MakeMyTrip's Amazon trip

How India's biggest online travel aggregator is opting for scale in a trade-off with the bottom line. But can it replicate the success of the US ecommerce giant?

“We can turn profitable, but that will hit our growth. At this stage of the market, you cannot afford to go slow.”

“We can turn profitable, but that will hit our growth. At this stage of the market, you cannot afford to go slow.”Deep Kalra, chairman and group CEO, MakeMyTrip

The numbers were alarming, and unprecedented. For the June-ended quarter of fiscal 2018, marketing and sales promotion expenses of MakeMyTrip (MMT), India’s biggest online travel aggregator (OTA), rose to $142.3 million, higher than its net revenues of $141.2 million. Losses widened to $52.1 million, up from $33.1 million in the March-ended quarter.

The signs looked ominous, especially as it was the first full quarter after Ibibo’s financials were consolidated with MMT's. The Nasdaq-listed company (Naspers came on board after the merger of Ibibo) had bought its nimbler rival for $1.1 billion in October 2016.

A year later, little appears to have changed. Although operating losses dipped to $23.5 million for the fourth quarter of the March-ended fiscal year 2018, sales and marketing costs as a percentage of net revenue stayed high at 81.2 percent.

So, is MMT Chairman and Group CEO Deep Kalra worried? Not quite. His reasoning: To build a hotel business, in a highly under-penetrated Indian market, investments are required. The priority, then, is growth, not the bottom line.

“We can bring that [investment] down, and turn profitable. But that will hit our growth,” he argues. At this stage of the market, he lets on, one can’t afford to go slow. “We have to maintain our market share and keep growing. It’s critical. It’s all about the long term.”

“When it comes to business, our philosophy is very similar to Amazon's... We admire not only that company but also its business.”

“When it comes to business, our philosophy is very similar to Amazon's... We admire not only that company but also its business.”Rajesh Magow, co-founder and CEO, MakeMyTrip

Kalra’s emphasis on growth at the cost of short-term profitability mirrors the strategy that Amazon Founder Jeff Bezos shared with shareholders in his historic annual letter back in 1997. “At this stage, we choose to prioritise growth because we believe that scale is central to achieving the potential of our business model.” Bezos has since been religiously following the investment theory he had famously postulated. As of end-2017, although Amazon had posted profits for 11 straight quarters, margins of its North American operations are still in lower single digits and those of the international operations are in negative territory; it’s only the web services arm that’s thriving on fat margins of over 25 percent.

For Amazon, growth always had an upper hand in a trade-off with profit, even when there appeared to be genuine reasons to worry. Take, for instance, the third quarter report card of fiscal year 2014. The company posted an operating loss of $544 million, over 20 times what was lost during the same period in 2013. Revenue, in sharp contrast, grew by a fifth to $20.84 billion.

An unfazed Bezos, in his projection for subsequent quarters, said he expected the red ink to spread further. The intent and the message was clear: Amazon would stay on the path of growth, even if that meant enduring losses. And the move seems to have paid off.

It took Amazon over 14 years—58 quarters after its initial public offering in May 1997—to make, cumulatively, as much as the profit it posted in the fourth quarter of 2017: $1.86 billion. Its first quarterly profit came in the fourth quarter of 2001: All of $5 million on a top line of $1.12 billion.

MMT may have taken a leaf out of Bezos’ annual letter. Agrees Co-founder and CEO Rajesh Magow: “When it comes to business, our philosophy is very similar to Amazon’s,” he contends, explaining two decisive constituents of Amazon’s approach: Maintaining market leadership, and obsession with consumers. What investors want to see is whether a company is in control of the business or not. “If in control, then you make conscious business decisions, just like Amazon,” he says, explaining the key business moves integral to Amazon’s model: Staying ahead in the game, focusing on growth, continuously acquiring customers, and building categories.

Magow’s partner chips in to add another similarity: Both the companies—MMT and Amazon—are listed in the US. One of the best things, points out Kalra, for a company being listed in the US market is that investors are more growth-focussed. “The difference in India is that investors here are more profit-focussed.”

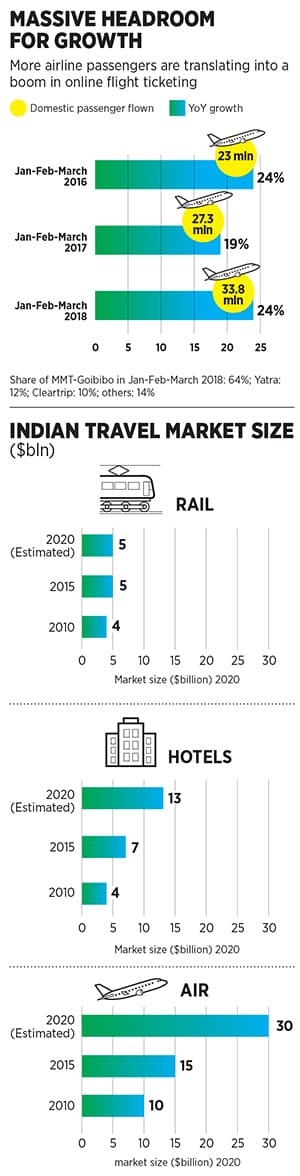

HEADROOM FOR GROWTH

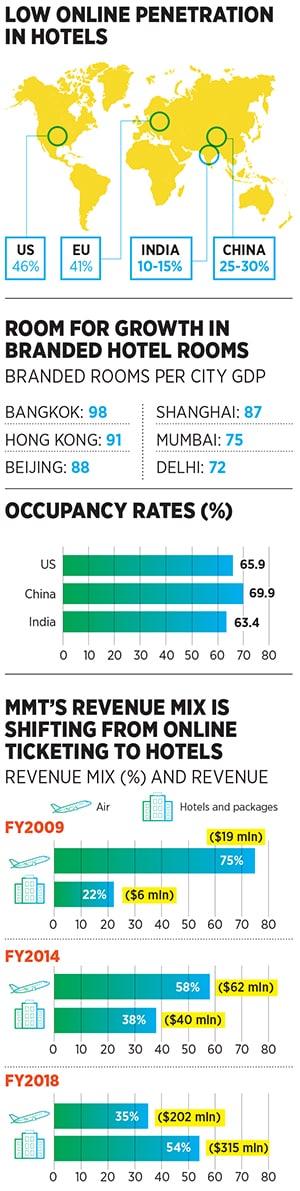

What has prodded MMT to take Amazon’s path of growth is the massive headroom the hotel industry offers in India. The Indian travel market is projected to grow at 11 to 11.5 percent to $48 billion by 2020, according to a BCG-Google report released last year. Driven by robust domestic demand, the hotels sector is projected to grow to $13 billion by 2020, with budget and midscale hotels making up 52 percent of the market.

The MakeMyTrip office in Gurugram

The MakeMyTrip office in GurugramImage: Amit Verma

However, the game changer for travel aggregators like MMT is the growth of online. The Indian online hotel booking industry, estimates the report, will be worth $4 billion by 2020. Though hotel bookings are going online globally, India is still early on the adoption curve. “The country’s internet user base is projected to expand from 332 million users in 2016 to over 650 million in 2020,” the BCG-Google report projects, adding that by 2020 nearly half of all Indian urban consumers will be digitally influenced.

As consumers shift towards higher income segments, annual average leisure hotel spend per household is expected to increase by 7 percent to $18 by 2020, as against $13 in 2015. Budget and luxury hotels, the BCG-Google report highlighted, would drive growth by 2020. While budget hotels, which make up 8 percent of the market, are expected to grow at 13.5 percent, consolidation, standardisation and branding of the unbranded properties would take care of the supply side of the business. “Mid-scale hotels, two- and three-star properties will continue to maintain their dominance,” the report concluded.

Though the dominance of mid-scale hotel category spells good news for MMT, which beefed up its presence in this segment after buying out Ibibo, the travel portal has been doing its bit to plug its relative weakness in the budget segment.

Take, for instance, the move to renew ties with Oyo, which was delisted from MMT’s platform in 2015. When asked if MMT might look at acquiring the Softbank-backed startup, Magow declined to comment. He, however, quickly adds that MMT is open to evaluating buyouts. “We’ve always been open in the past and we continue to stay open.”

MMT has a history of growth through acquisitions. In March 2010, it acquired some assets of Travis Internet, an online bus ticketing company, including the website ticketvala.com. The buyout enabled it to provide bus suppliers with access to a real-time bus reservations technology platform.

The second buyout came a year later. In May 2011, MMT acquired a 79 percent stake in Luxury Tours & Travel, a Singapore-based travel agency providing hotel reservations, excursion tours and related services. And in 2016 came along Ibibo. “redBus was the pleasant surprise package of the Ibibo merger,” grins Magow, adding that the bus ticket booking platform commands a 70 percent market share. redBus has witnessed strong growth momentum with more than 39 million tickets booked in the 2018 fiscal year, a nearly 48 percent year-on-year growth.

redBus also gives MMT an opportunity to go deeper into tier II and III towns to catch the next wave of internet users. These consumers will largely demand vernacular and localised content, with machine-to-person interactions using voice.

HELLO, GIA

MMT is now leveraging artificial intelligence, big data and machine learning. “We have introduced artificial intelligence-based chatbots aimed to drive consistency across our post sales experience,” points out Kalra.

MMT’s chatbot, Gia, is serving up to 5,000 unique users per day for their post sales queries. Gia has also been trained to perform over 300 actions, including enabling web check-in for flights. The company is planning to add more functions such as enabling travel bookings in a more conversational manner by leveraging the power of natural language processing. The move will help, says Kalra, attract the next wave of first-time net users who may be more comfortable transacting over chat and voice.

In May, MMT rolled out Goibibo Express, a conversation-based app targeted at the next 100 million internet users, who are fairly new to the web and primarily users of low-cost smartphones. The app, only 1.5 MB in size supporting voice-based and chat-based inputs from users in both Hindi and English, allows hotel bookings, trend status updates, and status check of waitlisted train bookings. It will soon offer bus and train bookings.

The company is also working on programmes to drive greater loyalty and retention among consumers. Take, for instance, MakeMyTrip Black and MakeMyTrip Double Black. The subscription based loyalty programmes now have 750,000 and 30,000 members, respectively. Since the inception of both programmes, Kalra informs, members contribute up to 20 percent of MMT’s topline, with transaction repeat rates that are two times those of non-Black members.

“From a customer experience standpoint, we have to be as ambitious or more to hit the global benchmark like Amazon,” avers Magow. Take, for instance, net promoter score, a key indicator of customer experience. While for Amazon it is 65 to 70 percent, MMT’s is around 50 percent. “So, our ambition is to get there,” he says, adding that a high NPS means business through word of mouth and repeat purchases go through the roof.

OBSESSION WITH CONSUMERS

Magow draws another parallel with Amazon: A focus on impeccable customer experience, and the belief that the business’s long-term sustainability would come from an overall high quality of customer experience. “While refund to consumers is instant, we resolve every query within 48 hours,” he claims.

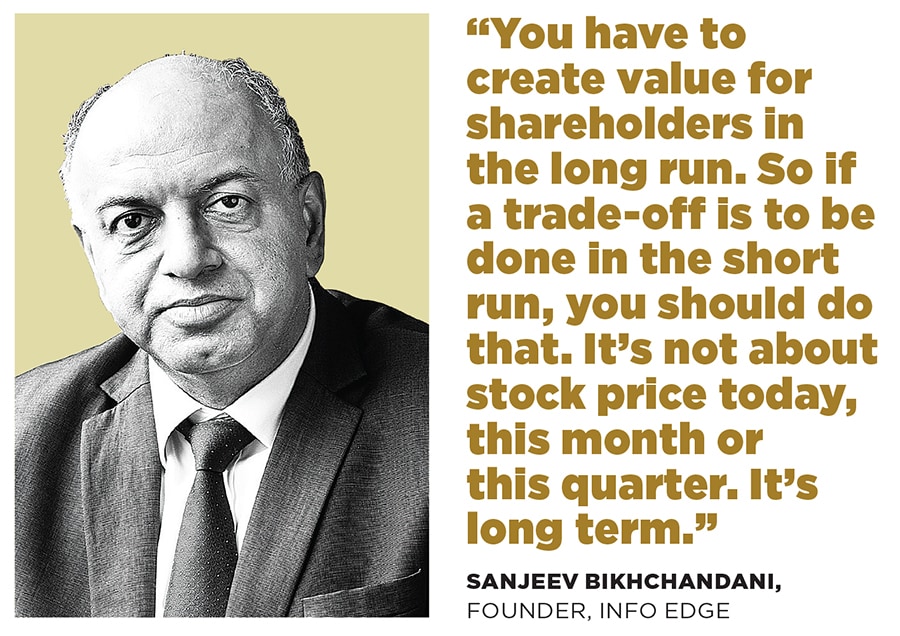

Sanjeev Bikhchandani, founder of internet firm Info Edge that owns portals such as Naukri, Jeevansathi and 99 Acres, is also a firm believer in long-term value-creation over profits in the shorter term. “It’s not about stock price today, this month or this quarter. It’s long term,” says Bikhchandani, who got Info Edge listed in 2006. While conceding Info Edge is fortunate to have Naukri with its 60 percent operating margins, the internet firm has been investing in other ecommerce ventures as well, which are not generating profits.

In a first, Info Edge wrote off and provisioned ₹ 186 crore in its startup investments for fiscal year 2018. Three of its core businesses too continued to bleed. While real estate portal 99 Acres posted a loss of ₹ 36 crore, Jeevansaathi and Shiksha combined had a loss of over ₹ 24 crore.

Bikhchandani is unfazed. “You make investments for the long run,” he says, adding that the nature of ecommerce is different from traditional businesses. “Our discussions are never around what is the profit target for this quarter,” he says, pointing out how the business landscape has changed over the last decade. Firstly, internet users have exploded, both broadband and mobile. The payment ecosystem has evolved and matured. “So the opportunity now is much larger.” The new opportunity, he explains, has brought in its wake a new set of investors with a different mindset. “Investors are saying spend the money, grab share and get customer loyalty. It’s okay to burn money initially.”

While Info Edge’s DNA is to be frugal, cash-flow positive and capital efficient, its investee firms operate in a different environment. “They are competing with people who have got pots of money. So they too need pots of money,” he says. If the competition is raising crazy money and spending it, sooner or later you have to respond, argues Bikhchandani, who counts Zomato and PolicyBazaar among the prized investments of Info Edge.

ROCK CONCERT AND BALLET

In an interview to Business Insider in 2014, Bezos quoted Warren Buffett to make the point of having clarity in approach and conveying it to shareholders. “You can hold a rock concert, and that’s okay. And you can hold a ballet, and that’s okay. Just don’t hold a rock concert and advertise it as ballet,” he said, citing Buffett.

When asked about Amazon’s tidy and erratic profit margin, Bezos sounded confident of posting profits but added that he would prefer free cash flow and investment.

MMT, for its part, too made its stand clear way back in 2010 when it filed its prospectus for getting listed on Nasdaq. “We have sustained operating losses in the past and may experience operating losses in the future,” it mentioned in its filing.

“We expect that our operating expenses,” the company explained, “will increase and the degree of increase in these expenses will be largely based on anticipated organisational growth and revenue trends.”

Mohit Kabra, chief financial officer of MMT, reiterated the company’s position in a recent earnings call. Keeping in mind the prevailing competitive dynamics in the coming quarters of the new fiscal year, he explained to analysts, MMT will continue to tactically place sharper focus on driving growth and operating efficiencies to keep driving growth and reducing losses. Kabra pointed out the strengths of the company to give it a chance in the long run. MMT’s deep history and knowledge of India’s travel market, market leadership and a strong balance sheet with nearly $390 million in cash and cash equivalents place it in a position to leverage the growth potential as well as counter any potential pricing irrationality by an existing or new competitor, he argued.

Competition, indeed, has intensified in the online ticketing business, where Alibaba-backed Paytm has disrupted the segment by luring users with hefty cashbacks. The company reportedly sold 38 million bus, flight and rail tickets in FY18, and the new target is to set 10 million tickets per month. “There is not necessarily anything that we lose our sleep right now,” Magow chuckles, adding that the main job is to stay focussed. Like Bezos was over the past two decades.

Meantime, Amazon seems firmly on the path to profit, recording its 12th straight quarter in the black in the January-March period. It’s been a long, heady—and often strange—trip. Like Amazon, MMT too has few doubts that it has to—as the song goes—‘just keep truckin’ on’.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X