As finfluencers grow, can Sebi's regulations snap investors out of their fantasy world?

Market regulator Securities and Exchange Board of India's (Sebi) recent interventions to clamp down on menacing influence on stock markets and misleading naive investors are steps in the right direction, even if perhaps a little late

With the new guidelines, the market watchdog wants to bring transparency in all stock market recommendations by non-mainstream financial analysts and trading strategies as they often seem to be manipulating prices and indulging in speculative trading.

Illustration: Chaitanya Dinesh Surpur

With the new guidelines, the market watchdog wants to bring transparency in all stock market recommendations by non-mainstream financial analysts and trading strategies as they often seem to be manipulating prices and indulging in speculative trading.

Illustration: Chaitanya Dinesh Surpur

Imagine a world where your money doubles, triples and quadruples every day; you get to own luxurious cars, take exotic holidays, and perhaps even travel to the outer space. You get rich and richer, just sitting at home. Financial influencers or finfluencers peddling such cotton candy-like world is not new in the Indian capital markets anymore.

Market regulator Securities and Exchange Board of India’s (Sebi) recent interventions to clamp down on such menacing influence on stock markets and misleading naive investors are steps in the right direction, even if perhaps a little late.

Finfluencers were largely unregulated before such norms were introduced by Sebi. With the new guidelines, the market watchdog wants to bring transparency in all stock market recommendations by non-mainstream financial analysts and trading strategies as they often seem to be manipulating prices and indulging in speculative trading. As concerns of frauds and scams led by finfluencers increase, the Sebi regulations will protect investors from misinformation related to capital markets.

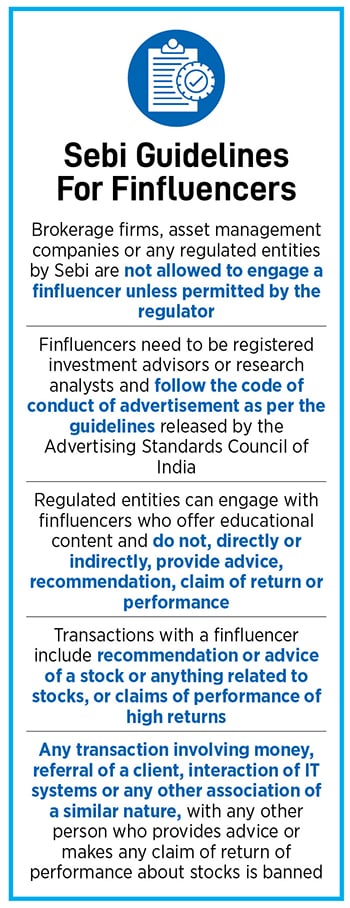

Sebi has banned brokerage firms and fund houses from engaging finfluencers for promotion or marketing campaigns. It explicitly states that no regulated entity can deal with any finfluencer who offers financial advice or makes performance claims without the market regulator’s permission. Transaction with a finfluencer includes any monetary deals, referral of a client or interaction of IT systems or any other association of similar nature. Referral fee for usage, non-cash benefits, direct compensation from social media or other platform, income from a profit-sharing model with the product, channel, platform or services are income sources identified by Sebi that finfluencers are not allowed to avail to promote content.

Simply put, a regulated entity can associate with a finfluencer only if the person is a registered investment advisor or research analyst. Second, the person—even if they are a Sebi-registered investment advisor or research analyst—can’t make performance claims.

(This story appears in the 18 October, 2024 issue of Forbes India. To visit our Archives, click here.)

“Unfortunately, finfluencers have contributed to a rapid increase in retail participation in speculative and high-risk products rather than long-term wealth-creating investing,” says Mayank Joshipura, vice dean, research and professor (finance), School of Business Management, NMIMS. He adds that most influencers give hope on how quickly money can be made without informing about the associated risks.

“Unfortunately, finfluencers have contributed to a rapid increase in retail participation in speculative and high-risk products rather than long-term wealth-creating investing,” says Mayank Joshipura, vice dean, research and professor (finance), School of Business Management, NMIMS. He adds that most influencers give hope on how quickly money can be made without informing about the associated risks. They are required to comply with the advertisement guidelines issued by Sebi, stock exchanges as well as any Sebi-recognised supervisory body. Also, Sebi-registered intermediaries/regulated entities are not allowed to pay any trailing commission based on the number of referrals as referral fee.

They are required to comply with the advertisement guidelines issued by Sebi, stock exchanges as well as any Sebi-recognised supervisory body. Also, Sebi-registered intermediaries/regulated entities are not allowed to pay any trailing commission based on the number of referrals as referral fee.