How are India's power companies handling the crucial renewables transition?

India is seeing a record demand for power, spurred both by economic activity and the climate crisis. Power companies are expanding their renewables capacity, even as the country's dependence on coal is on the rise. How are they managing the transition?

Praveer Sinha, CEO & MD, Tata Power

Image: Mexy Xavier

Praveer Sinha, CEO & MD, Tata Power

Image: Mexy Xavier

The power industry in India is having a moment in the sun. Quite literally.

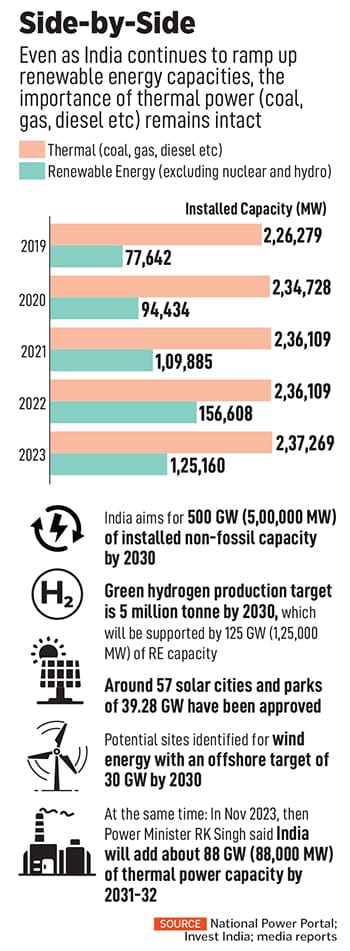

There are two main reasons. First is the rising, unprecedented demand for power, and second is the ambitious green energy transition goals the country has set, which are to be led by renewables.

India logged a record peak electricity demand of 250 GW on May 30, and the power ministry is bracing for it to reach 260 GW in June. Among the main causes for this is rising temperatures and heatwaves that have been gripping the country, leading to a surge in demand for cooling equipment like air conditioners.

Economic growth is another reason for high power demand. The International Monetary Fund has said that India will remain the fastest-growing major economy in 2024, and in its latest outlook, raised India’s growth projections for the year from 6.5 percent to 6.8 percent. The Reserve Bank of India, in its latest Monetary Policy Meeting, raised the Gross Domestic Product (GDP) forecast for FY25 to 7.2 percent from 7 percent earlier. Sabyasachi Majumdar, senior director at CareEdge Ratings, says it is generally believed that the demand for power grows roughly at 0.9 percent of the GDP demand.

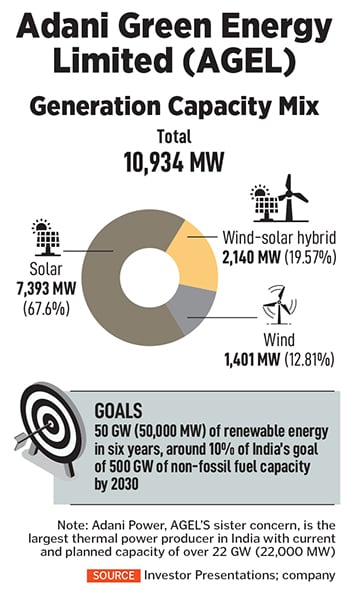

Over the next two decades, India’s energy needs are set to account for a quarter of global demand, with projections indicating a surge of 25 to 35 percent in demand by 2030, says Sagar Adani, executive director, Adani Green Energy Limited (AGEL). “This surge is intricately tied to India’s ambitious infrastructure development plans, encompassing roads, railway ports, and airports, all of which demand an expansion of energy capacity.”

Over the next two decades, India’s energy needs are set to account for a quarter of global demand, with projections indicating a surge of 25 to 35 percent in demand by 2030, says Sagar Adani, executive director, Adani Green Energy Limited (AGEL). “This surge is intricately tied to India’s ambitious infrastructure development plans, encompassing roads, railway ports, and airports, all of which demand an expansion of energy capacity.”

(This story appears in the 28 June, 2024 issue of Forbes India. To visit our Archives, click here.)

Adani Power, the largest private thermal power producer in India and a sister concern of the AGEL, has a current and planned capacity of over 22 GW of thermal power. It anticipates in a March 2024 investor presentation that while non-fossil sources will lead capacity addition, thermal will continue to serve most of the base demand for power. For instance, it estimates that in FY27, 59 percent of the gross generation 2,025 billion units of power will be thermal, while in FY32, it is expected to be 50 percent of 2,666 billion units.

Adani Power, the largest private thermal power producer in India and a sister concern of the AGEL, has a current and planned capacity of over 22 GW of thermal power. It anticipates in a March 2024 investor presentation that while non-fossil sources will lead capacity addition, thermal will continue to serve most of the base demand for power. For instance, it estimates that in FY27, 59 percent of the gross generation 2,025 billion units of power will be thermal, while in FY32, it is expected to be 50 percent of 2,666 billion units.

Majumdar of CareEdge explains that if India has a total renewable energy capacity of 450 GW by 2030, it will require at least 19 GW of PSPs and 42 GW of battery storage. “That will require a total capital expenditure of ₹17-18 lakh crore, out of which 75 to 80 percent, will come from the debt side,” he says.

Majumdar of CareEdge explains that if India has a total renewable energy capacity of 450 GW by 2030, it will require at least 19 GW of PSPs and 42 GW of battery storage. “That will require a total capital expenditure of ₹17-18 lakh crore, out of which 75 to 80 percent, will come from the debt side,” he says. Another way in which AGEL wants to accelerate the integration of renewable energy to the grid is by investing in hybrid, which is essentially a combination of different energy sources (like solar and wind, for example). Its benefits, according to Adani, include increased efficiency, optimal land and grid infrastructure use.

Another way in which AGEL wants to accelerate the integration of renewable energy to the grid is by investing in hybrid, which is essentially a combination of different energy sources (like solar and wind, for example). Its benefits, according to Adani, include increased efficiency, optimal land and grid infrastructure use.