India's regional brands are spicing it up

Regional brands' rapid growth has enthused private investors and the public markets. There's a lot to unpack in our 2024 edition of regional goliaths as we bring you stories from the different corners of India

It was in early 2021, in the throes of the Covid-19 pandemic, that Forbes India flagged off the ‘Regional Goliaths’ annual series. On the cover was Chandubhai Virani, who with his two brothers founded Balaji Wafers in 1982 to make potato chips out of a cubbyhole in Rajkot. When Rajiv Singh wrote the story, Balaji had a top line of a little over ₹2,300 crore, with pole position in the markets of Gujarat and Rajasthan. In two years, in the year ended March 2023, Balaji had more than doubled revenues to a little over ₹5,000 crore.

It’s such rapid growth that has enthused investors—both from the world of private equity and the public markets. Virani, who once rejected an offer to sell out for ₹4,000 crore, may not be keen on an initial public offering, or IPO (“I don’t need the money,” he had told Singh); but a few other regional snack dynamos have acknowledged the appetite for consumer companies that are on a rapid growth path.

Consider, for instance, snacking brand Bikaji, which takes pride in being the first (ethnic) snack maker from Bikaner, Rajasthan, to go public. It did so with an IPO in November 2022, in the price band of ₹285 to ₹300 per share. By mid-August 2024, the stock had entered the ₹700 territory.

In March this year, another maker of ethnic snacks that Forbes India had covered in the 2022 edition of Regional Goliaths offered shares to the public. Gopal Snacks, one more Rajkot-headquartered entity, as of October 2022, was No 2 in Gujarat, after Balaji. As founder Bipin Hadvani had told Singh (who you would have guessed by now is our roving regional brand spotter): “Only a regional player can understand the nuances of different kinds of taste within a state or a region.”

As of fiscal year 2023, almost 60 percent of Gopal Snacks’ revenue accrued from gathiya and namkeen; ‘western’ snacks like wafers accounted for almost 30 percent and products like papad, besan and spices for the rest. All these totted up to revenue of almost ₹1,400 crore.

To be sure, a Frost & Sullivan report pegs the savoury snacks (western plus ethnic) at roughly ₹800 billion, projected to grow at a compound annual rate of 11 percent till fiscal 2027. The split between western and ethnic is a close 51:49, with the organised market accounting for roughly 57 percent of the market.

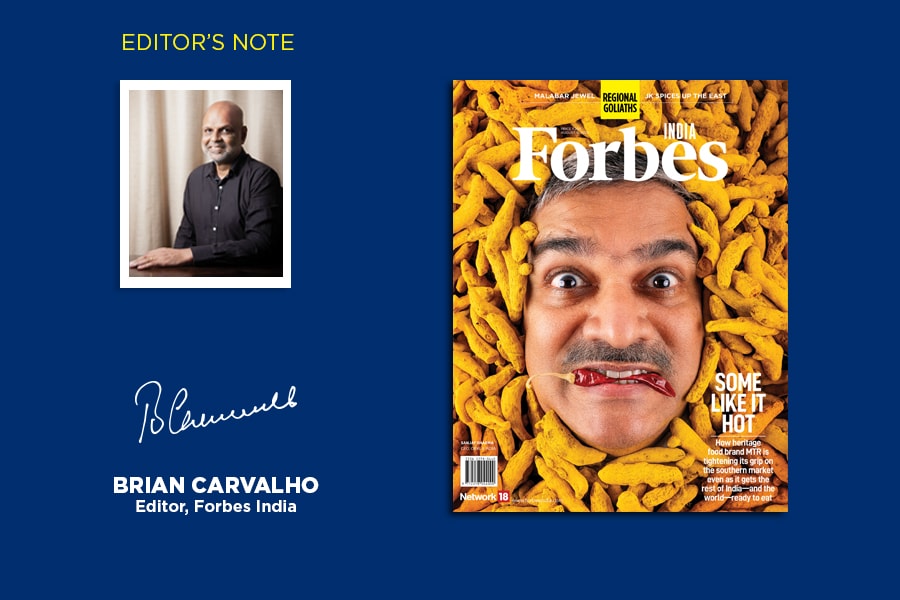

On the Forbes India cover is a Regional Goliath with a twist—a century-old Kannadiga packaged spices and foods powerhouse with a foreign owner. But rest assured, some 17 years after Orkla of Norway acquired MTR, the regional flavour with a focus on the local cuisine and culture remains as strong as ever (the MTR restaurant business, famous for its rava idli with dollops of ghee and sambar, continues to be owned by the founding family, the Maiyas). It gets even more fascinating when you consider that a brand with a Norwegian owner and a south Indian spread is led by a CEO from north India. “It was strange for a Punjabi to head a 99 percent Kannadiga business,” Sanjay Sharma, CEO, Orkla India, tells Singh “I mean, we are two different cultures.”

The mix is working like a charm across the region. While Karnataka accounts for half of MTR’s revenues, Andhra Pradesh and Telangana bring in a fifth. In spices, MTR is No 1 in Karnataka and Kerala, and in Andhra it is the second-biggest foods brand (after Teju Masala). For more on this fascinating story of spice and smarts, ‘A Mouthful of South’ is a must read.

Brian Carvalho

Editor, Forbes India

Email: Brian.Carvalho@nw18.com

X ID: @Brianc_Ed

(This story appears in the 09 August, 2024 issue of Forbes India. To visit our Archives, click here.)