Forbes India CEO Dialogues: Time to step up the pace

Arun Jaitley should pause on fiscal consolidation, believes India Inc, and instead focus on spending towards infrastructure, the rural economy and health care

Nearly two years after the Narendra Modi-led government assumed power, business sentiment has shifted from euphoria to cautious optimism, with a growing feeling that rhetoric must translate into action. The upcoming Union Budget is an opportunity to set the ball rolling.

Despite a marginal rise in India’s position in the World Bank’s Ease of Doing Business 2016 ranking, and easing fiscal deficit and inflationary pressures, there are still some areas of concern: Credit growth from banks is muted, rural demand has slackened due to two drought-like seasons and exports continue to slide amid weakening global demand for goods.

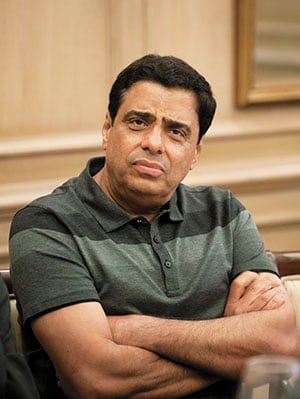

As part of the second season of the Forbes India CEO Dialogues: The Leadership Agenda, Adi Godrej, chairman of the Godrej Group, Ajay Piramal, chairman of the Piramal Group, Ronnie Screwvala, founder, Unilazer Ventures, Zarin Daruwala, CEO-designate, Standard Chartered Bank, Ridham Desai, managing director at Morgan Stanley India, Haigreve Khaitan, senior partner at Khaitan and Co, and Rashesh Shah, chairman and CEO of Edelweiss Group, spoke about their expectations from Finance Minister Arun Jaitley and the government in Budget 2016.

The unanimous view was that Jaitley should pause on fiscal consolidation and instead focus on spending towards infrastructure, the rural economy and health care. Recapitalisation of state-run banks and tackling rising levels of non-performing assets (NPAs) is critical too.

There was also consensus that the government must place greater emphasis on skilling, privatisation and import substitution. Excerpts from the discussion moderated by Forbes India Editor Sourav Majumdar:

Sourav Majumdar: How important will Budget 2016 be, given the economic scenario that the country is in?

Adi Godrej: Although we are the fastest-growing major economy in the world, things on the ground are not very good. Consumer demand is not good, particularly in rural India. It may not improve much unless a few things are done. The implementation of the Goods and Services Tax (GST) is most important; even passing a constitutional amendment will create a positive sentiment. I hear that the government plans to roll out a three-year plan, which is unusual in India. [But] it would give you an idea about what the government plans to do. I expect the government to make important announcements for rural India; in the unlikely event of a third consecutive year of poor monsoons, things could get very bad. The future of India is very good, but how we handle it over the next six months is very critical.

Majumdar: Mr Screwvala, there is a lot of talk about this being a big-bang budget. Will it be one?

Ronnie Screwvala: The government has done well by taking one step at a time. The big-bang concept has not been played out. The government feels more comfortable taking a long-term view. It could have done a lot in the first 100 days through big-bang reforms, but it has been going about it meticulously. Some ministries have taken a very strong executional stance, but not a big-bang approach. The rural [economy] has not grown, we are too focussed on industrialisation. We have some major state assembly elections coming up, including West Bengal this year and Uttar Pradesh next year; and they are agrarian economies. The government also has a plan to get the fiscal deficit down to 3 percent, but we are running late by a year.

Majumdar: How important will this budget be for accelerating economic growth?

Zarin Daruwala: We have reached a good level of GDP growth and now we are at an inflection point. It is a very important budget if we are to get to 9 percent growth. Private sector investments have slowed down and some public sector enterprises have Rs 2.8 lakh crore of cash surplus; private sector corporate profits are at a low, as a percentage of GDP, and the sentiment is a little low to make further capital allocations. The budget is important to kickstart the capital expenditure cycle.

Majumdar: Mr Khaitan, from a corporate deals perspective, what is the need of the hour?

Haigreve Khaitan: On policy, the government has to show that it is more friendly to both Indian and international investments. It must demonstrate that both execution and implementation are critical.

Majumdar: Mr Shah, your initial thoughts?

Rashesh Shah: One of the most critical questions which the finance ministry has to answer is whether the economy is in an inflationary or deflationary situation. We need an expansionary fiscal policy when the monetary policy [from the RBI] is highly conservative. If we have a slightly tight monetary policy, we cannot have a tight fiscal policy at the same time. Equity investors want the government to spend more, while bond market investors and rating agencies are looking for fiscal consolidation; it would put pressure on yields.

I think the answer might be to spend towards rural investment, capex cycles, asset sales and privatisation. If the FM can show that he is thinking like a private equity investor, it would be great.

Majumdar: What are the key challenges that Mr Jaitley faces at this time?

Godrej: The FM is in a good position; he will not allow fiscal deficit to go out of hand, but there will be spending. The government could do more on crop insurance and the FM should look at a reduction in the rates of direct (and personal) taxes. It could lead to better revenues in the same fiscal year; it can be positive. He may not play around with indirect taxes, with GST expected to come in soon.

Daruwala: Though not linked to the budget, India should look at locking [favourable] gas prices for power plants. On the budgeting side, the government should assume higher food prices; it is better to over-deliver than over-promise. Also, if you see the expansion story of the Asian Tiger Economies, they never compromised on health and education, this is important given India’s low ratings on various parameters of the Human Development Index.

Shah: India has a great opportunity due to low oil prices. The fall in oil prices, from an accounting viewpoint, is only a one-time gain. In the coming year, the government may not have that windfall. So where has the

Rs 80,000-90,000 crore gone? It has gone to the states, but we have to eye the state finances properly.

Majumdar: Can Jaitley ‘fix the fisc’ and also get that leeway for spending?

Shah: He has got it under control; it has got absorbed. The government will have 100 things to spend on and only some funds on the other side.

Majumdar: But where will the money come from?

Godrej: He has increased excise duty on some oil-based products, which will increase revenues. He can find ways of direct tax adjustments, which can help improve collections and the economy. Other countries have managed to do this very smartly.

Ridham Desai: While on oil, I think prices at $30 a barrel is a great thing even next year. Since 2012, India has saved $50 billion on its oil bill. So where has the money gone? Someone in Delhi thought through this and raised excise and taxes [this amounted to savings by the government]. It cannot go away and can be used when it wants to. Hence fiscal deficit is at 3.4 percent and not 3.9 percent despite the government missing divestment targets.

The price which Indians now pay at a gas station is $120, but the international price is $30, so we are paying four times more because the government has hiked taxes to that extent. The government can use the money to build roads. And why does the oil gain not go away? Till the time you don’t lower taxes, you are still capturing the gain. Only when you lower taxes, you are giving it away to the consumer.

What if oil goes to $60? There is no other country which did what India did—increase taxes. A lot of countries import oil and most of them passed it on to their consumers, notably America. In America, consumers saved the money. In India, the government saved it, which is why the country is being rewarded. India has outperformed other emerging markets by 35 percentage points. If oil prices go up again, the government has the option to raise retail prices or cut taxes; this option was not there before.

Majumdar: So why then is there disappointment in India Inc that reforms are not moving?

Screwvala: The media needs to answer that. [Because] the government is at work; the momentum is there. One or two legislations not going through have rattled people.

Shah: In the past 4-5 years, no asset inflation has happened. When we speak to corporates, no asset inflation has kicked in. Interest rates are still high.

Godrej: Real interest rates for the industry are extremely high, but rates for consumers are reasonable.

Desai: This is because we changed the benchmark from the producer price index to the consumer price index (CPI). The point which Rashesh makes is relevant… you can import plants through China at cheaper rates compared to five years ago as import costs have declined. The digression in the economy is something the US is also grappling with; so producers are experiencing deflation in prices and consumers are experiencing a rise in prices—the gap is the increased cost of non-tradeables. The price of a taxi ride is going up, but the price of a car is not because the latter uses steel, prices of which are going down.

Majumdar: Mr Piramal, given the scenario of manufacturing and exports going down, what do you expect?

Ajay Piramal: The finance minister should relax the fiscal deficit target next year as people need the confidence that money is coming in. The issue of non-performing assets (NPAs) in the banking system has to be addressed. I feel embarrassed; sometimes we are willing to write off tens of thousands of crores for industry and businesses, but if subsidy is to be given to someone, we make a lot of noise. This game should stop now.

Majumdar: Zarin, do you think there is an increasing understanding in the government that the NPA situation cannot go on? How does a banker like you look at this situation?

Daruwala: This [difficult business] cycle has persisted much longer. When banks looked at restructuring stressed assets, they thought the cycle would revive in 18-24 months; the restructuring was done on that basis. But this did not happen and that is why the assets are looking like non-performing ones. From an NPA viewpoint, the entire ecosystem–vendors, talent, dealers–freezes and takes a hit.

Desai: This is the only place where the government missed the point. Two years ago, our view was that there was an urgent need to recap SOE (state-owned enterprise) banks. India is facing a deep cyclical problem and 70 percent of India’s banking system does not have capital to lend and the government is the owner of these banks. It is incumbent on the government to energise these banks by infusing capital and this can be done through a recap bond. Banks are facing pain because they thought that the cycle would change; it is now hurting the prospective lending cycle as they don’t have the money to lend.

Piramal: You may recapitalise banks, but the quality of management of public sector banks has been deteriorating over the past 10 years. They don’t have the ability to take the right credit decisions—either they give risky loans or are risk-averse and don’t lend at all.

Khaitan: I agree with Mr Piramal. This has gone on for too long. We need a policy and efficiency correction on debt recovery. We have the laws, but nobody is thinking about efficiency in terms of recovery. The government is not allowing efficient recovery.

Godrej: The government has not done anything about disinvestment; we always wait for the end of the financial year and if the markets are down, we don’t look at it. Unlike the AB Vajpayee-led government, this government is not talking about privatisation.

Desai: I had proposed a systematic disinvestment plan (like an SIP), where at the end of each month, the government should sell Rs 500-1,000 crore of equity. It should be a process which is already embedded.

Shah: It has not sold as the fiscal deficit is under control due to low oil prices.

Godrej: Why did it not sell assets in the first place?

Shah: It feels that this is like having cash in a bank. I will sell them [the stakes] when I want and need the money very badly.

Desai: I don’t think the government has capital as a problem; it’s all about execution and not about financing. We became a little liberal with foreign direct investment (FDI) and we have received $80 billion in the last two years.

Majumdar: Health care, skilling and education are also critical. What should the government do?

Godrej: Skilling and training are very important as they can add value very early into the economy. There is a shortage of skilled people in India. There is no unemployment, just unemployability. However, just being a university graduate does not make you employable. I feel education will see increased allocations in the budget.

Screwvala: There will be increased allocation towards education. But in terms of skilling, we need our benchmarks to be much higher than they are today; how many of these [trained or skilled] are employable...

Piramal: I don’t see too much increase in spending in health care and education. There will be skilling though. There is hardly any discussion on health care. It [the government] will rather spend on the public sector, where it is visible. The social sector may not get as much as it ought to.

Majumdar: What can the capital markets expect to translate household savings into investments. What remains to be done?

Desai: I think what had to be done is done. The government has delivered on the fiscal deficit; when it came to office, it was around 5.8 percent, [we feel] it is now down to around 3.4 percent. The RBI has already engineered a shift in household savings, which were moving towards buying physical assets like gold and property because inflation expectations were high. Now, as inflation expectations are coming down, you can see a tick up in financial assets—real equity investing is at an all-time high.

Should there be more tax incentives? Tax incentives do not drive investors to buy financial assets, expectations of returns do. How do you keep returns intact? You do it by boosting corporate profits. How do you boost corporate profits? You do this by spending more money on infrastructure. Tax incentives make good headlines, but do not boost savings.

Shah: I agree largely. The key to convert savings into long-term investments is by having real rates which are attractive, which the RBI has done. But there are a few things which need to be done: We need to reduce the dividend distribution tax. We should encourage companies to give out more to their shareholders because on an average, they are not good allocators of capital.

We need local capital which can be a potent force. India can get up to $40-50 billion from household savings; we should also make taxation easier for REITs (real estate investment trusts).

Desai: I disagree with Rashesh on companies not being good allocators of capital. They are superb at that, which is why in dollar terms, on a 20-year basis, India is the best performing stock market in the world. If Indian companies were indeed such poor allocators of capital, it would not have generated such high returns for shareholders.

Shah: Which is why I said it does not apply to all companies.

Daruwala: We should focus on import substitution, particularly in electronics. We can take a hint from Finland about how it created an ecosystem, instead of just SEZs [special economic zones]. Also India needs to have a skilling programme linked to this, if electronics manufacturing needs to jump.

Piramal: We have to improve ease of doing business. When we interact with ministers, their intentions are all very good. But when you go down to the next level, things do not move due to bureaucracy. Something has to be done.

Majumdar: As we draw to the end of the discussion, what are the top three things on your wish list?

Godrej: We are in a great position for long-term growth. There are opportunities to reduce [ease] direct taxes. Some other actions where lower rates of taxes can still create more revenues are possible. We need a stimulus to the economy, but not through indirect tax reduction; it should be through direct tax reduction. GST will hopefully come in soon. If passed, India will get into double-digit growth.

Piramal: We have to seize this opportunity; we have to focus on the ease of doing business. We need to show more faith in the private sector; privatisation does not exist in the government agenda. We should push for more privatisation, which also means we should take strict action to resolve the NPA situation. If you don’t solve your banking sector problems, you can’t have growth. Banks are still unable to attract high quality talent.

Screwvala: If the FM has a three-year plan, there needs to be clarity on how it will be easier to do business in India. India needs articulation on R&D [research and development] to reinvigorate innovation. Thirdly, if we launch 10,000-15,000 startups, that’s huge. But India needs one million startups. Then we have a movement which would be quite different from Bric countries. Also, like SEEPZ, India needs startup zones. The truth is that the psychological barrier for people to jump fence and become an entrepreneur is still huge.

Daruwala: We hope that GST comes in, but if it does not, the budget should have a road map where alignment of taxes is more towards a GST type of structure. At least directionally we should head towards GST, wherever possible. Secondly, the public sector capital expenditure cycle should be rebooted. Thirdly, focus on import substitution, particularly since the demand for exports may not go up soon.

Desai: The government has done a fabulous situation control on fiscal deficit and 2016-17 is the year to take a pause. No more fiscal consolidation; the government needs to spend, we need to boost growth. Infrastructure spending has increased over the past 12 months, but that needs to continue. There is a clear requirement for a boost to the rural economy, which has suffered in the last two years.

Khaitan: The government needs to work on judicial reforms. No timely relief comes from the courts or tribunals. India also needs a tax clean-up, there are a lot of inconsistencies and transparency needs to improve for investors. Thirdly, the government should concentrate on execution.

Shah: I hope there is an expansionary fiscal orientation in the budget; the economy needs a stimulus. This should be supported through asset sales—real estate assets or privatisation. I would like to see aggressive bank recapitalisation.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)