Why Tinsel Town is 'Haunted' by An Indian

Sanjay Gaikwad has challenged Hollywood’s monopoly with a technology that enables cinema halls to show 3-D movies at a fraction of the cost

In April this year, ticket sales at South Mumbai’s famed Regal cinema got an unexpected boost. Occupancy at this 78-year-old theatre, designed by Charles Stevens, usually hovers at around 25 percent — a far cry from what it was in the ’50s and ’60s when the crème da la crème of Bombay’s society thronged it.

But during the last week of April, some shows ran to full house at the theatre which can seat 1,100 people. On an average, tickets were sold for three out of four seats that week.

The reason for the sudden jump in numbers wasn’t a Salman Khan blockbuster or some other star-studded film. It was Haunted, a horror film. And people were willing to pay a premium to see this film.

The reason? It was the fancy 3D technology that Regal had adopted. It was among the first theatres in the country to be fitted with a cheaper 3D system designed by an Indian company called UFO Moviez. And Haunted, India’s first 3D horror film, had brought audiences out in droves to cinemas. It showed that middle class Indians are willing to fork out 25-30 percent extra for a 3D film. Manoj Gupta, an exporter from Crawford Market, described the experience as superb. “I’d be willing to pay double the price for a good 3D film,” he said as he exited Regal Cinema.

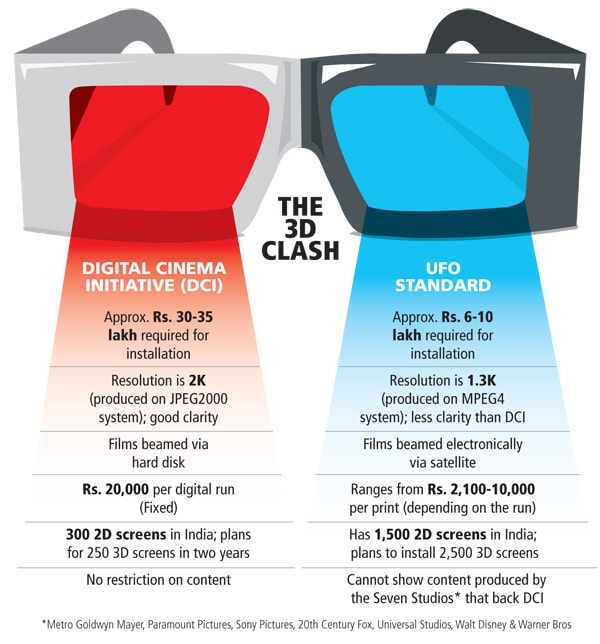

This is exactly what Sanjay Gaikwad, CEO, UFO Moviez, wants to hear. He will be investing Rs. 100 crore to enable 1,500 movie theatres across India with 3D technology. The most audacious part of his bet is that he is using is his proprietary 3D solution and not the Digital Cinema Initiative (DCI) standard backed by seven Hollywood studios. DCI is a joint venture formed by Metro Goldwyn Mayer, Paramount Pictures, Sony Pictures, 20th Century Fox, Universal Studios, Walt Disney and Warner Bros. The studios are using their monopolistic position to force theatre owners into adopting DCI technology. UFO is now contending with this major player. In April, UFO raised Rs. 260 crore from Providence Private Equity to enable the company to reach its target of fitting 1,500 screens with 3D projectors by the end of 2012. Indian theatre owners are excited about the audience that 3D can deliver. Take for instance Haunted. It has recouped three times its Rs. 8 crore investment.

Vikram Bhatt, the producer of Haunted, says the idea for his next 3D film is already brewing in his head. And this despite it being 40 percent more expensive and time consuming to shoot a movie in 3D. People in the industry say he has already signed a three-film deal with DAR Motion Pictures. But there’s a caveat in producing such films. Sainath Ramanathan, associate director, 3i Capital, an investor in UFO, says, “The industry has to be careful not to churn out badly produced 3D content as this could cause audiences to turn away.”

A Profitable Market

However, for Gaikwad this is an attempt at creating a market for 3D films in India. He knows that it is only a matter of time before Indian audiences lap up content in 3D. Avatar started the trend and generated $1.5 billion in profit for 20th Century Fox. Last year, nine of the world’s top 20 movies were shot in 3D.

But Hollywood’s 3D solution, DCI, is an expensive proposition for theatre owners. They have to pay anywhere between Rs. 30-35 lakh for the 3D technology. This is the reason why DCI’s expansion has been slow. Ten years after its first 3D film hit India, it has only managed to sign on 76 theatres.

For Gaikwad, this presented a good opportunity in the market. The audience wants to see 3D films, but cinema owners don’t want to invest large sums to have that capability. This is what made Gaikwad develop his own technology and reduce the cost of making a theatre 3D-compatible.

An Experienced Risk-Taker

Taking this kind of risk is not new to Gaikwad. A decade ago, he did the same when he started UFO. Fresh off the success of Playwin, an online lottery platform from the Essel Group, he noticed that the movie distribution business was incredibly inefficient. As each film spool cost Rs. 60,000, roughly 20 percent of a film’s budget went towards getting these prints to cinemas. At best, producers could only hope to reach 500 cinemas on the first day of the release. So the smaller towns would receive the spools only after the films had been screened in urban centres for a couple of months. But with 120 million homes connected to satellite television, audiences knew about the latest releases at the same time as their city brethren and were unwilling to wait. Pirates had a field day and the industry was the loser.

Gaikwad knew that if he could eliminate the need for prints he’d have the film industry on his side and could rapidly scale up the model. Though not an easy task, he managed to convince the cinema owners to download films via satellite instead of waiting for spools. Today, both theatre owners and

Gaikwad have profited from this move.

With 2,500 screens on the digital cinema platform, Gaikwad’s business is cruising on auto pilot and is on its way to recovering its capital investment.

The Opportunity

Gaikwad clearly sees a similar opportunity in 3D films, that’s why he got his researchers to struggle for over a year and a half to bring the cost down. 3D films can be shot in various formats like frame sequential, checker board, side by side and so on. The problem arises in reconciling these images on a projector and playing them on a silver screen. It was here that UFO made use of its 15-member research team and developed a box that would allow it to sync with the server on which the film is downloaded and the projector that plays the film.

Infographic: Hemal Sheth

Infographic: Hemal Sheth

The company shelled out Rs. 5 crore on developing this box and it took one year for the researchers to make this box compatible with all the 3D film formats.

In April 2010, the company tested this technology by broadcasting Indian Premier League matches in 3D at cinemas across the country. It passed with flying colours. “It is very close to a DCI 3D experience. Only a professional will be able to spot the difference in quality,” says Farokh Balsara, national leader, media and entertainment practice at Ernst and Young. The total cost is Rs. 6-10 lakh depending on which projector the cinema chooses. The only catch: It can’t play films produced by the seven major Hollywood studios that back DCI.

This presented a major problem for UFO. With no content from Indian studios, cinema owners were wary about investing in his technology. “We were faced with a chicken and egg situation,” says Rajesh Mishra, CEO, India operations at UFO. “Without cinemas being equipped, producers wouldn’t make films and without films, cinemas wouldn’t invest.”

Gaikwad then decided on a new approach. He gave the theatres everything free and did not charge the cinemas for the additional projector that a 3D film needs, the server, the cost of the silver coating and the viewing glasses. He asked the theatre owners to pay between Rs. 10-15 for every ticket that they sold. For the theatre owners, this converted a capital cost into a variable expenditure. The increased ticket prices more than compensated for the fee charged by UFO.

“Their business model is suited for emerging markets if you look at their quality, price points and service model,” says Biswajit Subramanian, managing director at Providence Equity Advisors India.

Gaikwad now has a dominant standard for the Indian 3D content. But what kind of money does he hope to make? The cost of fitting each theatre with his 3D technology works out to Rs. 10 lakh per screen. At a 10 percent return over a period of four years, the company would need to sell about 2,900 tickets a month. With 10 made-in-India 3D films slated to release this calendar, Mishra has based his calculations on at least five films doing well. But he concedes that the business plan remains a ‘bit in the air’ as no one can say for sure how the films will do. At best, he says, he can point to the Hollywood experience where every year an increasing number of films in the top 10 are 3D. In 2008, there was only one 3D film in the top 20. Last year there were nine.

The Future Demand

In its first year, UFO overtook the rival DCI platform and fitted 75 cinemas across India with projectors to screen 3D films. With 30 3D films slated to be released next year, the company says 200 cinemas have already signed on for its technology. Buoyed by the success of 3D, some producers are toying with the idea of filming in 3D. For instance, Aditya Chopra is said to be considering filming Dhoom 3 in 3D. However, since these are early days for the Indian audience, producers have to be careful not to lower the viewing experience. One way of doing this is to not convert 2D movies into 3D as they fail to provide the same viewing experience. UFO discourages this conversion.

For now, the company’s only problem is the inability of the system to play major Hollywood movies and Gaikwad is hedging his bets here. In April, his company acquired a 26 percent strategic stake in Scrabble, the company that distributes DCI-compliant projectors. So, in the years to come, if the Hollywood studios still don’t agree to release their movies on his platform and his technology fails to make a profit, he would be invested in a business that is doing well.

But many are confident that there’s space for both. “Look, there will never be 1,000 DCI screens across the country. Only a local platform will work due to its cost competitiveness,” says Ramanathan of 3i Capital.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)