Blow by blow: Samsung, Xiaomi locked in a fierce battle

Korean giant and Chinese rival slug it out for pole position in the Indian smartphone market

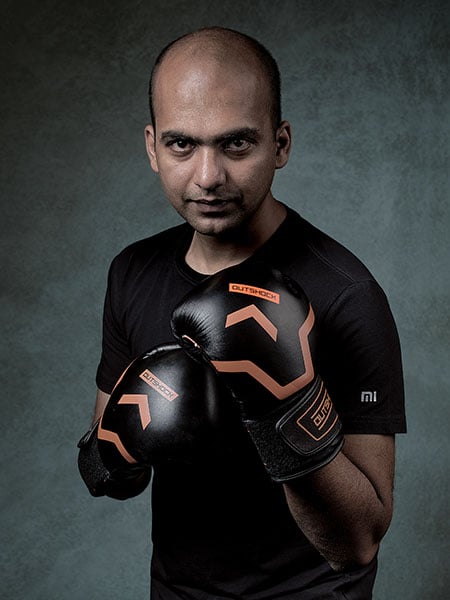

Image: Amit Verma

Image: Amit Verma

“Whatever we are doing is to stay No 1. We have remained No 1 over the years, and I believe as long as we keep our focus on the journey, the result will remain No 1.”

- Asim Warsi, senior vice president (mobile business), Samsung India

It’s an hour and a quarter after noon in early August in Gurugram. Dark clouds looming ominously since early Monday morning open up. The sprawling satellite town in the Delhi-National Capital Region is soon drenched in heavy monsoon showers. The streets duly get flooded and traffic begins to crawl.

The aerial view of the city, though, from the 19th floor of Two Horizon Center looks majestic. But there’s one big difference from the scenario 11 months ago. A thick cover of billboards with the green and blue logos of smartphone makers Oppo and Vivo that dotted the entire stretch of Golf Course Road in Sector 43, has vanished. Samsung, which has its India headquarters across eight floors of the 24-storied Two Horizon Center building, has weathered the onslaught of the Chinese siblings. Now it’s got to contend with another battle. With another Chinese giant. With aspirations to be top dog.

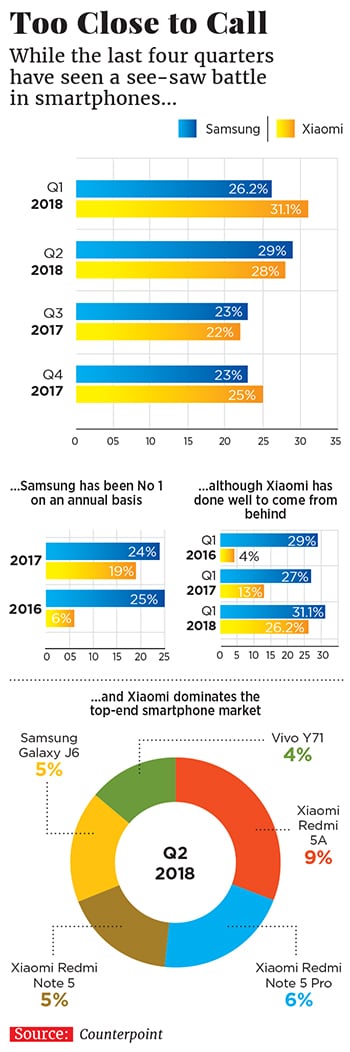

The challenger, Xiaomi, has been breathing down Samsung’s neck menacingly over the last three quarters, even emerging No 1 in two of them (see 'Too Close to Call' infographic below). Annually, though, Samsung has been numero uno for the past two years.

“The quarter approach has never driven our business,” avers Asim Warsi, senior vice president (mobile business) at Samsung India. Samsung, according to independent market research agency Counterpoint, pipped the Chinese rival by a percentage point in the most recent quarter (ended June) to reclaim pole position with a 29 percent share.

“Though I believe we are still No 1, we don’t lose sleep over one quarter numbers. If brands, who are here for decades, are fighting with a four-year-old startup, it tells the story.”

“Though I believe we are still No 1, we don’t lose sleep over one quarter numbers. If brands, who are here for decades, are fighting with a four-year-old startup, it tells the story.”Manu Jain, India managing director and vice president, Xiaomi

Image: Nishant Ratnakar for Forbes India

Samsung appears in no mood to yield ground from hereon, not just over quarters but over a longer period. “We take a long-term view, and that’s why over the years and for multiple years we have been No 1,” Warsi asserts. “We intend to stay the leader for many more years.”

The intent is matched by action. Samsung’s annual growth rate during the second quarter, at nearly 50 percent, was the best it’s been since the fourth quarter of 2015. “It has launched devices pitted directly against Xiaomi’s portfolio,” Canalys analyst Tuananh Nguyen said in a recent statement.

Jain’s unflinching confidence stems from two of Xiaomi’s successes in recent times: How it disrupted the global smartphone market over the last two years as well as how it spooked Samsung along with its own Chinese rivals in India, the world’s second largest smartphone market. For Xiaomi, which recently made its debut on the Hong Kong stock exchange, India is its biggest market outside its home country.

Though Xiaomi finished a close second in the April-June quarter, it was its best in India since it opened its account in 2014; it recorded its highest ever shipments in the country. Three out of the top five smartphone models, according to a Counterpoint study, were from Xiaomi, with Redmi 5A being the bestseller.

“From a small six-seater room four years ago to an 180,000-square-feet building with over 750 seats, Xiaomi India has come a long way,” Jain tweeted in April, when Xiaomi’s billionaire-founder Lei Jun was in India to inaugurate the company’s new office in Bengaluru. Sales, too, have followed a similar direction—from a 4 percent smartphone share in the second quarter of 2016 to 28 percent two years later.

“We don’t demean competition, but we will remain aggressive and stay No 1,” Jain thunders.

In spite of mutual respect for each other, Samsung and Xiaomi are not engaged in a friendly match. It’s a fierce battle between equals, reckon analysts, where no side is willing to settle for the runners-up spot.

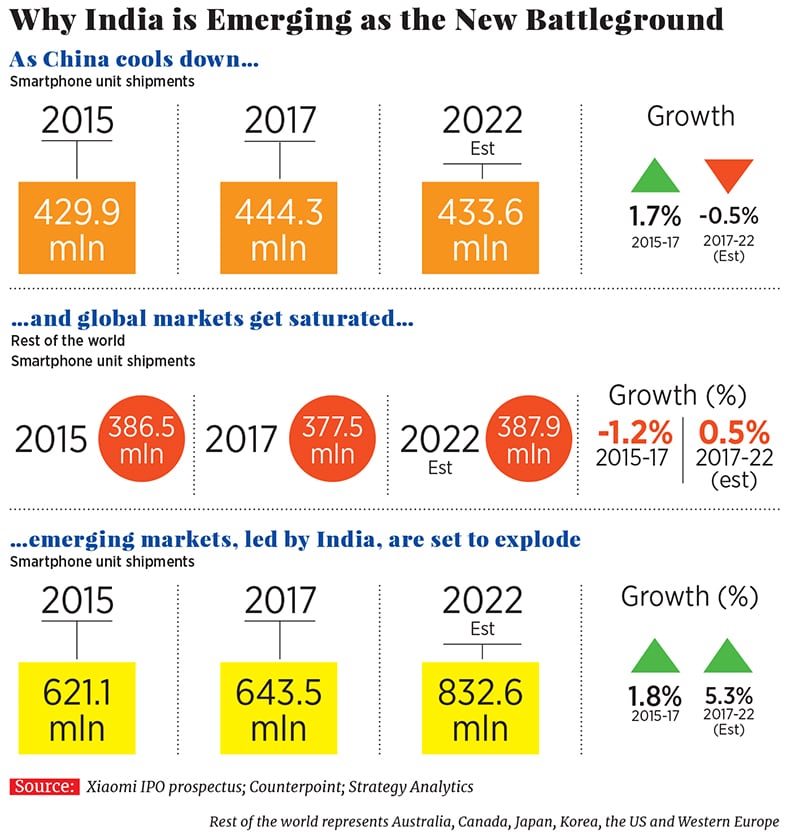

“The battle between Samsung and Xiaomi is heating up and is likely to continue for at least the next two years,” says Neil Mawston, executive director at Strategy Analytics. He adds that both players have deep pockets that will enable a long-drawn slugfest on a key battleground. “India is the new China,” says Mawston.

FIGHT SHIFTS TO INDIA

China’s smartphone market declined for the fourth consecutive quarter in April-June this year. The continuous slide signals one strong message: The world’s biggest market is cooling down. And smartphone shipments are projected to fall between 2017 and 2022.

China offers little solace for the two prizefighters. Xiaomi, which has slipped from No 1 to No 4, saw a 10 percent decline in its year-on-year (YoY) share. What’s making matters worse for Xiaomi, whose miraculous comeback after a dramatic sales plunge in 2016 made it the poster child of China’s entrepreneurial dynamism, is the tough fight from another homegrown player: Huawei and its sub-brand Honor. Huawei reached its highest ever share in China by topping the charts with 26 percent. Honor surpassed Xiaomi in overall volumes during the second quarter.

If Xiaomi is finding the going tough in China, Samsung, the world’s biggest smartphone maker, continues with its disastrous performance in Dragon Land; market share tanked below 1 percent in the latest quarter, a far cry from its heyday in 2013 when it lorded over a fifth of the Chinese market.

“As China is becoming a problem child for Samsung and Xiaomi, India is the next big bet for both,” says Neil Shah, research director at Counterpoint.

For Samsung, which recently opened the world’s biggest phone manufacturing factory in Noida, a big bet on India is the best, well, bet after losing the plot in China and ceding ground to Apple in the US.

For Xiaomi, India has turned out to be a promising land. Xiaomi, maintains Shah of Counterpoint, sees China as a tough market to grow in as it is maturing. Users are buying high- to premium-end phones and Huawei is breathing down Xiaomi’s neck in the mid-tier segment. Capitalising on India makes more sense.

One out of every three smartphones sold in India is a Xiaomi. It’s the biggest player in fitness bands; out of every two wearables sold in India, one is by the Chinese upstart. “We are the biggest online players in TV, routers and air purifiers,” claims Jain.

The pace of Xiaomi’s growth, reckon analysts, can do wonders for the brand. “If it maintains momentum, by next year India might become its biggest market,” reckons Shah, adding that the fight is tantalisingly poised between Samsung and Xiaomi who follow diametrically opposite business models, and cultures.

Xiaomi showed Samsung how successful online sales can be. The Chinese firm is now focusing on offline connect to take on its rival

Xiaomi showed Samsung how successful online sales can be. The Chinese firm is now focusing on offline connect to take on its rival CLASH OF CULTURES

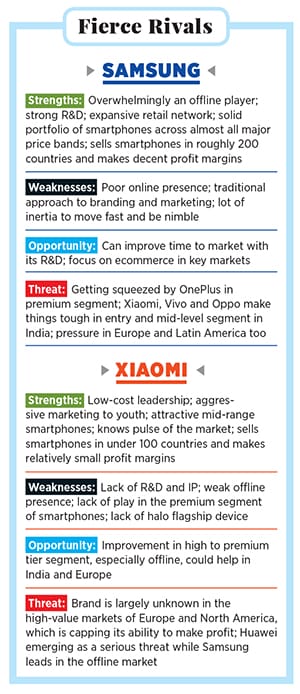

What makes the contest gripping is the way both the companies conduct their businesses. Samsung sees smartphone as a hardware; believes in making decent, if not hefty, margin on selling the device; prides itself in being present across all price points; and leverages its research and development capabilities by pegging it on consumer insights.

Take, for instance, the ‘chat over video’ feature in the recently launched models of Galaxy J series, which allows users to respond to messages or chats while viewing videos. The innovation turned out to be a blockbuster. Within two months, the company sold 20 lakh units of J8 and J6 mid-segment smartphones, Samsung claimed last month.

Warsi though would likely scoff at the idea that the company made changes dictated by competition. “The hunger to question the current status and inquire about what’s new for consumers are what make Samsung,” he says.

That Samsung has been tested a couple of times over the past two decades in India has added resilience to its DNA. While it displayed aggression in toppling Nokia in 2012, Samsung showed character in not pressing the panic button when in August 2014 homegrown player Micromax threatened to challenge its reign. “We have seen numbers 1, 2, 3, and 4 over the last decade or so... so we know that what it takes to slip or recover or sustain,” grins Warsi.

It’s again the wisdom gained by experience that has been the foundation of Samsung’s business strategy. The roots can be traced back to 1995. Over $50 million worth of hardware—around 150,000 devices—was burnt at a factory in Gumi, South Korea. Reason: Chairman Lee Kun-hee was dismayed to learn that mobiles he gave out as New Year’s gifts were inoperable. Over 2,000 employees gathered around the pile of phones, which was set on fire. When the flames died down, bulldozers razed whatever was remaining. “At the core of Samsung is quality of products and the trust of users,” Warsi underlines.

“ Xiaomi’s growth increased by 38% annually in the second quarter, down from 58% a year ago. Xiaomi is slowing due to fresh competition from Huawei.”

Linda Sui, director, Strategy Analytics

Initially mocked by rivals for adopting an ‘online-only’ approach in India, Xiaomi had the last laugh. “Four years back, selling handsets online was an alien concept in India. People thought it’s a gimmick,” recounts Jain of Xiaomi, a tech startup which recently pledged that it will cap its profit margin to just 5 percent. “Honest pricing, innovation for all and great products are what make Xiaomi unique globally,” he adds.

The strategy, though, at times has baffled people. Jain explains how. When Xiaomi phones used to go out of stock in a few minutes during flash sales, rivals alleged that the company is creating artificial scarcity. When the online sales used to last for hours, they came up with another weird logic: The demand for the product is petering out. “Our culture is different from any other company. We are a software company, not a hardware one that wants to make money out of handsets,” explains Jain.

Lei Jun, the maverick founder of Xiaomi, laid threadbare the fundamentals of the company in an open letter while filing the IPO prospectus this May. “We are an innovation-driven internet company… for which amazing products and honest prices come hand in hand,” he wrote, expressing his bafflement over the high margin game played by other companies. In 2011, Jun recalled, during the first employee annual meeting, the company resolved to make high quality smartphones and sell them for just $300. “At that time, similar smartphones were selling for $600,” he noted, adding that a shirt in China might cost $15 to make but retails at $150. “This is a shocking markup of 10 times,” Jun added.

That’s where Xiaomi differs from Samsung or any other company. A smartphone for Xiaomi is not an end in itself, but a means to cross-sell other products from pressure cookers and air purifiers to TVs and even pens to its loyal base of fans that make up the Mi community. There were over 190 million monthly active MIUI (Mi user interface) users globally by the end of March this year. Statistics mentioned by Jun in the prospectus reveal over 1.4 million users had more than five connected Xiaomi products, excluding a smartphone and laptop.

Back in Bengaluru, Jain has just wrapped up a Xiaomi dealers’ meet. “In spite of selling close to 10 million units consistently over the last three quarters, dealers still want more of Xiaomi,” he contends. Dealer and offline connect, a strategy that has helped Samsung cling to its market share in spite of a persistent push by Xiaomi, is the new mantra that the Chinese player has been using to enter Samsung’s fortress.

CHALLENGES GALORE

Though Xiaomi has managed to expand its offline reach, the challenge for the brand in India is on multiple fronts. While the ₹6,000-₹10,000 bracket has grown to be its biggest segment—with a share of over 35 percent in the latest quarter—Samsung is making its presence felt in this category. The resistance in the ₹10,000-₹15,000 segment—where Xiaomi has a 30 percent share—is again coming from the Korean giant.

Secondly, the pressure to post high numbers consistently might not be sustainable. While Xiaomi’s global growth increased by 38 percent annually in the second quarter, it was down from 58 percent a year ago. “Xiaomi is slowing due to competition from Huawei in its key markets of India and China,” avers Linda Sui, director at Strategy Analytics.

Thirdly, its effort to enter the premium segment will take some time to bear fruit. The fight from another Chinese peer—Honor—can also chip away some of its market share.

For Samsung, too, defending its fort won’t be easy, as it’s yet to crack the online market. While at the entry and mid-segment end, Xiaomi is breathing fire, the premium end fight is coming from OnePlus, which pipped Samsung to lead the premium smartphone segment in India for the first time with a 40 percent share during the second quarter this year. Though Samsung captured 34 percent share of the premium segment, its shipments dipped by 25 percent YoY, according to Counterpoint.

Samsung’s main problem, reckons Mawston, is that it is fighting hundreds of challenger brands in hundreds of countries worldwide. “It is hard to juggle so many balls at once. Nokia and Motorola faced the same issue a few years ago,” he avers.

Sharing the crown, feel marketing experts, might be the new reality in India as the days of single-player dominance come to an end. Brand strategist Harish Bijoor brings in a historical perspective. If you peek into India, he argues, the terrain has typically been divided between the Dravidian in the south and the Aryan in the north. Samsung in the north, and Xiaomi based out of Bengaluru in the south, have to come to terms with this historical fact. That may be acceptable as long as sales of the two rivals head in one direction: Northwards.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X