Roposo vs ShareChat: Which will replace TikTok?

Roposo and ShareChat lead a bunch of local contenders that have emerged after the ban on Chinese apps

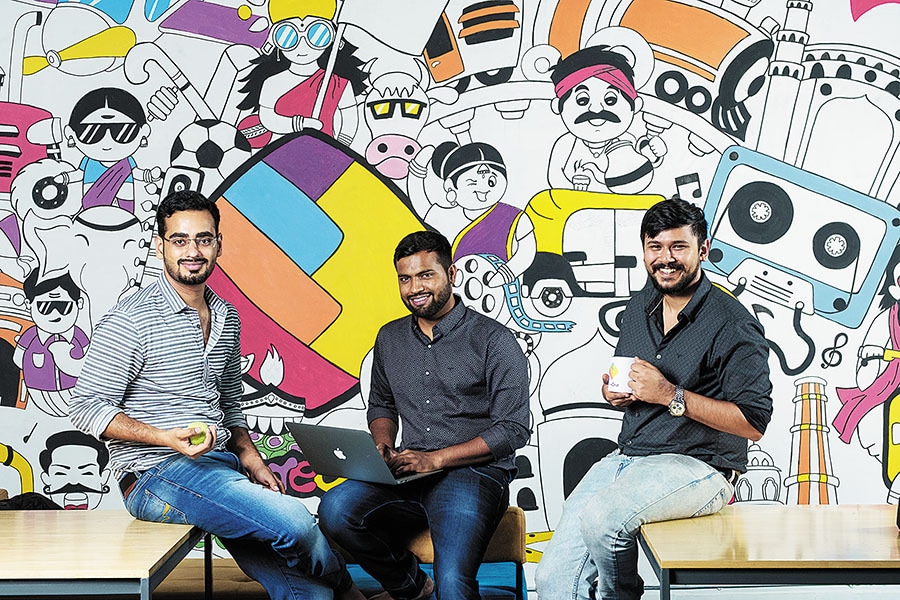

(From left) Mayank Bhangadia, CEO and co-founder, Roposo, Kaushal Shubhank, co-founder and CTO, Roposo, and Avinash Saxena, co-founder, Roposo

(From left) Mayank Bhangadia, CEO and co-founder, Roposo, Kaushal Shubhank, co-founder and CTO, Roposo, and Avinash Saxena, co-founder, Roposo

Images; Kaushal: Amit Verma; Avinash: Nishant Ratnakar for Forbes India

Hours after the government banned 59 China-made apps citing national security concerns, Roposo’s engineers were in a tizzy. Branded as “India ka apna video app” or India’s own video app, the short video-sharing platform, akin to TikTok, the wildly popular Chinese app that counted 200 million users in India until the ban, saw a sudden rush of users.

“It was crazy… our servers got jammed and we had to quickly upgrade them to deal with the increased traffic,” says Avinash Saxena, co-founder at the Gurugram-based startup which was acquired by advertising tech unicorn InMobi late last year. Daily active users rocketed from 6 million before the ban to 17 million just days after the ban, says Naveen Tewari, InMobi’s chief. At the time of writing, Roposo claims to have been downloaded 80 million times. “This is India’s digital atmanirbhar moment,” he beams.

Sure enough, a number of local short video-sharing platforms rushed to fill the void left by TikTok, including Chingari, Mitron and Rizzle. As did entrenched players like ShareChat and Instagram. But only one or two platforms will come out on top, say industry bosses.

Back in 2014, along with his IIT-Delhi mates, Mayank Bhangadia and Kaushal Shubhank, Saxena founded Roposo as a social network focussed on fashion. It allowed users to discover and share the latest trends in clothing and accessories via a chat-like interface. “We soon realised that video was the default mode in which users were sharing stuff,” says Saxena. So the trio turned their attention to videos and expanded beyond fashion.

This pivot to videos came in August 2017. “It was around the time that Instagram was taking routes in India,” says Anand Lunia, founding partner at India Quotient, an early investor in Roposo. “When we invested [in 2014], it was the early days of smartphones and the internet in India; Instagram was not popular either. Roposo was India’s first social network app and our mandate at IQ has always been to invest in 2 to 3 social media startups with the aim of discovering the next Facebook from India. Besides, Roposo had a good technical team,” he says.

(From left) ShareCart Co-founders Ankush Sachedeva, Bhanu Pratap Singh, Farid Ahsan have built short video-sharing platform Moj

(From left) ShareCart Co-founders Ankush Sachedeva, Bhanu Pratap Singh, Farid Ahsan have built short video-sharing platform Moj