant in Chennai, the carmaker brought many of its South Korean makers and vendors, who localised the manufacturing processes, while maintaining international standards and controlling costs at the same time. This included body parts, headlights, and engine parts among others.

Hyundai then brought in Bollywood superstar Shah Rukh Khan as the company’s ambassador to establish the brand in the country. The partnership continues to this day. “To a large extent, Shah Rukh Indianised Hyundai,” says Harish Bijoor, founder-CEO, Harish Bijoor Consults. “He was a door opener for the brand, who had an image of a boy-next-door for a car-next-door product. Very few stars have had that contributory effect on a brand that they proposed, as Shah Rukh Khan did.”

The South Korean carmaker also brought on board a crop of new generation entrepreneurs to become its dealers when many automakers were busy partnering with well-established names across multiple dealerships in the country.

“We wanted young, enterprising individuals who did not have a background in automobiles to become our dealers,” Puneet Anand, group head of marketing for Hyundai India, tells Forbes India. “We wanted credible and focussed people, and not the ones who were already dealers for other automobile companies. We had received interest from many well-established businessmen, but we chose to go with those who had a passion for automobiles.”

Yet, it was innovation and understanding the Indian customer that cemented Hyundai’s success in the country. “Just look at the Hyundai i20,” says Deepesh Rathore, co-founder of Gurugram-based automotive consultancy Emerging Markets Automotive Advisors (EMMAAA). “The quality of plastics is so much better than the [Maruti Suzuki] Baleno. That makes it much more desirable to a consumer. Hyundai has been focusing heavily on researching the Indian consumers and what they want, much more than Maruti.”

Along the way, the company was also instrumental in creating newer categories of vehicles in the Indian market. “In 1998, when it came in with the Hyundai Santro, it created a new segment in the automobile industry,” says Gupta of IHS Markit. “It did the same with the i20, the Grand i10, and even with the Creta. It has understood the pulse of the market that was ably helped by its understanding of the global automobile industry. Hyundai did not go about copying Maruti Suzuki and created a niche for itself.” In the process, Gupta reckons that Hyundai has positioned itself as a premium to Maruti.

Winning India Over

Today, Hyundai has an average customer age of 29, almost five years lower than its closest rival, the company claims. Among other things, a steady focus on design has helped it attract new customers. In 2011, Hyundai had introduced the “fluidic design” concept, which focussed on aesthetic appeal on the exterior and interior. Over the next few years, it will redefine this design language with a concept it calls, ‘sensuous sportiness’: Making the vehicle sportier and therefore more appealing to a younger audience. This new design language has already been launched on the Grand i10 Nios in August, the third-generation of its popular hatchback i10.

“When I speak to other manufacturers in India and ask them about their perspective on the country, their answer is that their brand is based in Japan or Europe, while the focus is on Japan or the US or Europe,” says Kim. “We are 100 percent Indian, and our product planning and development processes are based on India.”

Experts agree. “Suzuki has been using Maruti to take the money out from India,” says Gupta of IHS Markit. “Hyundai has been pumping money into India. The global business has been able to provide cutting-edge technology to the Indian arm, something Suzuki hasn’t been able to do. There lies the difference, when it comes to matters of tomorrow.”

Last year, Hyundai also made India one of its regional headquarters alongside Hyundai Motor North America and Hyundai Motor Europe. The three entities are free to function autonomously in their respective regions. “That is a significant elevation,” says Piparsania of Counterpoint Research. “They are now free to make their own decisions and show the intent of the group about India in the coming years.”

This year, the South Korean carmaker was ranked first in the 2019 JD Power After-Sales Customer Service Index Study, the third time in a row. Tata Motors and Mahindra & Mahindra were second and third respectively. “Hyundai is miles ahead when it comes to knowing what the customer wants,” says Rathore of EMMAAA. “In the service segment, it has been a notch above Maruti, with the launch of products at the right time, and better technology; it will improve on its market share and take away from Maruti by at least 10 percent in the next seven years.”

Yet, so far, Hyundai has been unable to match Maruti Suzuki when it comes to vehicle sales and market share. According to the Society of Indian Automobile Manufacturers, the apex body for automobiles in India, Maruti Suzuki sold 1.7 million units last year, while Hyundai sold about 545,243 vehicles in the same period.

Much of Maruti’s success has been largely due to its first-mover advantage, a large dealer network and economies of scale. The company was founded as Maruti Udyog Limited in 1981 and merged with Japanese automobile company Suzuki in October 1982. The company’s wildly popular Maruti Alto dominates its focus on the lower-end-of-the-pyramid. All in all, Maruti continues to be the market leader in the small hatchback segment.

“Maruti created the automobile industry in India,” says Gupta. “It has a much bigger dealer network and visibility in the country. Its economies of scale are much better, helping it keep costs low, which means it also caters to a wider audience.”

That said, Hyundai wants to retain its equal focus on the hatchback and SUV segments with five new launches next year, even if the SUV market continues to see significant growth. “Fifty-two percent of the market in India is hatchback. But the overall growth is better in the SUV segment, which has been growing at 25 percent,” says Anand. “So it will be a mix of products.”

India provides a massive opportunity for automobile companies, especially since vehicle ownership here remains low. According to government think-tank Niti Aayog, only 22 people out of a thousand own a car, as opposed to 980 and 850 per 1,000 in the US and UK respectively.

“Since it came to India, Hyundai has been offering the right technology without compromising on quality,” adds Piparsania. “Hyundai is no longer a challenger. It is now a direct competitor of Maruti, and in the coming years, with a better understanding of the Indian market, will be able to corner significant market share.”

Kim, however, maintains that Hyundai is not much of a volume seeker. “Our focus is on the customer: How to take care of the customer, their concerns, and how to make them happy. That is our process and thinking. Increasing market share is only a by-product of that.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)