Volkswagen's strategy for India 2.0 has revved up the engines

German automaker Volkswagen has revamped its game plan to gain a bigger share of the country's booming auto market

Gurpratap Boparai, managing director of Skoda Auto Volkswagen India, is gearing up to grow the Volkswagen Group’s market share in India to 5 percent by 2025

Gurpratap Boparai, managing director of Skoda Auto Volkswagen India, is gearing up to grow the Volkswagen Group’s market share in India to 5 percent by 2025

Image: Madhu Kapparath

Gurpratap Boparai certainly knows the importance of planning well. He often spends a few weeks every year riding across India on his Triumph Thruston R and in the last few weeks of December, the managing director of Skoda Auto Volkswagen India (SAVI) rode from Mumbai to Wayanad in Kerala, a distance of more than 2,000 km over 10 days. Certainly, that could not have been done without a detailed plan in hand.

It is perhaps this attention to detail the engineer-turned-business executive is banking on to resurrect the fortunes of the world’s largest carmaker, the Volkswagen Group, in India. A veteran of the Tata Group, Boparai, 50, is known for the phenomenal success of SUV maker Jeep, when as the head of FCA India Automobiles (Fiat) he played a crucial role in bettering localisation levels and ensuring seamless production of the Compass model. At SAVI, Boparai has several challenges in the year ahead.

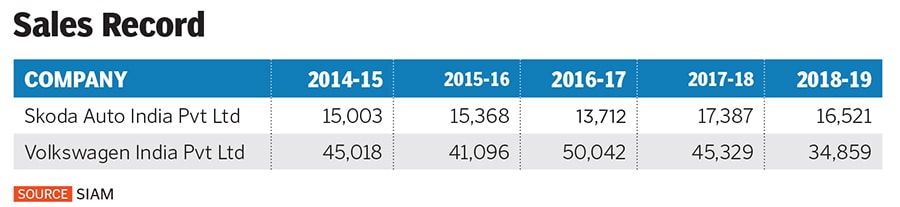

The Volkswagen Group—makers of Skoda, Volkswagen, Audi, Lamborghini, and Porsche—has struggled in India, particularly against Korean and Indian carmakers, in gaining a sizeable presence for more than a decade. Having begun operations in 2001 through its subsidiary Skoda Auto India, the Wolfsburg-headquartered company is yet to replicate its global success in India, the world’s fifth-largest automobile market. In 2018, the Volkswagen Group sold nearly 11 million vehicles globally; in India it didn’t even cross 100,000. With a combined market share of 2 percent, Volkswagen’s fortunes are in stark contrast to Hyundai Motors, which began operations in India four years before Skoda’s entry and has emerged as the country’s second-largest carmaker, cornering a little over 18 percent of the market.

“It is no secret that we have struggled so far,” says Boparai, who was roped in from Fiat in 2018. “The market share is not in line with what we expected. As a group we want it to grow to 5 percent by 2025.”

To do that, Boparai and the Group have devised a new three-pronged strategy, code-named India 2.0: It will merge different units to create an umbrella organisation and increase dealer networks; it has developed a new platform, MQB A0-IN, on which to launch four new vehicles, starting 2021; Skoda, the Volkswagen Group’s Czech subsidiary, has been handed the mandate to lead India operations, in line with a global strategy where one Group subsidiary drives strategy and sales in a specific region. “The idea was to reboot our approach to India,” says Boparai.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

Skoda’s Aurangabad plant (above) will have synergies with Volkswagen’s factory in Chakan, Pune

Skoda’s Aurangabad plant (above) will have synergies with Volkswagen’s factory in Chakan, Pune