Ultratech signs on Kesoram Cement's dotted line

With the acquisition of Kesoram's cement business Ultratech stretches its lead with Adani Cement

Ultratech acquired the 10.75 million tons on offer in an all-stock deal with 52 equity shares of Kesoram Industries being swapped for 1 share in Ultratech.

Image: Amit Dave/ Reuters

Ultratech acquired the 10.75 million tons on offer in an all-stock deal with 52 equity shares of Kesoram Industries being swapped for 1 share in Ultratech.

Image: Amit Dave/ Reuters

India’s cement majors are on an expansion-through-acquisition spree. Three months after Adani Cement moved to acquire smaller rival Sanghi Industries, its larger rival Ultratech Cement has moved in to acquire Kesoram Industries’ cement business in an all-stock deal.

The move was widely expected as Kesoram Industries had demerged its tyres and rayon business in 2019 and 2022 respectively. The market had been waiting for the last three years for Kumar Mangalam Birla, the grandson of BK Birla, to take over its cement business. Industry insiders say the cement operations were already being informally run by personnel from Ultratech. Kesoram Industries is owned by Manjushree Khaitan, Kumar Mangalam’s aunt, who took over in 2019 after the death of her father BK Birla.

Ultratech acquired the 10.75 million tons on offer in an all-stock deal with 52 equity shares of Kesoram Industries being swapped for 1 share in Ultratech. The price reflected a 34 percent premium over the closing price of Kesoram Industries on November 30 and valued the cement business at Rs 5,379 crore. Including debt the deal is valued at about Rs 7,600 crore. Ultratech’s share capital will rise by Rs 294 crore.

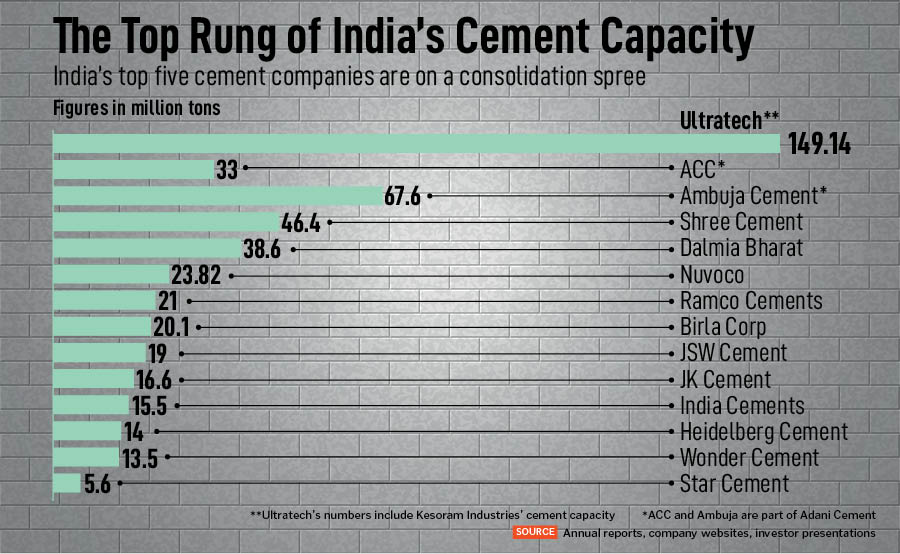

The acquisition comes as Ultratech is moving quickly towards achieving its goal of reaching 200 million tons in cement capacity. At present its capacity stands at 149.14 million tons, making it the world’s largest cement producer outside of China.

The last year has seen quick moves by cement companies to consolidate their positions. A key ingredient has been the fact that now mines are almost always automatically transferred in case of an acquisition. This makes it much easier for companies to justify the price paid. Add to that the fact that a brownfield asset cuts down by at least three years the time taken to expand capacity and it is not hard to see why companies are choosing the acquisition route.