Axis Bank to buy out Citi India's consumer banking business for $1.6 bln

Deal will help Axis close the gap with peers HDFC Bank, ICICI Bank, but the bank will face a steep challenge of retaining talent and clients in a tough business environment

The valuation of this deal is based on a PE 18.7x based on normalised calendar year 2020 standalone earnings of this business; Image: Andrey Rudakov/Bloomberg via Getty Images

The valuation of this deal is based on a PE 18.7x based on normalised calendar year 2020 standalone earnings of this business; Image: Andrey Rudakov/Bloomberg via Getty Images

Private sector lender Axis Bank on Wednesday announced a deal to acquire Citibank India’s consumer banking business for Rs 12,325 crore (approx. $1.6 billion), in a move to try and narrow the retail banking gap between themselves and leaders such as HDFC Bank and ICICI Bank.

The transaction comprises the sale of the credit cards, retail banking, wealth management and consumer loans. The procedure—which is likely to be completed over the next 9 to 12 months—also includes the sale of the consumer business of Citi’s non-banking financial company, Citicorp Finance (India) Limited, comprising the asset-backed financing business that consists of commercial vehicle and construction equipment loans as well as the personal loans portfolio. Citi will retain its institutional client business.

Calling this a “once in a lifetime” deal, Axis Bank’s managing director and CEO Amitabh Chaudhry, said: “This is one of the best consumer franchises in the country with the quality of customers and wealth franchise unmatched. The value we are paying is right. If we can manage client attrition, employee attrition and technology integration well and then cross-sell to our customers we will come out the winner.”

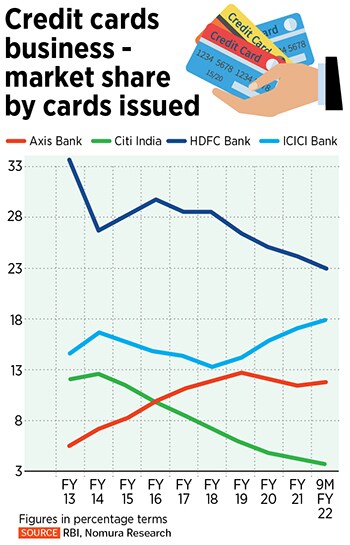

Citi has 2.55 million credit cards issued and a loan book size of Rs 8,900 crore, according to RBI data, but its market share in the credit card business has been reducing due to increased competition from domestic private sector banks. The valuation of this deal is based on a PE 18.7x based on normalised calendar year 2020 standalone earnings of this business.

Strengthening credit cards, wealth management

Besides boosting the credit card business, the deal will help Axis expand the wealth management business, with the combined AUM of wealth franchise expected to increase by 42 percent. Axis is competing with foreign giants such as Julius Baer and Credit Suisse and domestic experts such as IIFL and Kotak Mahindra Bank.

The deal will close in 9 to 12 months and it will take an additional 18 months to fully integrate the businesses, Chaudhry said. The payment will be made when all approvals and assets and liabilities of Citi’s consumer banking business are transferred to Axis Bank.

The deal will close in 9 to 12 months and it will take an additional 18 months to fully integrate the businesses, Chaudhry said. The payment will be made when all approvals and assets and liabilities of Citi’s consumer banking business are transferred to Axis Bank.