Kaveri Seeds: Sowing new seeds

Why Kaveri Seeds, which was propelled by hybrid cotton to the top, needs to do an encore with maize, rice and vegetables

Image: Harsha Vadlamani for Forbes India

Even today, Mithun Chand has a vivid recollection of his visit to the Indian Seed Congress in February 2011. Kaveri Seed Company, the business he represented as executive director, was at an inflection point. A new cotton hybrid seed Jadoo, which comprised the Bollgard II gene, had been the talk of the industry.

It promised to help farmers improve yields and company insiders were enthused with the initial results. Since its launch in 2009, Kaveri had sold 27,000 packets—a number that was to rise nearly 10-fold the next year to 241,000. Still, the company thought the market was much larger. Inside Kaveri there was the keen anticipation of a student the night before an important exam—the kind when you’ve worked hard and are waiting to get your hands on the question paper.

News about Kaveri’s cotton seed had spread and several industry leaders visited its stall. When the head of a then, much larger rival dropped by and asked about the seed, Chand, who is today executive director at Kaveri Seeds, answered confidently: “This product will take us to the next level.” Chand and his uncle GV Bhaskar Rao, who founded the company in 1976, had pinned their hopes on Bt cotton. After being in business for over 30 years, Kaveri had only managed a top line of ₹100 crore. While it had a good brand name, a robust research and development setup and a national distribution reach, the growth spurt had eluded the company so far.

So while Kaveri had prepared well for the exam what it wasn’t prepared for was the manner in which it would ace it. Kaveri’s Bt cotton seeds, sold under several brands—Jadoo, Moneymaker and ATM—took the market by storm. The company went on to sell 53,00,000 packets in 2015. As farmer yields and income rose, Bt cotton seeds became a product that they were willing to pay for. At its peak, the company charged over ₹930 per packet of seeds.

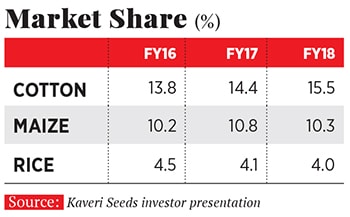

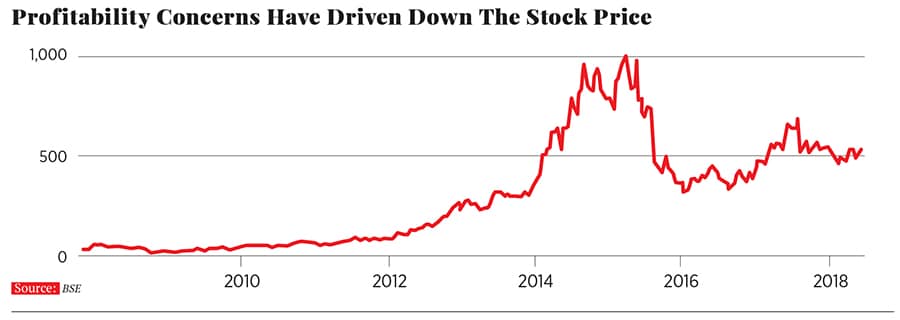

Kaveri’s track record so far indicates it has a good chance of capitalising on increasing rural spending by farmers. The company was the top beneficiary of the hybridisation of cotton in India. In the five years from 2010, its top line zoomed from ₹162 crore to ₹1,115 crore. Profits surged from ₹29 crore to ₹301 crore and the market rewarded shareholders with an 82 percent annual growth in the stock price, taking its market cap to ₹6,600 crore at its 2015 peak.

Now, a robust pipeline is expected to help Kaveri carve out a significant position in hybrids for vegetables, rice and maize in the next five years. “At its core, this business is not about inventory management or about production; it is all about the pipeline of products,” says Kenneth Andrade of Old Bridge Capital Management. Through the funds he manages, he has been an investor in the company since its initial public offering in 2007.

The Research Edge

To understand where Kaveri gets its edge from, one has to travel 45 kilometers northeast of Hyderabad to the village of Pamulaparthy. On a 30-acre farm, a team of scientists is working on the next set of hybrid seeds. These are seeds produced by cross-parenting plants to get a result that improves vigour and yields, and makes them less likely to be affected by pests. For instance, maize hybrid seeds can take yields up to 60 quintals per acre from 12 quintals per acre. But getting it right is a time-consuming and painstaking process. Seeds have to be continually tested across different soil and climatic conditions. As the salinity of ground water in India has increased over the last decade, adjustments need to be made.

Industry insiders draw comfort from the fact that GV Bhaskar Rao is a scientist at heart. His idea of time off on Sunday is an on-the-ground survey of how his seeds are faring in field trials at the research facility. After graduating from the Acharya NG Ranga Agricultural University in Hyderabad in 1975, a visit to his village in Karimnagar made him realise the potential for improving yields and he started growing hybrids on a 10-acre farm. “Our first major success in the initial years was with corn where we were able to double yields,” he says. After he started selling seeds in Karnataka, he named the company Kaveri Seeds after the river that flows through it.

Rao admits that the company only started conducting research in an organised manner after 1997. That was also the time it started taking steps to build a national distribution network—critical as seeds are sold in much the same manner as soaps and toothpastes with the company being responsible for marketing but sales being left to a network of distributors. Rao’s nephew C Vamsheedhar has in the last two decades built a network that traverses all states of the country except the northeast and Jammu & Kashmir.

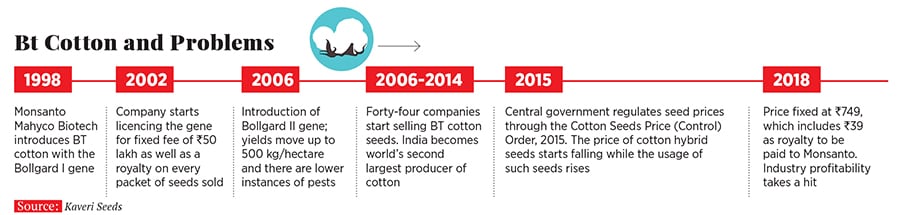

Kaveri’s efforts in developing hybrids received a leg up from an external force that swept the industry like a gale force. In 1998, Monsanto through its joint venture with the Maharashtra Hybrid Seed Company (Mahyco) started conducting test trials for genetically modified cotton hybrid seeds with the Bollgard I gene. Environmentalists decried the move due to its ‘terminator’ technology, which did not allow the seeds to germinate a second time. This meant that farmers would have to buy new seeds every year after paying Monsanto a hefty royalty.

While one can argue on the validity of Monsanto’s patent and on whether it is fair to use the ‘terminator’ technology, the data points to the fact that the seeds changed the shape of cotton cultivation. In 2002, Monsanto started licencing the gene to Indian seed companies for a fixed fee of ₹50 lakh plus a royalty on every packet sold. In the decade from 2002, the technology was licenced to 44 companies and cotton production nearly trebled to 33.4 million bales, according to data from Phillip Capital, a brokerage. Yields in the same decade were up by 38 percent to 489 kg/hectare taking India from being an importer of cotton to an exporter.

One can argue about the validity of Monsanto’s patent, but the data points to the fact that its technology increased the area under cotton cultivation The demand for protein is expected to rise rapidly even as the land available for cultivation shrinks

It was this opportunity that Kaveri would be able to effectively tap into. As cotton hybrid sales rose to 8,500,000 packets across all brands, the company recorded its best ever profit of ₹301 crore in the financial year ended March 2015. It rode past once-larger rivals Rallis India and Nuziveedu Seeds.

This was also the time when the advent of pests and declining yields prompted farmer agitations that eventually resulted in the government regulating the prices at which cotton hybrids were sold. Under the latest Cotton Seeds Price (Control) Order, the government has mandated that Bollgard II seeds be sold at ₹749 per packet or three-fourths of their peak prices. Monsanto’s royalty or trait value was reduced from ₹49 to ₹39. As a result, even though volumes have increased, profitability of the industry is under stress and innovation in BT cotton has all but stopped; the market size is expected to remain stagnant at $1 billion (₹6,700 crore). Lower profit has also meant that smaller seed companies have been unable to spend on research in other seed categories, setting the stage for consolidation in the sector.

Meanwhile, Monsanto is embroiled in a nasty patent dispute with the industry. While it has settled with most seed companies, including Kaveri, Nuziveedu continues to hold out and has dragged it to the Supreme Court, which has listed the matter for daily hearing in July. (The Delhi High Court had revoked Monsanto’s patent in April.)

A Wider Play

As India urbanises and becomes richer, two trends are likely to play out over the next decade. First, the demand for protein is expected to rise rapidly. Second, the amount of land available for cultivation is expected to shrink.

Kaveri has aggressive plans to take advantage of both these trends and has targeted a 5 percent reduction in revenue from cotton every year. Maize in India is an indirect play on protein in the country and at $600 million (₹3,900 crore), the second largest cash crop after cotton. Its hybridisation journey is relatively recent and Kaveri along with Bayer and Rallis has been at the forefront. “We are seeing high single-digit growth and in the last three years, we have expanded sales from South India to Maharashtra, UP and Bihar,” says Chand. Farmers are gradually shifting to the crop as maize is used in shrimp feed, chicken feed as well as for milch cows.

A product typically has a five-year cycle from introduction to acceptance. Initially there are early adopters who see increased yields and then spread the word about the seeds among the farming community. “If the seeds perform, sales almost always rise after two years,” says Vamsheedhar. In the meantime, the company has to make sure its distribution reach ensures that seeds are available by April when farmers start preparing for the kharif season.

There’s also rice, which presents a potential opportunity as large as cotton. China, the world’s largest rice producer, reached 90 percent hybridisation in the 1960s and the industry is hopeful of a similar trend in India. At present less than 5 percent of rice in India is hybridised. With seeds costing only 5 percent of input costs for rice and at 43 million hectares under cultivation, this is another $1 billion opportunity. With water levels declining and water salinity increasing, hybridisation is the only answer, according to Andrade. Kaveri’s 468 hybrid, which launched two years ago, is beginning to see traction.

Last, there’s vegetables—tomatoes, okra, chillis and gourds. Here, from a much lower base, Kaveri expects to grow at 15-20 percent a year. The markets for sunflower and bajra have stagnated.

In the last three years, in addition to price control headwinds in cotton, the company was also buffeted by regulatory headwinds. In December 2015, it received a letter from the Securities and Exchange Board of India, asking the company to undergo a forensic audit. The audit was completed and the company hasn’t heard back since. Its income is classified as agricultural income and so, Kaveri pays no tax on profits, something that strikes many investors as odd. However, the company clarifies that it sees no reason not to take advantage of the exemption afforded to it and that it would be happy to pay taxes if the laws change. It has no pending dispute with the tax authorities.

For now, Kaveri believes it has the right products to tap into demand for hybrid maize, rice and vegetables. It has targeted a 15 percent growth in sales and 20 percent increase in bottom line over the next three years. With its stock down by nearly 50 percent since 2015 the market has chosen to adopt a wait-and-watch attitude. The company needs to shed the one-hit wonder tag and show that it can pivot from cotton to a wider range of products. The opportunity is there and its product pipeline is in place. All that remains to be seen is whether farmers bite.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X