Hyundai Motor IPO: Do valuations justify the price?

Despite stable financials, the auto manufacturer is far from being the industry leader in India's passenger vehicle space, raising valuation concerns of the Rs 27,870 crore-IPO

(File) A worker inspects parked Hyundai vehicles ready for shipment at a port in Chennai.

Image: Arun Sankar / AFP

(File) A worker inspects parked Hyundai vehicles ready for shipment at a port in Chennai.

Image: Arun Sankar / AFP

As investors are vying to grab a share of the world’s third-largest auto manufacturer Hyundai Motor India, the initial public offering (IPO) appears to be richly valued. Though the company has consistently grown and been the first mover in various passenger vehicle categories, the country’s largest IPO is hardly leaving anything on the table for investors.

Hyundai Motor India plans to raise Rs27,870 crore through the IPO with a price band of Rs1,865-1,960. The issue, which is open for subscription from October 15 to 17, has already received anchor investors’ hefty money. A clutch of 225 anchor investors has pumped in Rs8,315.3 crore in the South-Korea based company’s IPO.

Of the total allocation of 4.2 crore shares to anchor investors, 1.46 crore shares were allocated to 21 domestic mutual funds through 83 schemes. Some of the marquee anchor investors include the Government of Singapore, New World Fund Inc, Monetary Authority of Singapore, Fidelity, Government Pension Fund Global, and American Funds Insurance Series New World Fund.

The issue is a complete offer-for-sale in which the promotors are reducing their stake by around 17 percent, and the company will not receive any proceeds from the sale. It plans to utilise the proceeds in research & development (R&D) of new cars.

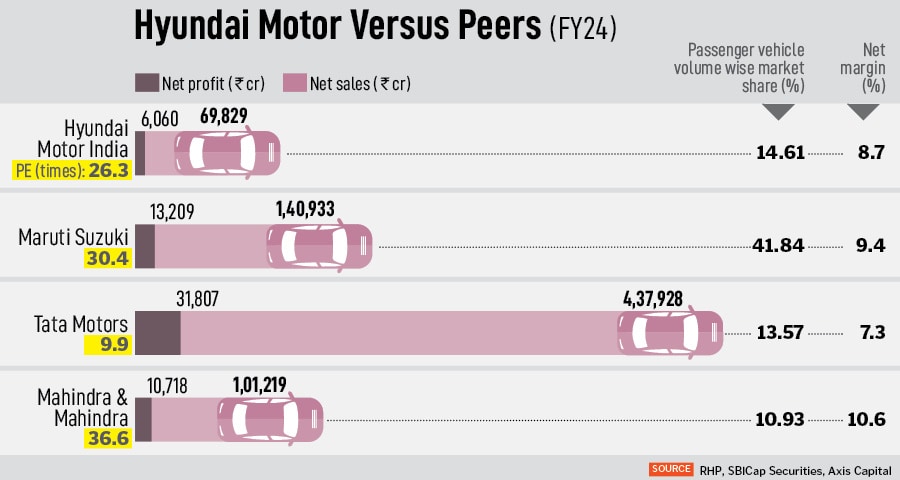

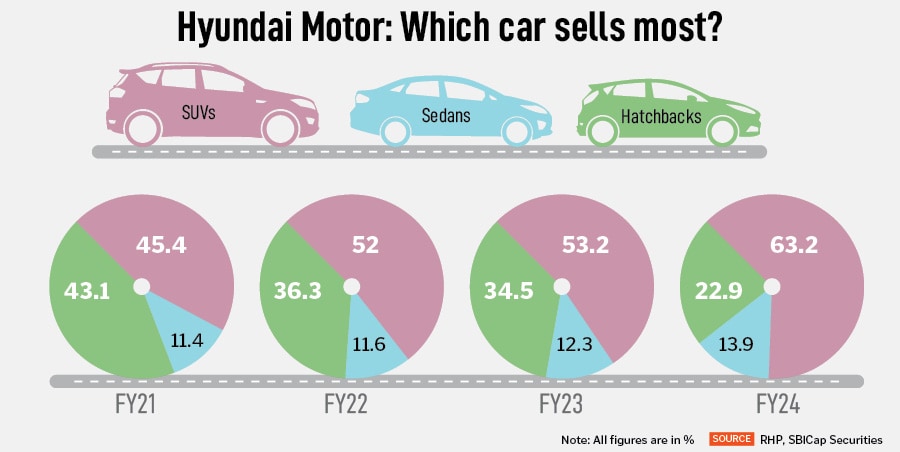

Hyundai has been one of the largest automakers in India garnering a market share of 14.6 percent (second to Maruti) in FY24 despite competition. It has a 24 percent market share in exports—one of the highest in industry. However, Mihir Manek, analyst, Aditya Birla Capital, finds it risky that Hyundai has been unable to increase its market share beyond 20 percent. He points out that there is a slowdown in electric vehicles (EVs) demand with no hybrids on offer and over 67 percent of its volume is derived from the SUV segment, which is not favourable for the company.