Sliding Tata Group stocks expected to survive boardroom battle

Developments at Bombay House has raised investor concerns, but experts say investor fears are misguided

Image: Danish Siddiqui / Reuters

Any boardroom coup in the corporate world impacts strategy for the group and investor confidence over the near term. The unceremonious removal of Cyrus Mistry as chairman of Tata Sons on October 24; the debate over the rightness of his removal and the decisions that stakeholders in several Tata group companies take will play out in coming weeks. But it has raised investor concerns over how the listed companies of the Tata Group will be impacted as the battle for control at the top of the bluest of blue chip conglomerates unfolds.

On Friday last, the independent directors of Tata Group firm Indian Hotels expressed their support for Mistry’s leadership. Earlier last week, the interim chairman Rata Tata, in a bid to ease concerns of employees, wrote an email to them, where he said that the decision taken by the board of Tata Sons, the flagship holding company of the $103 billion-group, to replace its chairman was “well-considered and a serious one for its board members. This difficult decision, made after careful and thoughtful deliberation, is one the board believes was absolutely necessary for the future success of the Tata Group”.

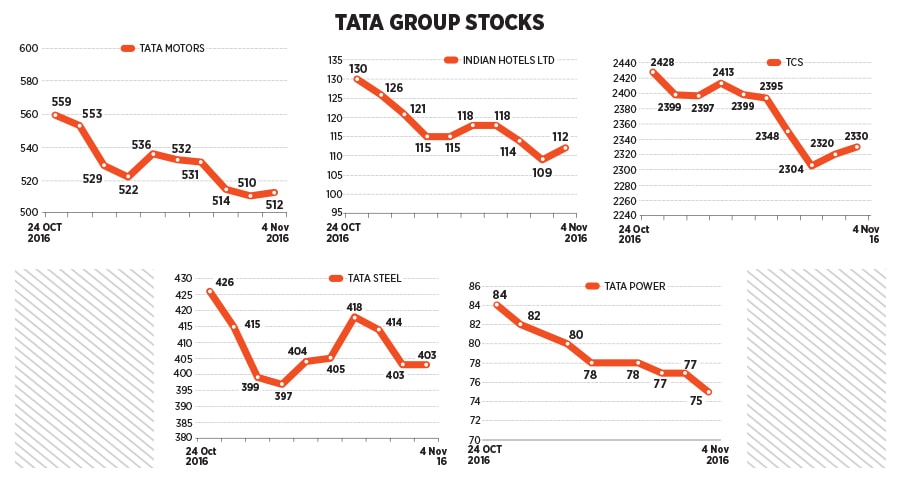

From Mistry’s side, he has said that he plans to continue as chairman of all the Tata Group companies, including Tata Steel, TCS and Tata Motors. Mistry also remains a director on the board of Tata Sons, by virtue of his family’s 18.4 percent stake in the company. Each day’s news flows has impacted most of the Tata Group stocks: TCS’ has slid by 4.02 percent since the details of Mistry’s exit broke and Tata Motors’ has fallen by 8.40 percent in the same period. Others such as Indian Hotels Ltd have lost more ground, falling sharply by 13.33 percent and Tata Power by 10.7 percent. Tata Steel has fallen by 5.43 percent in the same period.

Each day’s news flows has impacted most of the Tata Group stocks: TCS’ has slid by 4.02 percent since the details of Mistry’s exit broke and Tata Motors’ has fallen by 8.40 percent in the same period. Others such as Indian Hotels Ltd have lost more ground, falling sharply by 13.33 percent and Tata Power by 10.7 percent. Tata Steel has fallen by 5.43 percent in the same period.

But investment experts and fund managers Forbes India spoke to signal a couple of things. Firstly, the impact of the corporate developments at Bombay House (the corporate headquarters of the Tata Group) has largely been factored into the correction seen in share prices of key Tata Group stocks. Secondly, some of the stocks, such as Tata Coffee, Tata Global Beverages and Tata Chemicals – which are impacted by commodity cycles – could well see an uptrend, as global commodity price cycles are starting to improve.

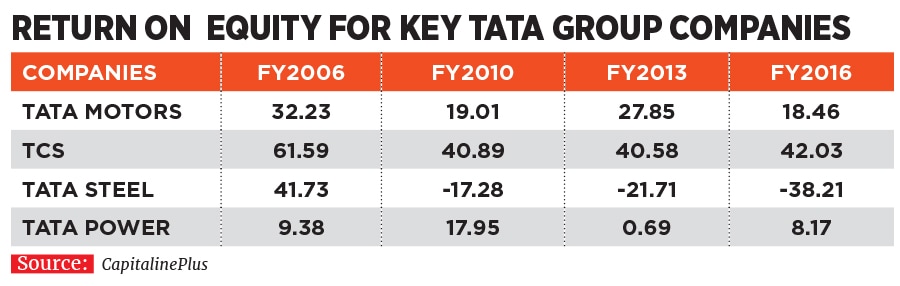

“I see no shift in investor confidence, most of the problems which have reflected in the balance sheet are known,” a mutual fund veteran, who now runs his own investment advisory firm, said on condition of anonymity. He said investor fears are misguided as most Tata Group stocks have – in the past – provided strong upsides during a cyclical upswing in the sectors they operate in. “One good cycle often sees these stocks moving up sharply.”

A research head with an institutional equities firm said small investors should continue to take investment decisions based specifically to the commodity cycle or based on fundamentals aligned to the stock.

“Several of the Tata Group stocks look good irrespective of what has played out in recent days,” the head of research said. “There is no doubt that [recent events] have cast a shadow on the (Tata) Trusts and possibly their near-term functioning in terms of strategic planning and execution, but it is unlikely to have a significant impact on specific stocks.

Gautam Trivedi, chief executive officer with Religare Capital Markets, said: We find Tata Motors an attractive stock based on its fundamentals,” led by the Jaguar Land Rover He declined to comment on other Tata Group stocks.

Tata Motors, whose sales and operating income is led by British marquee brands Jaguar and Land Rover which they acquired in 2008 from Ford, this month said its total retail sales jumped by 11 percent to 46,325 units in October 2016, compared to the same time the previous year. Sales were led by the Land Rover, Discovery Sport, Range Rover Evoque and the Jaguar XF.

For the June ended quarter, Tata Motors’ consolidated net profit had more than halved to Rs 2,236 crore, hit by forex losses and rising expenses.

The TCS stock has underperformed at the markets in the past three months, but that is more on account of the malaise which the sector faces due to slow spends by US-based clients in the banking and financial services space (This traditionally accounts for a substantial portion of TCS’s revenues). TCS reported an 8.4 percent rise in consolidated net profit to Rs 6,586 crore for the July to September quarter this year.