Will Vodafone Idea manage to stay in the game?

Vodafone Idea's Q2FY22 earnings brought some relief for the debt-ridden company, but raising funds and Arpus are critical for its survival as focus shifts towards 5G technology

Vodafone Idea (VI) struggles to raise fresh capital from existing or a new set of investors

Vodafone Idea (VI) struggles to raise fresh capital from existing or a new set of investors

Image: Debarchan Chatterjee/NurPhoto via Getty Images

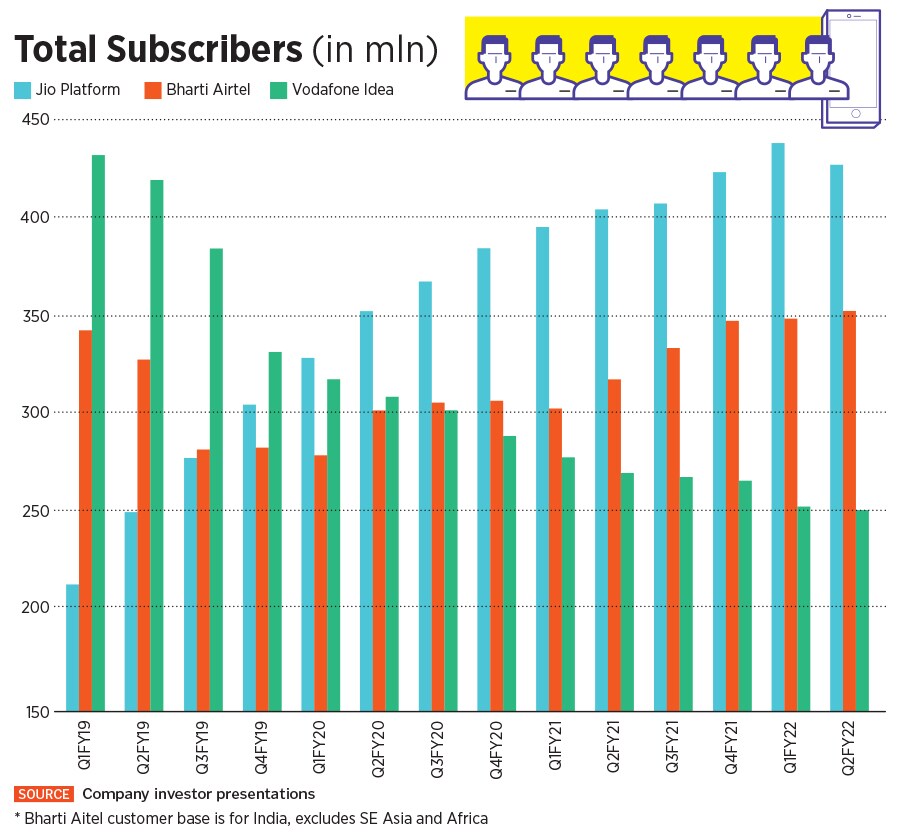

The longer Vodafone Idea (VI) struggles to raise fresh capital from existing or a new set of investors, the deeper it sinks into the abyss of uncertainty. The marginally improved operating performance which VI showed in its September-ended Q2FY22 quarter, for which results were announced last week, is acknowledged. But short- and long-term uncertainties—including repayment of non-convertible debentures, servicing of total debt, the urgent need to invest in 4G technology and buying 5G spectrum next year—are real investor concerns and continue to weigh down the stock.

VI and Bharti Airtel, to some extent, got lifelines from the government in September, through a four-year moratorium for companies to pay up statutory dues. VI has, like Bharti Airtel, accepted the moratorium for spectrum dues. The VI board in October-end also agreed to opt for a four-year moratorium on payment of Adjusted Gross Revenues (AGR) dues. It means that additional funds will flow to the company and not towards paying back the government.

But the telecom landscape will become more competitive at the start of fiscal FY23, starting April 2022. India is likely to start the 5G spectrum auctions in April-May, media reports have quoted communications minister Ashwini Vaishnaw as saying, after the regulator Telecom Regulatory Authority of India (Trai) submits its final report in early 2022.

Reliance’s Jio Platforms and Bharti Airtel are planning on allocation of capital towards 5G but VI needs to intensify its need for fund raising before planning for the future.

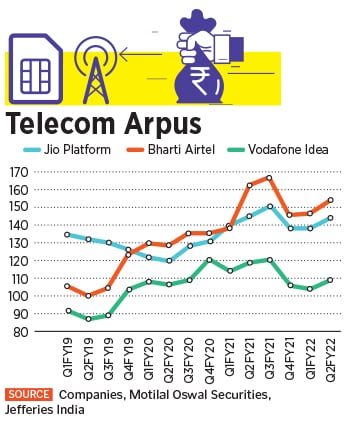

VI’s Arpu rose to Rs 109 for the three months to September from Rs 104 in the June-ended quarter. The one positive for VI is that its Arpus will continue to rise in coming quarters, though slowly, as its subscribers upgrade to 4G from 2G plans. The number of 4G subscribers grew by 3.2 million in the sequential quarter to 116.2 million.

VI’s Arpu rose to Rs 109 for the three months to September from Rs 104 in the June-ended quarter. The one positive for VI is that its Arpus will continue to rise in coming quarters, though slowly, as its subscribers upgrade to 4G from 2G plans. The number of 4G subscribers grew by 3.2 million in the sequential quarter to 116.2 million.