Industry sceptical about government push for electric vehicles

Can subsidies alone power India's push to electric vehicles?

The lack of adequate charging infrastructure adds to range anxiety of EV owners

The lack of adequate charging infrastructure adds to range anxiety of EV ownersLeapfrogging technologies can be problematic—eliminating intermediate steps often results in messy policy and slower adoption. It’s a problem electric vehicle (EV) makers and consumers globally have grappled with. While some governments have intervened, like China’s, most have let market forces play, waiting for battery prices to fall and an ecosystem to develop.

India has believed that throwing money at the problem will result in faster (and superior) results. It hasn’t worked so far.

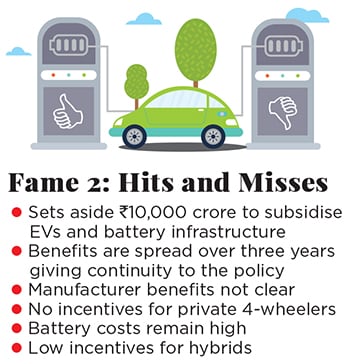

In early March the government announced a significant increase in the support given to EVs. Under Fame 2 [Faster Adoption and Manufacture of (Hybrid &) Electric Vehicles] scheme the Department of Heavy Industry laid out a ₹10,000-crore, three-year plan to incentivise vehicle owners and battery makers, with ₹8,596 crore as subsidies to owners, up from the ₹795 crore allocated under Fame 1 in 2015.

Fledgling EV makers have supported the move. “There are a lot of learnings from the previous policy that have been incorporated here,” says Mahesh Babu, CEO, Mahindra Electric, who says Fame 1 received a tepid response primarily because it was announced for a year and carmakers were unsure about its longevity. However, a large carmaker says, “The previous policy did not kick-start anything. This is only an extension of that policy and doesn’t alter our plans.”

Industry watchers question the wisdom of the new incentives for three reasons. First, the technology is still not quite there. People buying EVs still suffer from range anxiety, and charging stations that are few and far between do not help. Fame 2 does little to address this, by allocating only ₹1,000 crore for charging infrastructure.

Chetan Maini, vice chairman of Sun Mobility, which is working on developing a network of battery swapping stations, says it is very important for the government to be technology agnostic. For now the government is moving in one direction, of subsidising battery ownership. But it would be worthwhile to look at ways to amortise battery cost so that owners are not saddled with upfront costs, and offer subsidies on everything from charging stations to infrastructure for battery swapping. For now the policy is silent on this. In February, Sun Mobility set up four battery swapping stations in Delhi and Gurugram, with a capacity to swap up to 800 batteries a day.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)