Why Idea Cellular chose Bharat over India

Idea Cellular has clawed its way from a fringe player to become the third largest mobile telecom service provider in India. Now, it faces its biggest battle yet, as the market readies itself for another upheaval

In the competitive arena that is the telecom industry, analysts had written off Idea Cellular as the underdog. Ruled by multiple masters since the time it was founded in 1995 (then called Birla Communications), it had missed many opportunities, especially during the robust growth phase of the Indian telecom sector between 2000 and 2007. Yet, the company’s present-day narrative belies its past missteps.

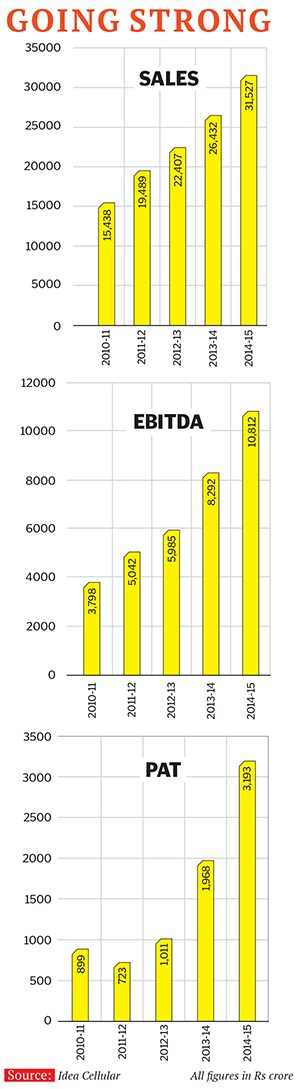

Today, the $5 billion mobile telephone service provider is no longer the underdog, as competitors, investors and even global peers have come to realise. “Idea continues to be the best execution engine in the industry. We like what we see as far as Idea’s operational and financial results are concerned,” notes an April 2015 report by telecom analysts from Kotak Institutional Equities. The report goes on to praise the company for its ability to “deliver industry-leading” topline and underscores its 40 percent standalone earnings before income, tax, depreciation and amortisation (Ebitda) growth in the fourth quarter of FY15. This verdict is a validation of what Idea Cellular has achieved in the last five years.

Its turnaround is all the more noteworthy given the company’s chequered past: In its earlier avatar as Birla Communications, it experimented with joint ventures (with American multinational AT&T), mergers (with the erstwhile Tata Cellular) and acquisitions (of RPG Cellular, Escotel Mobile Communications, among others). It was renamed Idea Cellular in 2002, but that did little to improve its fortunes.

The catalyst that changed its trajectory can be traced to the year 2006, when the Aditya Birla Group ended up with a substantial 42.26 percent stake and transformed it from a regional operator in danger of falling off the telecom map to a pan-India company. This was achieved by strengthening its rural and semi-urban network, while slowly making inroads into lucrative (and competitive) urban markets such as Delhi and Mumbai.

With capital infusion via an initial public offering (IPO) in 2007, Idea Cellular overhauled its operations, strategy and investment road map to make up for lost time. Since then, it has clawed its way from a fringe number six operator into the top three telecom players in India after Bharti Airtel and Vodafone India.

Financially, it has seen tremendous growth: Idea Cellular’s revenues have doubled from Rs 15,438 crore in FY11 to Rs 31,527 crore in FY15, while profit has jumped from Rs 899 crore to Rs 3,193 crore in the same period. Over the last five years, it has become one of the fastest growing companies (not just in the telecom sector) delivering the stock market favourite 20/30 growth pattern—20 percent growth in revenue consistently along with a 30 percent growth in Ebitda.

This has been possible on the back of adding a subscriber base of nearly 150 million in the last seven years and scaling its presence from 30,000 villages in 2008 to 3.5 lakh currently. Data from the Telecom Regulatory Authority of India (Trai) shows that as of July 2015, Idea Cellular had 162 million subscribers, just behind Vodafone’s 185 million. Bharti Airtel is far ahead with 231 million subscribers. Idea was able to compete in the same arena as the A-listers by following a ‘rural first’ mantra.

Bharat over India

Even as it was gearing up for a pan-India launch, Idea had to confront a new set of operators who began entering the fray in 2008, thereby increasing the competitive landscape of the Indian telephony market. (The number of telecom operators went up from six to 16 with former telecom minister A Raja issuing multiple licences during that period.)

Meanwhile, large players, including global companies like Vodafone, Uninor and Aircel, focussed on expensive urban expansion in the race to chase higher ARPUs or average revenue per user. But the management at Idea Cellular, including then managing director (MD) Sanjeev Aga, took a strategic decision to adopt a contrarian business model. Instead of following the pack that was chasing premium customers in large cities, Idea chose to concentrate on tier-2 and tier-3 towns and consolidate its presence beyond the metros.

In other words, Idea Cellular chose Bharat over India, and in doing so, it ensured that it had a firm hold on the subscriber base in semi-urban and rural parts of the country first.

“India is not a homogenous market. There are three or four Indias, and we focussed on its heterogeneity. We chose to go rural first,” says Himanshu Kapania, 54, who has been with the company for more than 15 years and climbed the ranks from circle head to MD.

The budget, too, was a deciding factor as urban licences were expensive and Idea Cellular did not want to take on more than it could chew, not at the initial stage of expansion. It bought spectrum in Mumbai and Delhi only after it had built sizeable revenues beyond the big cities.

“The rural focus has truly worked for us in terms of growth and achieving scale,” says Kapania with satisfaction. “India has a rural mobile penetration of 41 percent.”

Today, Idea claims to lead this market with its 56.6 percent subscriber base. Kapania believes it is this base that will also give the company value added growth in the future with users now upgrading and subscribing to data services. And here, too, the service provider continues to go against the grain—this time around in the ‘voice versus data’ growth opportunity.

While many telecom analysts and even global players like Verizon and T-Mobile talk about the end of voice era in mobile telephony and the growth of data consumption on smartphones, Idea Cellular believes there is enough juice left in the voice business in India. It will not be shifting its entire focus on the data/internet business.

“We believe an incremental 300 to 400 million subscribers will enter the voice era (globally), and hence, we will again take the contrarian approach and continue to bet on voice,” says Kapania. That said, Idea will not completely ignore the data business either. It chose its bets carefully when embarking on its ‘rapid expansion phase’ from 2008 onwards. While it did invest in 3G and 4G spectrum auctions two years later, it did so in a calibrated manner, and stayed away from big metros in the first round even as its competitors spent significant amounts bidding for spectrum.

It first bought 3G spectrum in 2010 in only those states where it had built a significant presence, such as Andhra Pradesh, Gujarat, Haryana, Himachal Pradesh, Jammu & Kashmir and Kerala, among others. In doing so, it benefitted from the relatively lower cost of licences in these regions. “Our financial success, as well as brand success, has been driven by our contrarian approach and sharp focus on our pockets of strength,” says Kapania.

And Idea’s rapid growth has obviously pleased Kapania’s boss as well. Kumar Mangalam Birla, 48, chairman of the $41 billion Aditya Birla Group, tells Forbes India that his company is now primed to take on the big players. “Our focus will still be in tier-2 and tier-3 cities, but lately, in metros we have started offering a full-fledged service, which is much more than it has been in the past. The aim is to get quality market share. We have been the fastest growing telecom operator in the past three to four years,” he says.

Idea’s focus area for the future is investing in 3G and 4G spectrum, besides building up the existing network. “I don’t see this as a business where you can put up capacity and say that you’re done. This is a business which is highly capital intensive and we are committed to it,” says Birla, who is not afraid to walk the talk.

Since 2010, Idea Cellular has participated in five auctions committing Rs 48,000 crore for a 20-year spectrum licence. It has also enhanced its overall spectrum quantum—the key raw material for telecom operators—from 101.8 MHz (2010) to 270 MHz (2015).

This long-term investment has not only assured investors who were worried that the Aditya Birla Group would sell the telecom business, but has also helped boost the morale of employees. “You look at the leader at the time of crisis when all is not well. This [investment] sent immediate confidence to the team. Everyone was inspired,” says Kapania.

It’s worth noting that a number of factors contributed to Idea’s success. For instance, it benefitted from the pooling of some of its infrastructural resources with Airtel and Vodafone. Apart from their individual towers, the three service providers together have stakes in telecom tower company Indus Towers. This way, Idea was not forced to deploy expensive capital for its expansion.

The journey from here, however, is fraught with challenges.

Aiming for the second spot

Kapania is an optimist. An engineering student from the Birla Institute of Technology, Mesra in Ranchi, he never imagined that he would one day be leading the charge for a Birla company. He believes that Idea Cellular is within striking distance of becoming the second-largest telecom player in the country given that it is just 23 million subscribers shy of Vodafone India’s subscriber base as of July 2015.

Mohammad Chowdhury, PricewaterhouseCoopers’s leader for telecom, media and technology sectors in Australia, New Zealand and Southeast Asia, however, is more cautious in his outlook. “If you look at the last four years, Idea Cellular has consistently grown its RMS (revenue market share) and has been gradually nibbling away at the market share of its competitors. The brand is particularly strong in tier-2 cities, which underlines its strengths and points to its opportunities,” says Chowdhury.

The telecom company’s strengths include having good quality spectrum in its tier-2 strongholds, a solid distribution network and a well-recognised brand presence. “Idea Cellular tends to appeal to the middle-of-the-road user more than some of the other operators. One advantage is that this market has a growing purchasing power and rapidly rising smartphone penetration, fuelling demand for data services,” he adds. On the negative side, Chowdhury points out that Idea needs more spectrum in big cities such as Mumbai and Delhi. “Its market share in these cities is relatively low with a total of about 16 or 17 percent, whereas it is 25 percent in tier-2 towns,” says Chowdhury.

Poor penetration in high ARPU areas is not its only challenge. Idea Cellular is bracing itself for what could well be its biggest fight yet: Its mettle will be tested with the launch of Reliance Jio Infocomm Ltd (RJIL), which is slated to enter the telecom arena in December 2015. (Disclaimer: RJIL is a subsidiary of Reliance Industries, which owns Network 18, the publishers of Forbes India.)

Reliance Jio has already invested up to Rs 70,000 crore for its launch, and telecom analysts predict that its entry will set off a round of tariff cuts across the telecom industry. This will affect revenues and impact all players, especially the top three from whom Jio would like to grab a sizeable market share. Of the existing three leaders, one is a global telecom giant (Vodafone); the other is the biggest Indian telecom player (Bharti Airtel). Analysts predict that neither will leave any stone unturned to hold on to their position. That leaves Idea, which might just find itself fighting to retain its number three position, let alone climb to the second spot.

But Kapania, buoyed by Idea’s success since 2007, is confident of the company’s game plan.

Brand recall

Peers and analysts, too, are hardly writing off Idea Cellular. Its catch-up act over the last eight years surprised everyone, including its competitors, and they are not discounting its determination to remain a major player in India.

After the change of shareholding in 2006, if Idea had to be relevant, it had to race against time. “In 2007, a range of ‘transformation projects’ were undertaken, not just in customer support, but in IT, sales and distribution, supply chain and in the underlying HR and finance processes,” says Sanjeev Aga, its former MD, who is credited with laying the foundation for Idea’s success.

Back then, Birla had thrown down the gauntlet giving a clear goal to the teams: The company should either aim for a spot in the top three—or exit. “He gave us this challenge and was serious about it,” recalls Kapania, who became MD in 2012. The company had to build the brand and communicate what it stood for. The brand name, ‘!dea’, was in existence since 2002, but was never tapped or used extensively in all its communication. That changed in 2007, with an aggressive marketing push. “We weren’t putting on Idea as our face till then, it was more as a sign-off,” says Kapania. Here, too, the service provider stayed clear of the well-trodden path. “We decided not to tout our features or products, but instead pushed the brand name. We prioritised our focus on building the category rather than fighting with competitors. It was a non-combat strategy.”

The telecom’s first national ad campaign, with the tagline ‘What an Idea, Sirji!’ was successful across India. With actor Abhishek Bachchan, who was roped in for this campaign, Idea Cellular tackled the theme of casteism in rural India, its core subscriber base. The objective was to ensure that potential customers associated words like ‘innovation’, ‘new’, ‘bright’ and ‘idea’ with the brand. “We have always focussed on themes rather than product-based advertising—right from caste wars to the recent idea of the internet enhancing one’s knowledge with the line, ‘No Ullu Banaoing,’” says chief marketing officer, Sashi Shankar.

Apart from this branding exercise, the company’s decentralised management approach that empowered employees has also helped it ramp up operations. “We have 142,000 cell tower sites on 2G and 3G. These are equivalent to factories. Every day, mobile minutes and data bandwidth from these factories need to be consumed in the vicinity where it is generated. Hence, it is vital to empower people manning these factories instead of having someone at the state level or the central headquarters in Mumbai deciding the strategy for each factory,” says Kapania.

The other contrarian approach that Idea Cellular adopted was to not follow the typical fast moving consumer goods (FMCG) model when it was expanding in rural India. In the traditional set-up, FMCG companies usually rely on a wholesale model and appoint a distributor in tier-2 and tier-3 cities. “We followed a ‘sons of the soil’ approach. We appointed direct distributors in rural areas to service customers while the sales and service team is on our payrolls,” says Kapania, adding that Idea has 4,500 sales personnel. It also has an army of 50,000 distributors, servicing 1.5 million retailers. “We don’t send anyone from an urban to a rural area; train urban go rural is not our model.”

One advantage is that local, home-bred employees are not in a hurry to leave their homes and move to urban markets. They also have native wisdom, which no MBA sent from urban areas will bring to the table.

Idea’s chief service delivery

officer, Navanit Narayan, explains how the company set up call centres in Raipur, Vadodara, Hyderabad and other smaller towns to service customers in those areas instead of putting up customer support centres in Mumbai, closer to the company’s headquarters. “The employees in these towns take great pride in having such a job, which otherwise only existed in Bengaluru, Pune and Mumbai, and their loyalty to the brand is unmatched, compared to a big-city employee who is usually looking for the next big job and pay raise,” he says.

It is through measures like these and its adherence to the tenets of customer centricity, employee empowerment and best-in-class execution, that Idea Cellular has been able to weather the troughs and crests of the Indian telecom industry. Today, as it braces itself for the next competitive phase, it remains buoyant and upbeat—confident in its ideas for the future.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)