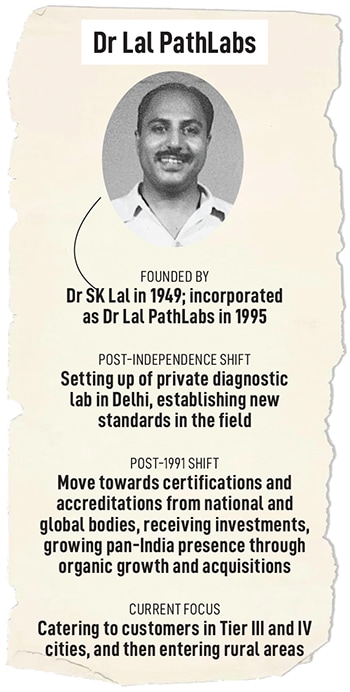

How Dr Lal PathLabs stands the test of time

SK Lal, who moved to Delhi from Lahore during Partition, started Dr Lal PathLabs, which is now India's largest diagnostic chain

Dr Arvind Lal, chairman & MD, Dr Lal PathLabs

Image: Madhu Kapparath

Dr Arvind Lal, chairman & MD, Dr Lal PathLabs

Image: Madhu Kapparath

When my father, Dr SK Lal, decided to make India his country at the time of Partition, and came to Delhi from Rawalpindi, he had 31 dependents with him,” recalls (Hony) Brigadier Dr Arvind Lal, executive chairman of Dr Lal PathLabs Ltd.

The senior Lal was a graduate of King Edward Medical College, Lahore, and was commissioned in the IMS, the erstwhile Army Medical Corps, in 1940. He was a graded specialist in pathology, having been trained at the former Army Medical Training College in Pune, which was renamed Armed Forces Medical College, post Partition. “He had briefly worked at the government-run Provincial Health Laboratory in Delhi, but had found it to be too chaotic and disorderly for his liking, given his disciplined experience in the Army,” says Lal. “So, he chose to quit and start his own lab.”

In 1949, Lal Sr set up the first private standalone lab in North India. “It was in our residence at Hanuman Road, which is just off Parliament Street,” says Lal. “The lab was set up in April 1949 and I was born in August 1949. So, the lab and I are almost like twins,” he says with a laugh.

An established pathologist, Lal Sr soon began to find clients among individuals as well as government establishments. Setting up a private pathology lab in those days was not just revolutionary, but also challenging. “There were no suppliers or established procurement chain for private labs then. Also, there were no ready-to-use reagent kits. This meant he had to manually prepare these from individually available chemicals,” says Lal.

An established pathologist, Lal Sr soon began to find clients among individuals as well as government establishments. Setting up a private pathology lab in those days was not just revolutionary, but also challenging. “There were no suppliers or established procurement chain for private labs then. Also, there were no ready-to-use reagent kits. This meant he had to manually prepare these from individually available chemicals,” says Lal.

In the 75 years since its inception, Dr Lal PathLabs has grown from a single laboratory in Delhi to one of the largest diagnostic chains in India, with a network of more than 280 labs, 5,500 collection centres and more than 11,000 pick-up points in hospitals, nursing homes and other labs. “We have developed a model in which the collection centres are run as franchisees, but the testing laboratories are all owned by us,” explains Lal. “We serve patients in more than 1,500 cities, testing nearly 1 lakh patients every day.”

(This story appears in the 23 August, 2024 issue of Forbes India. To visit our Archives, click here.)