The biggest killer for innovation is raising too much money: Ronnie Screwvala

At the Forbes India 30 Under 30 event, the entrepreneur and philanthropist spoke about building businesses for the long-term, and not for valuations

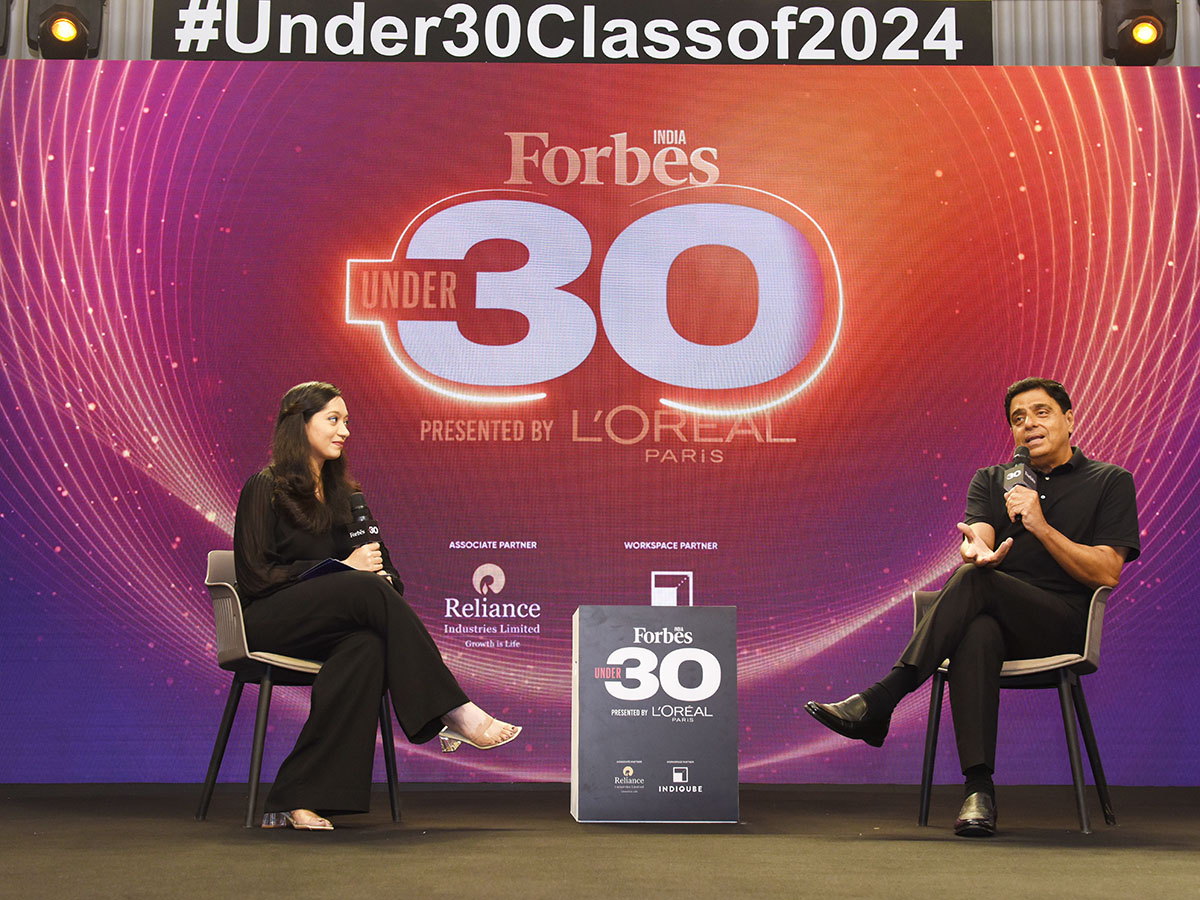

Naini Thaker, assistant editor, Forbes India in conversation with Ronnie Screwvala, entrepreneur and philanthropist

Naini Thaker, assistant editor, Forbes India in conversation with Ronnie Screwvala, entrepreneur and philanthropist

Ronnie Screwvala learnt the importance of value creation very early. He started his first business with only Rs37,000. He came from a middle-class background and his father had a clear message for him: If you want to start something of your own, do it.

But if something goes wrong, we’re with you morally, but we can’t bail you out financially. “When you have no opening balance, it’s a different approach to life. It keeps you grounded for the rest of your life. And the more your feet are on the ground, the higher the chances of success,” he says.

Screwvala built UTV into a massive media conglomerate, which was eventually sold to global giant Walt Disney. Currently, he is the co-founder of edtech venture upGrad, and not-for-profit Swades Foundation. At the Forbes India 30 Under 30 event in Mumbai on October 4, Screwvala spoke to Forbes India about building for the long-term and more. Edited excerpts:

On not getting caught up in the numbers

Anyone who is building a business needs to remember that the money you have raised is not an asset, it’s actually a liability. It’s a great cash flow, and it is a positive, but at the end of the day, you have to give a return.

The biggest killer for innovation is raising too much money. What does it mean? Some investor told you about the four seasons, and stocking up for winter because nobody else is going to do that—that’s a complete disillusionment. It’s their agenda and how they want to run it.