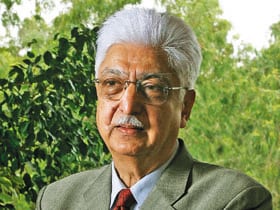

Premji: 'Part of It Is Gut Feel'

Azim Premji does not believe in wasting anything, least of all his time. That he spent over an hour talking to us shows how important ecology is to him

Why is it important for Wipro to start diversifying into ecology?

Don’t narrow your perception on what we are trying to do just to diversification. There are other dimensions, as a citizen - ecological sustainability is a global problem but completely unaddressed in India.

Second, every year we set a target for conserving water used by the company. That’s an aggressive target of improvements of about 10-15 percent every year, inspite of more complexities and longer working hours.

Third we see incremental business opportunities that we can create in our existing businesses, like green lighting and green data centers.

On the fourth axis really is how you create a new business like Wipro Water, we see water as an important beachhead where we can build a global business.

As far as renewable energy goes we have identified a very major opportunity called renewable energy, frankly we don’t have a fit of it, what is it wind power, is it solar, is it the blades of wind power plants

You talk about renewable energy, but you say that you haven’t decided which of these you will back. What will be the criteria if you have to choose one, say wind over water or bio-fuel?

I would assume that one of the big criteria will be the scalability of the market. Second is the kind of returns that you will make on the investment. Three it will be differentiating technology. It has to be of a significant size of business for it to make worthwhile for us, because our scale of operations has become so large now. If something is very sidey, it is not going to be of interest to us.

But what will really Wipro bring to the table which will help you compete successfully?

Oh most certainly, better management. It will be a differentiating factor. Two, The players that are here today are reasonably large, except in wind power. But we have a strong brand and just like we found in IT, being an Indian company is no disadvantage even when compared to IBM. If you are able to give a good solution the customer will be willing to pay you. Three, we will hopefully be able to put together a differentiated strategy, product or service.

You also talked about getting into manufacturing, why is that?

Because technology is embedded in manufacturing and if you buy from someone else generally he would capture the customer. India is becoming globally competitive when it comes to manufacturing. And a well run Indian plant will be able to benchmark with the best in the industry. If you talk to Nokia you will understand that their productivity in the Indian plant is equal to the best in the world. Same thing with Bosch, they are benchmarking the new Indian plants with the best of German plants. And German plants are extremely productive in terms of man hours, maybe not in terms of cost per man.

Would you also look at GE for your energy and ecology business as a partner?

Downstream yes, but we want to have a strong beachhead. I believe that once we have established ourselves our negotiations with our partners is strong.

What would you describe as maturity in this case?

Scale, size, customer loyalties and understanding of technology. The interesting thing now is that good technology is becoming available from much smaller companies because of all the extra venture capital funds and PE funds coming into renewable energy. It has today the highest investment market share globally of any sector.

Would you look at that model as well, invest in a startup that has promise and then merge that company in Wipro?

Why not? We can do it through Premji Invest which is our investment arm.

So going forward what are the kinds of capabilities you reckon you need going forward? Especially say talent?

Some talent is available here. I think we also find that a lot of Indians settled abroad are willing to come back.

When you talk about renewable technologies or green technologies the perception is that this is a first world bastion. Looking forward do you think there will be a perception problem with a company coming out of India in this kind of space?

I don’t think so. You need to build a good marketing network; you need good front end people, particularly in Europe, also to some extent in US. The problem with a lot of companies is that they have build success very quickly and have a huge drive for market cap which is very dangerous thing. You look at these companies, the slickest thing that they have is investor presentation. It is really amazing; we are not able to build investor presentation like that, even after being in this game for years and years. The owners of some company will spend a quarter of their time with investor conferences. I was measuring how much time I have spent and I have spent 0.75 percent of my time with investors. You can’t over hype things like that.

How do you tap ideas internally? How do you go through the process of elimination?

One is very clearly if the business cannot be run ethically we wouldn’t touch it. We will never be in real estate and in road construction since you cannot run those businesses ethically. Anyone who says he can run a real estate business ethically is fooling himself. Today it is important that the business should be able to reach a certain scale. When we entered the IT business many years ago the question was can we afford the business? We had a budget of Rs 20 lakhs that time. (Laughs). Otherwise it takes a lot of senior management time for very little scalability. That becomes very important. Now we will look at businesses that are expanding on the Indian market and have an opportunity to build a global footprint. We can learn a lot from India these days because India is now a very sophisticated market. It becomes a good laboratory in a way, because you are more trusted here as a brand you can do more complex work. And then obviously it has to meet certain threshold of profitability.

Is capital invested also a concern? You said in IT you had too little at one point in time? You obviously have a much larger pocket now?

We would want some amount of investment. The services businesses are people intensive, manufacturing is more capital intensive. The water business is half way between the two. I would assume renewable energy, unless we get into something like solar which will be very capital intensive, should be similar.

So those are the things you wouldn’t get into?

I don’t know, let us see. We are not yet able to find the right opportunity in solar which is making a breakthrough. It is still dependant on subsidies. We wouldn’t go into a business which is dependant on economies of subsidy.

So the green area is also pretty much a Greenfield as of now? You could make a bet and that may not pan out.

We can afford to lose some money. We have done lots of things where we have lost money and had to wind it up like the Wipro Netcracker ISP business or Wipro Finance where also we lost money.

What did you take away from these losses?

You’ve got to be serious about a business. Which is why I get completely stunned with some of the diversifications that some of the other groups make. They are unbelievable, how they think they can pull it off. I am really very amused. Maybe they have some management talent which we are not able to build in our company.

How do you spot business cycles? Twenty five years ago, you identified IT as a big opportunity. Are you at a similar stage with ecology now?

A: Part of it is gut and the other is to scan and talk to people, to see what trends are emerging.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)