Vodafone Idea: When will it stop playing catch-up with Jio, Airtel?

The responsibility of turning around VI is back on the company following a government rescue package. Finding new investors to raise capital and raising prices are critical to its survival

Customers stand in a queue outside the Vodafone-Idea mobile network service provider store in Mumbai

Customers stand in a queue outside the Vodafone-Idea mobile network service provider store in Mumbai

Image: Punit Paranjpe / AFP

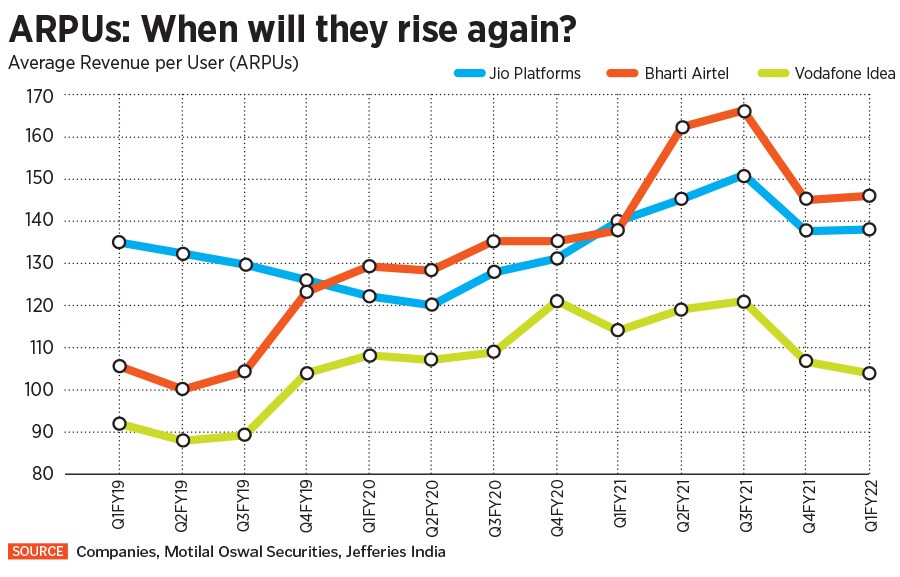

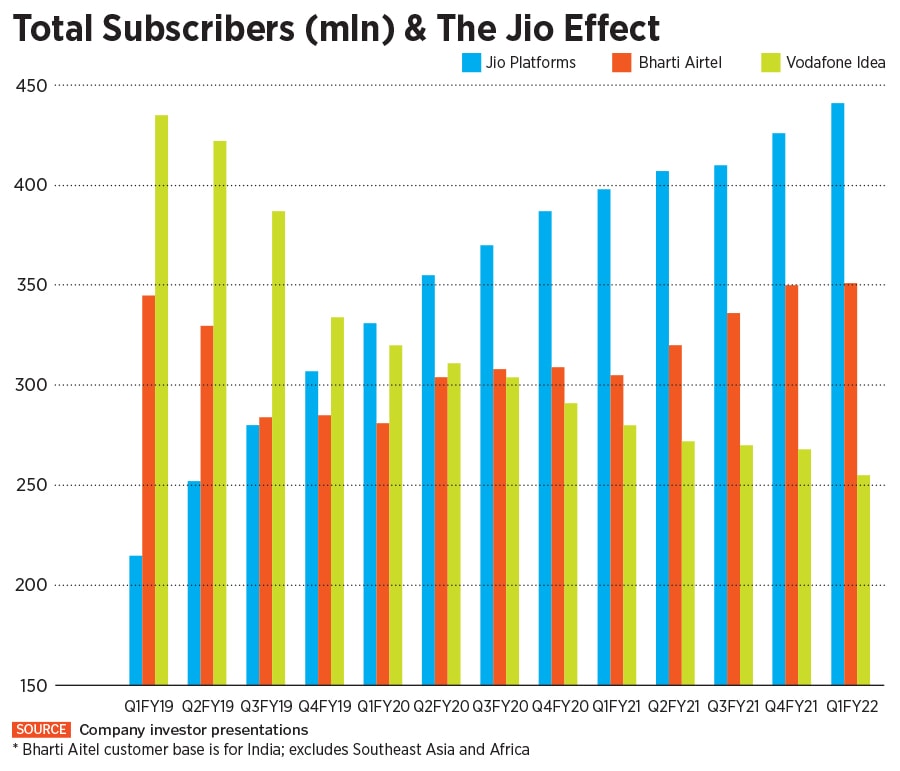

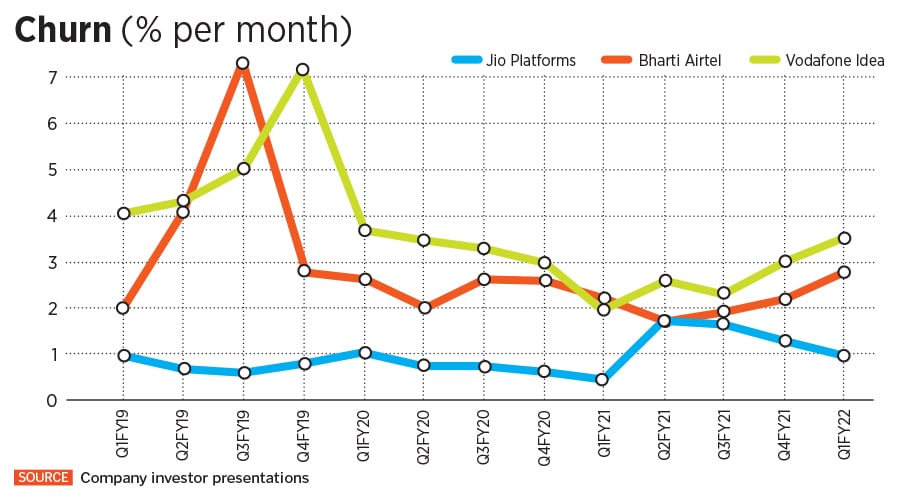

Each week, investors and stakeholders into Vodafone Idea (VI) appear to breathe a little easier when the debt-ridden company gets injected with fresh lifelines. Once the fastest-growing telecom company, VI has, in the last three years, been losing subscribers and market share to leader Reliance’s Jio Platforms and rival Bharti Airtel (see chart).

In October, there are reports that the government plans to withdraw its appeal on one-time spectrum charges against telecom operators, reducing litigation concerns and amounts due. For Bharti Airtel, it means a lowering of liability of around Rs 8,400 crore and Rs 4,300 (check) crore for VI.

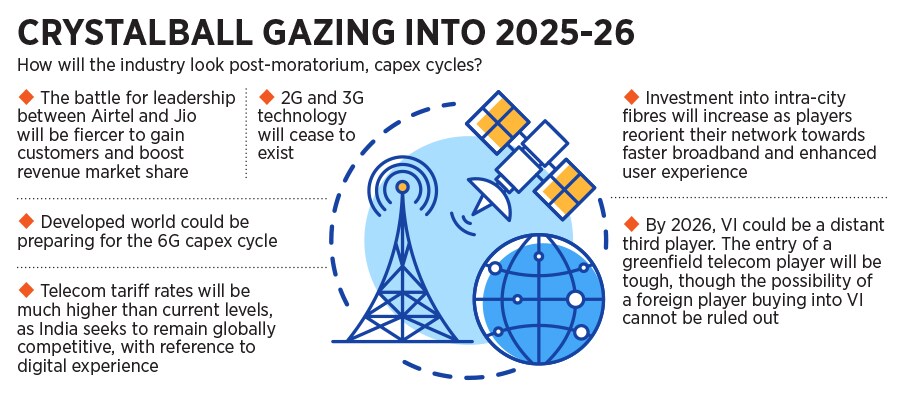

Then there was news of VI’s continued 4G technology expansion to Andhra Pradesh and Telangana circles, followed by reports of recording highest speeds during 5G trials in Maharashtra and Gujarat with vendors, expressing a certain amount of commitment towards next-gen technology for subscribers. Jio and Airtel have conducted similar trials on their networks and are “5G ready”.

VI’s management and promoters have now started to make forward-looking statements regarding its survival, finalising a business plan and scouting for fundraising from potential investors. The confidence stems from the fact that now additional funds will flow towards the company and not towards paying back the government. The government has, through a massive rescue package in September, granted a four-year moratorium for companies to pay up statutory dues.