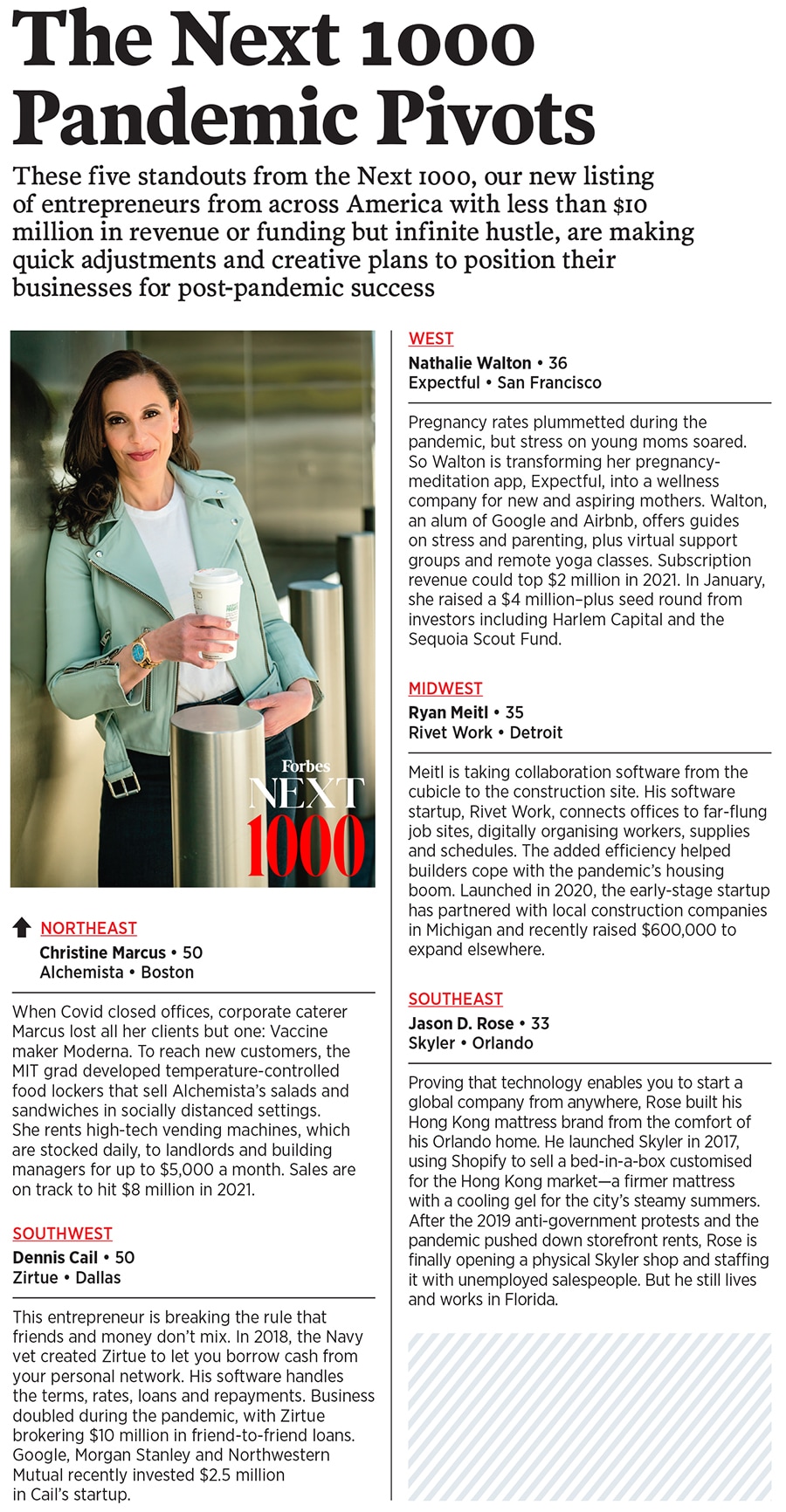

Covid-19's entrepreneur explosion: Why America will never go back to business as usual

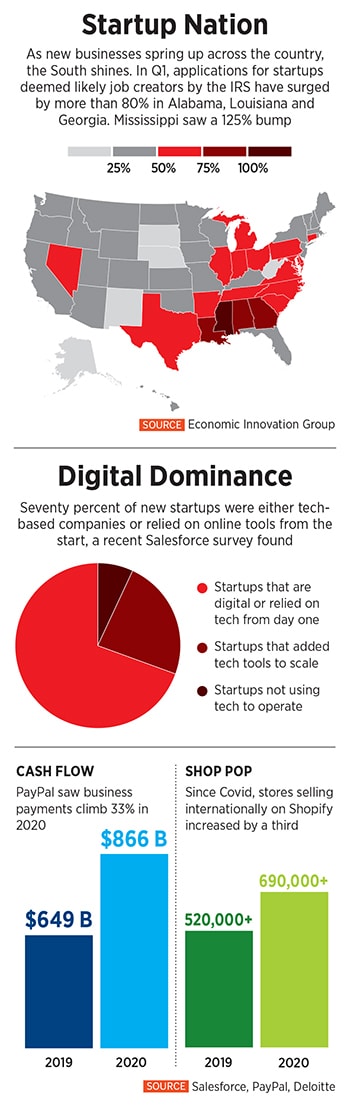

High unemployment, the magnifying power of the web and fresh fintech financing are fuelling an eruption of startups not seen in decades

Matt Redler’s startup, Panther, helps companies hire low-cost but far-flung foreign workers. “Since the pandemic hit, we have all participated in an uncharted experiment around remote work.”

Matt Redler’s startup, Panther, helps companies hire low-cost but far-flung foreign workers. “Since the pandemic hit, we have all participated in an uncharted experiment around remote work.”

In the gritty, gray concrete lobby of Firebrand Collective—a women’s coworking space in Kansas City’s industrial West Bottoms district—Jackie Nguyen makes lattes laced with cardamom and lychee from her colorful mobile coffee shop. A colossal dragon head covers the shop, Cafe CàPhê, painted the bold yellow and red of the South Vietnamese flag, with dashes of bright blue in a nod to the French influence on the country’s food. “And of course, this is Kansas City,” says Nguyen, 32. “They’re the colours of the Chiefs and Royals, too.”

Cafe CàPhê serves “Hella Good Lattes” and “Saigon” iced coffee to some 200 customers a day. Monthly revenue is roughly $30,000. “It’s been a crazy, amazing ride,” says Nguyen, a first-time entrepreneur. “The only business I knew before this was show business.”

Former Miss Saigon star Jackie Nguyen left Broadway’s limelight to open Kansas City Vietnamese coffee shop Cafe Cà Phê. “I really wanted to own something on my own.”

Former Miss Saigon star Jackie Nguyen left Broadway’s limelight to open Kansas City Vietnamese coffee shop Cafe Cà Phê. “I really wanted to own something on my own.”

A little over a year ago, Nguyen was an actress who had spent nearly two decades in musical theatre. Before the pandemic, she made $90,000 a year on the touring production of Miss Saigon. On March 15, 2020, she performed in Fort Myers, Florida. The next day, the lights went out on Broadway. “I didn’t have a house, car or any significant savings,” Nguyen says. She moved to Kansas City from Long Island City, Queens, investing $10,000 from her scant savings and an additional $13,000 from Kickstarter (it helps to have 4,000 Instagram followers). She’s never going back to the Great White Way. “As an actress, my career was always at the mercy of someone else,” she says. “Now I get to make all my choices and get to be very intentional behind what I choose.”

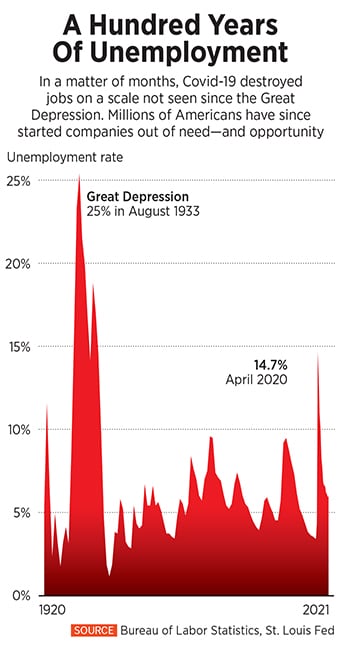

Nguyen is one of the 4 million–plus people fuelling America’s unprecedented entrepreneurial explosion. Sparked by pandemic unemployment not seen since the depths of the Great Depression, a permanent shift in where we live and work, access to fresh sources of capital through fintech, ubiquitous cheap technology and dogged determination, Americans are betting on themselves and launching companies at a historic rate.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)