Paytm: Leaving the regulatory overhang behind

With NPCI clearing the deck for Paytm to onboard new UPI users, it will be business as usual for the fintech. Analysts will watch for the success of its lending activity to drive growth and profitability in coming quarters

National Payments Corporation of India (NPCI) on October 22 has allowed One97 Communications to onboard new UPI users on their Paytm app.

Image: Shutterstock

National Payments Corporation of India (NPCI) on October 22 has allowed One97 Communications to onboard new UPI users on their Paytm app.

Image: Shutterstock

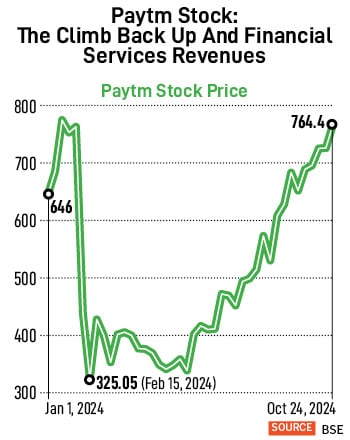

One97 Communications Limited, which owns payments and financial services distribution company Paytm, is moving into a phase where the regulatory overhang and risks now appear to be behind it. Paytm’s operations had been crippled after disruptions to its business operations, post the regulatory action earlier this year.

Now the National Payments Corporation of India (NPCI), which developed the payment system Unified Payments Interface (UPI), on October 22 has allowed One97 Communications to onboard new UPI users on their Paytm app.

Paytm has in recent months been trying to transition its core payments business from its subsidiary bank Paytm Payments India Ltd (PPBL) to four other banks (Axis Bank, HDFC Bank, SBI and Yes Bank) after regulatory action prevented PPBL from onboarding new UPI users.

The regulator Reserve Bank of India, this February, accused the company of persistent non-compliances and continued material supervisory concerns in the bank, warranting further supervisory action.

Citi analyst Vijit Jain says Paytm’s main focus going forward will be “on revitalising/recovering market share in consumer UPI payments and introducing new cross-sell opportunities into the UPI consumer Monthly Transacting Users (MTUs).”

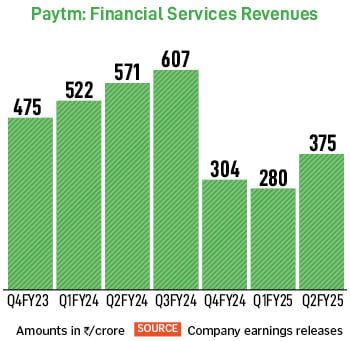

The company also turned profitable on a consolidated basis for the first time since listing, with a profit after tax of Rs 930 crore, but only due to a one-time exceptional gain of Rs 1,345 crore, on account of sale of entertainment ticketing business to Zomato. If this were adjusted for, the net loss stood at Rs 420 crore. In the first half of FY25, the company has posted a net loss of Rs 1,250 crore. Nitin Aggarwal, head-BFSI (institutional equities) at Motilal Oswal Financial Services forecasts the loss to improve 43 percent year-on-year and reduce to Rs 440 crore in 2HFY25.

The company also turned profitable on a consolidated basis for the first time since listing, with a profit after tax of Rs 930 crore, but only due to a one-time exceptional gain of Rs 1,345 crore, on account of sale of entertainment ticketing business to Zomato. If this were adjusted for, the net loss stood at Rs 420 crore. In the first half of FY25, the company has posted a net loss of Rs 1,250 crore. Nitin Aggarwal, head-BFSI (institutional equities) at Motilal Oswal Financial Services forecasts the loss to improve 43 percent year-on-year and reduce to Rs 440 crore in 2HFY25. In the Q2FY25 earnings call with analysts on October 22, 2024, the Paytm top management disclosed that previously the company operated at take rates between 4.5 percent and 5 percent without factoring in the DLG. Put simply, a take rate is how much money a business makes from a transaction.

In the Q2FY25 earnings call with analysts on October 22, 2024, the Paytm top management disclosed that previously the company operated at take rates between 4.5 percent and 5 percent without factoring in the DLG. Put simply, a take rate is how much money a business makes from a transaction.