What's next in the Jio-Vodafone-Bharti Airtel rivalry?

A flurry of investments in RIL's Jio Platforms means the pace of evolution for all telecom players will rise multi-fold

The fresh interest in India’s telecom space continues to be driven by the potential of internet usage and consumption per user

The fresh interest in India’s telecom space continues to be driven by the potential of internet usage and consumption per user

Image: Sumit Yelpale / EyeEm / Getty Images

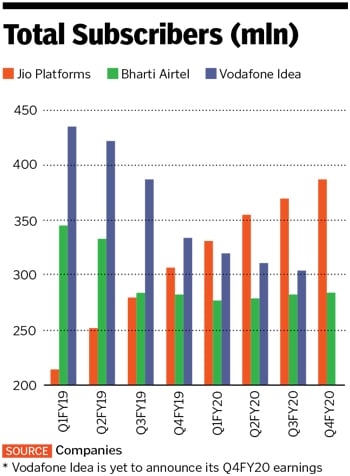

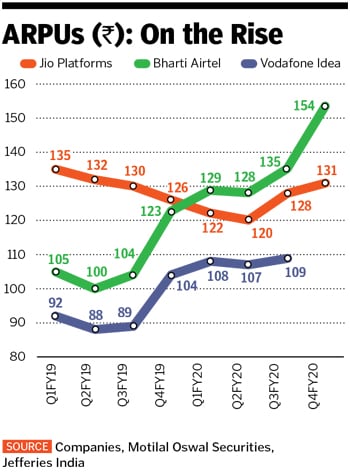

India’s top telecom companies—Jio Platforms, Bharti Airtel, Vodafone Idea and the state-run BSNL—are in the midst of a phase they have not seen in years. A series of investments flowing into the leading player Reliance Industries Limited’s (RIL) Jio Platforms has led to private equity firms, investment bankers and analysts closely mapping the average revenue per user (ARPU), subscriber costs and churn of these firms. It is a far cry from recent years when they battled more stringent regulatory hurdles and price wars, while competing among nearly 10 players.

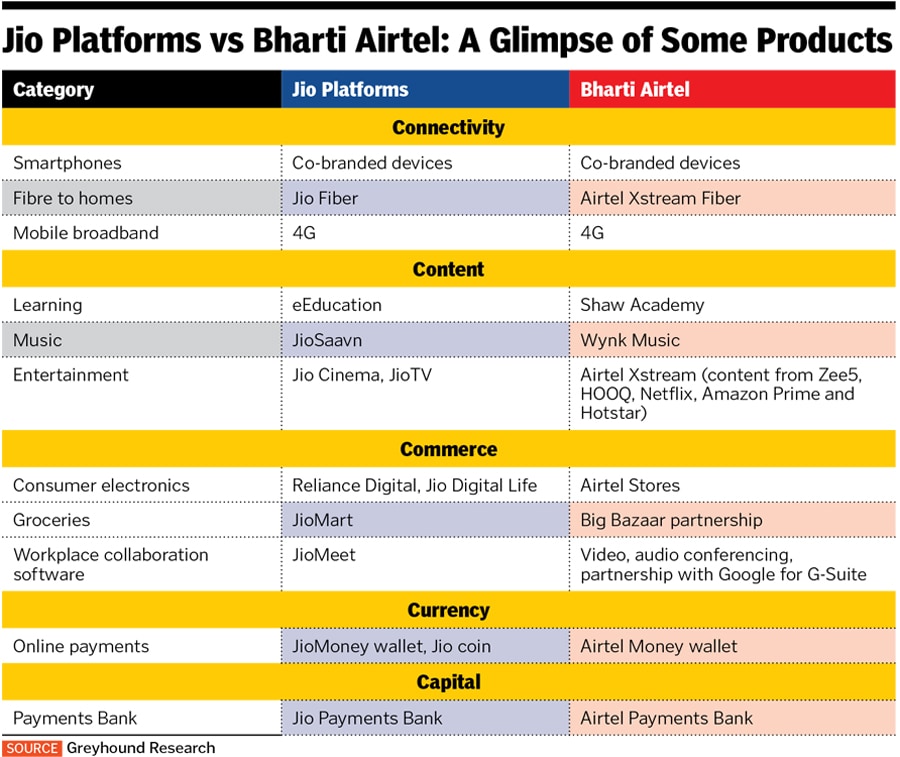

In about six weeks, Facebook and eight other global giants—Silver Lake Partners, Vista Equity, General Atlantic, KKR, Mubadala Abu Dhabi, TPG, L Catterton and Abu Dhabi Investment Authority (Adia)—announced 10 separate investments into RIL’s wholly owned subsidiary Jio Platforms, which has evolved from a voice-and-data connectivity player to one with integrated ecommerce and online payments platforms. (RIL is the owner of Network 18, publisher of Forbes India.) Over a fifth—22.38 percent—of Jio has been sold to these investors for a combined total of Rs 104,326.65 crore (around $13.7 billion).

Facebook—seen as a strategic investor with a 9.99 percent stake in Jio—is keen on the verticals related to retail and digital payments, and in building synergies with RIL. It brings its strength of data analytics and the experience of building platforms such as Instagram. Global technology investor Silver Lake had backed China’s ecommerce giant Alibaba prior to its IPO in 2014, and RIL is hopeful the same would work for Jio. Most of the other investors are of a financial nature, though Adia, which has a special focus on insurance, could find synergies with RIL and Jio in the future.

Jio’s rivals, Bharti Airtel and Vodafone Idea—for whom cash flows and profit could come under a cloud on account of past dues to the government—are unlikely to be overlooked. American technology giant Amazon is believed to be in talks to buy a 5 percent stake in Airtel for a value of $2 billion. Talk of a potential investment by Google into Vodafone Idea is also doing the rounds, though both Airtel and Vodafone Idea have denied such developments.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)