Happy New Year: US Federal Reserve pivots and signals early rate cuts

Markets cheer as FOMC officials say they are ready to dial back, and reduce rates by 75 basis points next year, marking an end of the historic rate tightening cycle seen in recent decades

US Federal Reserve Chairman Jerome Powell holds a press conference at the end of Monetary Policy Committee meeting in Washington, DC, on December 13, 2023. Image: Brendan Smialowski / AFP

US Federal Reserve Chairman Jerome Powell holds a press conference at the end of Monetary Policy Committee meeting in Washington, DC, on December 13, 2023. Image: Brendan Smialowski / AFP

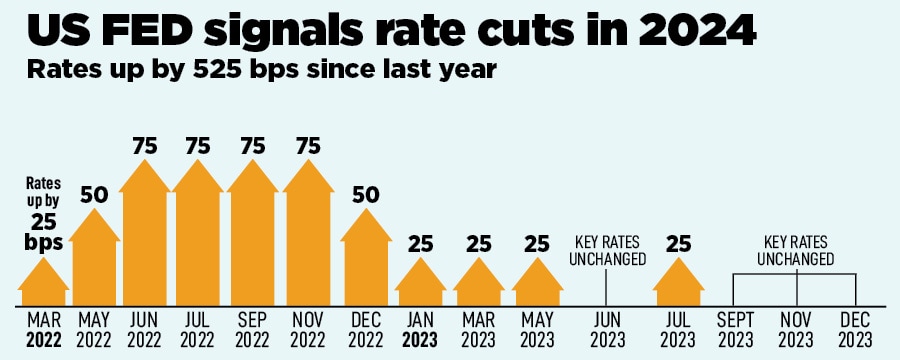

In its last meeting of the year, the Federal Open Market Committee (FOMC), left the target range for the benchmark federal funds rate unchanged at 5.25 percent to 5.5 percent, but parted with a new year gift for investors. Having raised rates by 525 basis points since March last year, US Federal Reserve officials said they have done enough, finally. Global markets rejoiced as the US Federal Reserve signalled early rate cuts to the tune of 75 basis points next year.

The Dow Jones Industrial Average rose over 400 points, crossing the 37,000 level for the first time; most Asian markets closed in the green, and at 1.50 pm India’s S&P BSE Sensex was trading 960 points higher at 70,544.

Most economists and fund managers expect 2024 to be a year of rate cuts. But given the sharp fall in bond yields, no one expected Jerome Powell, chairman, US Federal Reserve, to say so in the December meeting. So, it was surprising when Powell went as far as a central banker can go to clearly signal three early rate cuts in 2024 to end its aggressive rate-hiking cycle. “We are seeing strong growth that appears to be moderating. We are seeing a labour market that is coming back into balance. We're seeing inflation making real progress," Powell reportedly said at a press conference. "These are the things we've been wanting to see. Declaring victory would be premature but of course the question is when will it become appropriate to begin dialling back?”

Many analysts expect the rate cut cycle to begin as early as March. Economists expect headline personal consumption expenditures inflation to cool off at 2.8 percent this year and further decline to 2.4 percent by 2024-end. The US Federal Reserve, in the past, has reiterated its goal to lower inflation to 2 percent. Since June 2022, when CPI inflation hit a 40-year high of 9.1 percent, price levels steadily declined to 3.1 percent last month.

Obviously, there were caveats because the war against inflation is far from over, but there was a clear shift in the tone of the policy. “While participants do not view it as likely to be appropriate to raise interest rates further, neither do they want to take the possibility off the table,” Powell clarified. “The question of when will it be become appropriate to begin dialling back the amount of policy restraint in place that begins to come into view, and is clearly a discussion topic of discussion out in the world and also of discussion for us at our meeting reading today.”

Also read: US rate hike cycle nears end: One done, one more to go, maybe