RateGain: Thriving in chaos

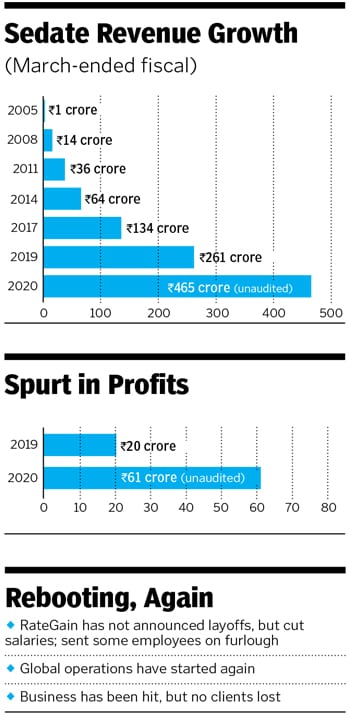

Can a healthy bottomline and a frugal fiscal DNA help travel-tech firm RateGain survive the severe Covid-19 turbulence? Well, the fight, and flight, are on

“It’s (life during Covid-19) insanely awesome. There is always an opportunity in chaos. You just need to spot it.” Bhanu Chopra, founder, RateGain

“It’s (life during Covid-19) insanely awesome. There is always an opportunity in chaos. You just need to spot it.” Bhanu Chopra, founder, RateGain

Image: Madhu Kapparath

November 2011. Bhanu Chopra had summoned an early breakfast meeting with his top management at his residence in New Delhi. There was freshly brewed filter coffee, grilled sandwiches, parathas, toast and eggs. What was also on the table was something unpalatable: A million dollar-buyout offer from a US firm for Noida-based travel-tech company RateGain, which then had a revenue of slightly over $7 million. “It’s a serious crisis,” the chief financial officer said with a grim look. “They have their foot firmly on our neck.” Over 75 percent of RateGain’s revenue was generated by this American company, which had been the sales partner for over six years. Selling out seemed to be the only plausible option for RateGain.

Chopra looked unfazed. “It’s an insanely awesome situation, gentlemen,” the founder said with a smile and took a swig from his coffee mug. “I don’t like normal. I love chaos,” he professed, dishing out an example of how the ‘insane’ DNA runs in the company. It was the same company with which Chopra had entered into a deal to have a revenue share of 90:10 percent. The insane part of the deal was that Chopra had to part with 90 percent of the revenue as the US company was giving him access to over 30,000 hotels to sell his software. “Either we accept what is on the table,” Chopra let on, “or we fight out.”

“And we will rebuild from scratch. But we won’t sell out,” he continued. His team believed in the vision of the founder.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)