PM Modi announces Rs 20 lakh crore package to help revive economy

The Prime Minister called upon Indians to 'be vocal for local' brands; fiscal discipline not the need of hour, say economists

Image: DIPTENDU DUTTA/AFP via Getty Images

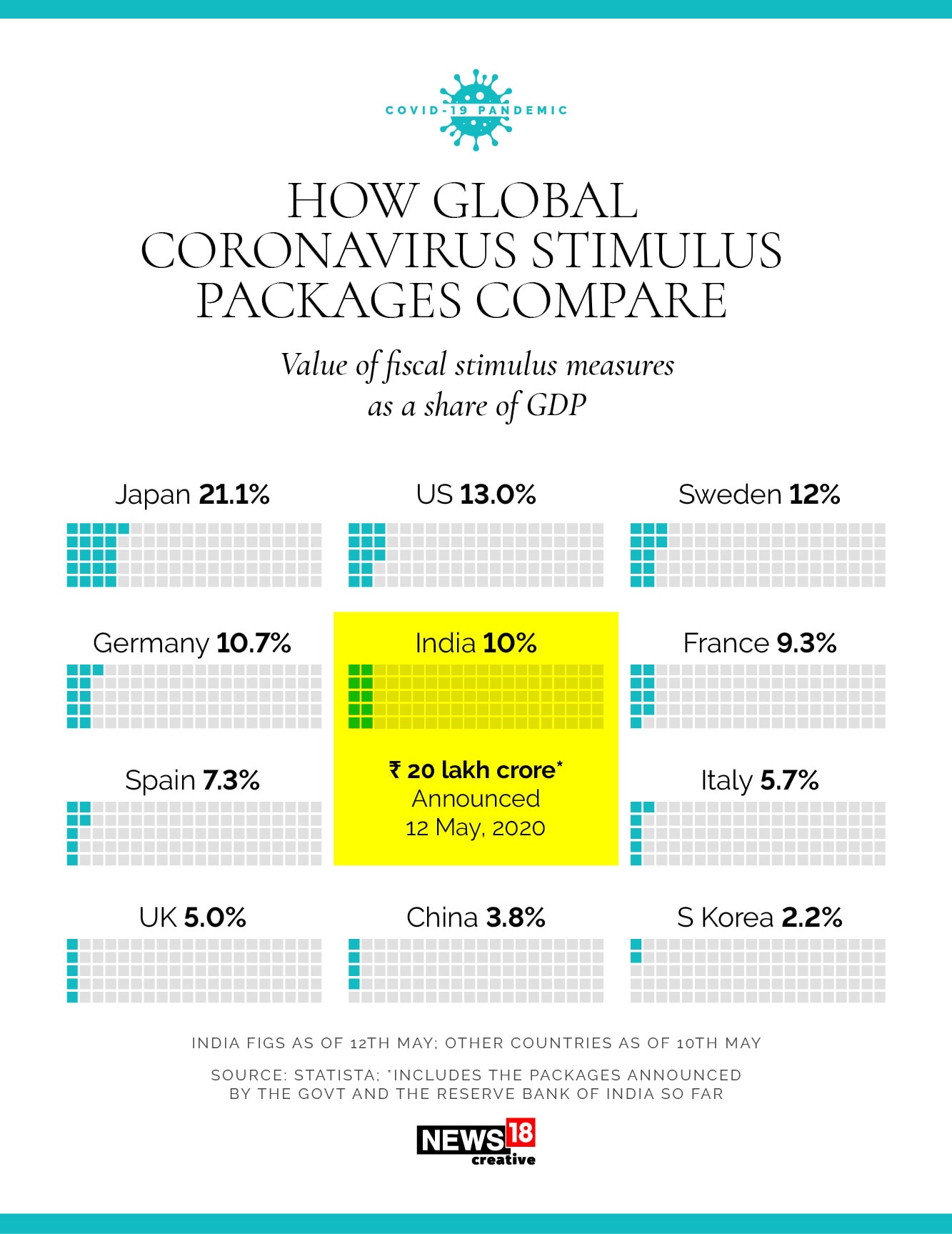

India’s Prime Minister Narendra Modi on Tuesday night announced a Rs 20 lakh crore package to help revive the economy, while also signalling the need for the nation to move towards ‘Aatma nirbharta’ (self-reliance) in order for it to grow in a world ravaged by the outbreak of coronavirus since the start of the New Year.

"The package will focus on land, labour, liquidity and law. It will also seek to help small businesses, labourers and farmers,” Modi said. It is expected that the Rs 20 lakh crore package will include the liquidity relief already announced by the Reserve Bank of India in recent weeks.

Investors and funds cheered the move, as the benchmark stock market indices at the BSE and NSE rose by over 3 percent each in early trade on Wednesday.

Details of the package will be announced by the finance minister Nirmala Sitharaman in the next few days, Modi said. But no details have been spelt out on how this programme will be funded.