Groww: Making investing as easy as ecommerce

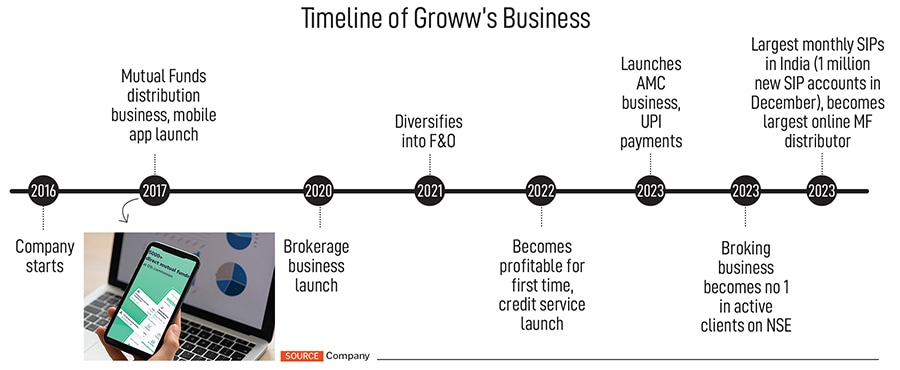

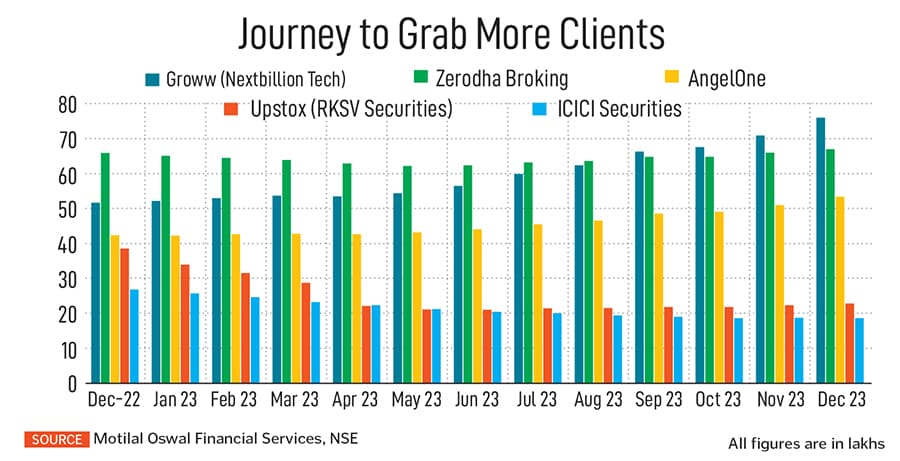

With its focus on making financial services simple and by remaining consistent in its expansions, Groww has become the biggest stock brokerage firm in India in terms of active clients on the NSE, in a short time span

(From left): Harsh Jain, Lalit Keshre, Ishan Bansal and Neeraj Singh, co-founders, Groww

Image: Nishant Ratnakar for Forbes India

(From left): Harsh Jain, Lalit Keshre, Ishan Bansal and Neeraj Singh, co-founders, Groww

Image: Nishant Ratnakar for Forbes India

Four shy techies fascinated by the capital markets wanted to make financial services in India easy and accessible. Just like what ecommerce did worldwide, they wanted to make investing hassle-free. That was seven years ago, when mutual funds penetration in Indian households was minimal and the monthly inflow of systematic investment plans (SIPs) was still below ₹5,000 crore.

The young engineers, who had worked at Flipkart, were confident that they could create a model in financial services with similar technology and customer-centricity that had disrupted the ecommerce industry.

The challenge was tough. The financial services market was, then, led by legacy players in the brokerage business, mutual fund distribution and asset management companies. New online discount brokerage companies had just emerged, vying to break through this heavily concentrated pie.

There itself was the golden chance, to explore the untapped section of people who were looking for investment options but stayed away for various reasons from lack of understanding of products to inaccessibility.

There itself was the golden chance, to explore the untapped section of people who were looking for investment options but stayed away for various reasons from lack of understanding of products to inaccessibility.

“Only 20 million Indians held a share in mutual funds from 2016 to 2018, despite 60 percent of household savings in India being held in financial assets (including mutual funds, insurance, cash, direct equity etc.). There was an opportunity to make the process of purchasing financial products more accessible and transparent,” says Lalit Keshre, co-founder and CEO, Groww.

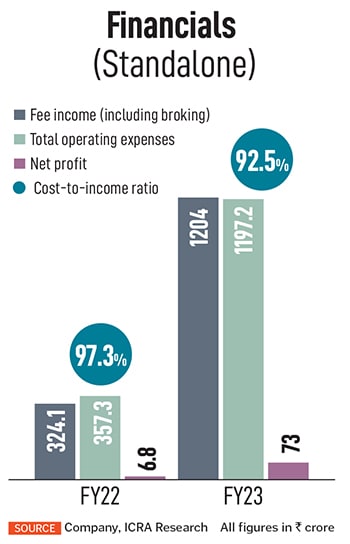

The growth in the company’s client base led to improved broking volumes and earnings in FY2023 with the company reporting a return on net worth (RoNW) of 13.2 percent, says ICRA.

The growth in the company’s client base led to improved broking volumes and earnings in FY2023 with the company reporting a return on net worth (RoNW) of 13.2 percent, says ICRA.