Introspecting on the Role of Technology in the New Normal

The Covid-19 crisis has irreversibly changed work and life as we knew it. Within the new normal, businesses and individuals find themselves grappling to conduct economic activities remotely, to work around the trade-off between ensuring physical and economic safety.

During these challenging times, mindsets have undergone a change and ecosystems are getting broken down and replaced with entirely new structures. Unique partnerships are emerging to cater to shifting customer preferences, and businesses are demonstrating openness to reinvent themselves by adopting new management practices and innovative strategies and solutions.

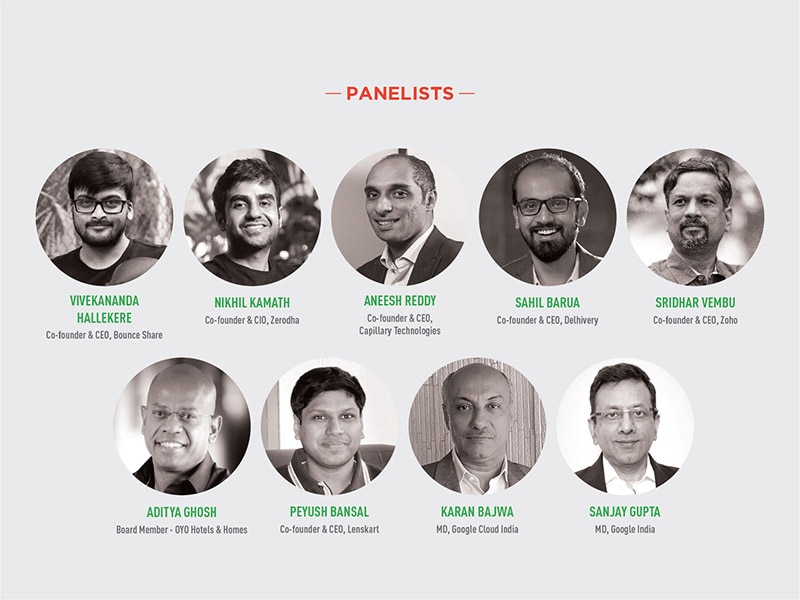

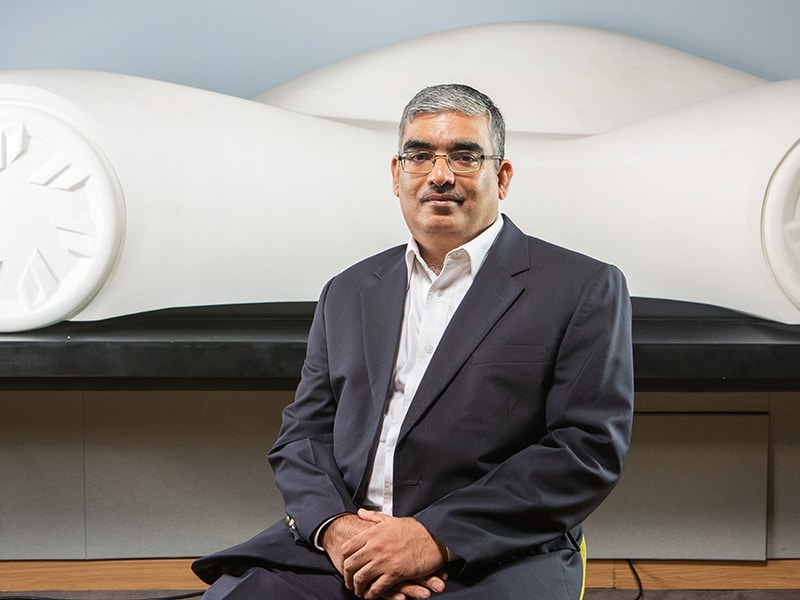

To comprehend the nature and extent of the disruption that businesses are undergoing and deliberate on the way forward, Forbes India hosted a series of virtual discussions between industry captains. The sixth in the series, presented under the banner of One CEO Club, witnessed Munish Sharda, MD & CEO, Future Generali Life Insurance; Mithun Sacheti, co-founder & CEO, Caratlane, and Karan Bajwa, CEO, Google Cloud India, sharing their new-found experiences and astute insights.

Sharda started the discussion by describing how his mindset went from uncertainty to despair and finally hope, as the crisis deepened further. “We were hit by the crisis in the middle of a very productive phase for the industry. March, the financial year-end, is usually a busy month for us. This month typically contributes about 25 percent of our revenue. This year, 70 percent of our March volumes dropped off, nullifying all the growth achieved until then. This created dire concerns about our financials for the year.”

The dark clouds were not without a silver lining. “It completely changed the way we perceived our customers and engaged with them. Secondly, while we were transitioning to digitization, the entire process was accelerated and completed. Today, transactions, processing, even the entire front office from prospecting to sales, is all digital,” said Sharda.

In Sacheti’s opinion, the pandemic has re-shaped long-standing business beliefs and buyer behaviour. “Billions of dollars have been spent by Flipkart, Amazon and the like, in different geographies across America and the world, to create the habit of online spending. And in one fell swoop, the pandemic has driven consumers to consume digitally,” he said.

He went on to narrate how he has seen a reflection of this change in consumption habits in his business too. “Our business has an omni-channel presence. We reach out to our customers through high-street stores, malls, try-at-home format and via our website, online.” The business from mall stores was completely dull and only a recovery of about 25 percent was expected from high-street stores that conventionally saw recoveries ranging between 50 and 60 percent or more. On the other hand, he said, the try-at-home format and online sales were expected to see growth spurts of 25-30 percent and 60-70 percent, respectively.

All these years, hundreds of crores of rupees have been spent on trying to bring about this change and it never happened. Then, all of a sudden, consumer behavior changed and all the theories about consumer behavior changing very gradually have gone out of the window, Sancheti said.

Bajwa agreed that Covid-19 had completely changed many assumptions about the way business is done. “All the assumptions that we carried about businesses and life, which were an outcome of our learning over years of doing the same thing over and over again, got debunked and demolished. We were resistant to change but when our hand was forced, we adapted.”

The first assumption that got discarded, in his opinion, was with respect to working remotely. “Of course, there are some industries where you cannot go 100 percent remote but, in many others, you can do a significant part of your work remotely. And we have seen that this can happen,” he said.

Another assumption that was breaking down was with respect to customer interactions. “We always thought customer interactions necessarily involved engaging in personalised conversations. While no one can ever replace the human element, a large part of it can be done remotely.” He added that ultimately, who and what is forcing our hand will determine how fast we change.

According to Sharda, all these developments simply endorsed his belief that there was an opportunity in every crisis. “It tends to force you to rethink your business model, expense structures, the value that you are delivering to your clients and to all stakeholders. It forces you to restructure your thought process and implement a complete shift from the way you were working before,” he says. As a result, our costs have come down and volumes have grown in the last quarter, with a rise in renewals. Afterall, insurance by its very nature is a business that is meant to protect people from unseen risks that they face in their lives.”

Bajwa stated that his biggest learning from the pandemic is that organisations will need to think ahead of being forced into doing something. “The reactionary approach doesn't work at this scale and it doesn't work for extended periods,” he said.

From Sacheti’s perspective, the crisis has also given precedence to the need for the safety of employees and customers, like never before. “These days I keep introspecting on what is the best decision for everyone, in terms of safety, as businesses can’t really shut shop for a year or two or however long it takes. That would mean shutting down and going out of business completely.”

The panelists also spoke about sector-specific changes and challenges. According to Sancheti, there is an urgent need to fix the health care system. He realised that it is important to be extremely careful with employee health and well-being during a pandemic, since costs attached to Covid-19 treatment are high. “It is just unimaginable how an individual could take care of himself at such high costs. This is really something that must be fixed in our health care system,” he said.

Bajwa shared a fundamental observation he had gleaned from interactions with numerous clients in the technology sector: Business leaders accepted that technology is an enabler, irrespective of whether the organisation has legacy systems or was born a digital native. However, this crisis has demonstrated that digital cannot merely be a part of the strategy of organizations; it must become the core of the strategy. “Lay every aspect of your business on the table and see what can fundamentally be done differently. It will be easy to go back to doing the same thing but the opportunity lies in envisioning how you could build your company from scratch, if you were doing it today, without any legacy. If there is an opportunity to do things differently, this is it,” he said.

The discussion concluded with Bajwa elaborating on how technology presents another layer of opportunity for businesses. There would be a shift, he said, from buying technology to partnering for technology, which would provide a better fit for large and small corporates, going ahead. This, he explained, would take the pressure off companies to spend large amounts of capex on technology and get far better access to superior outcomes by accommodating such expenses within opex budgets.

The panelists agreed that Covid-19 will be remembered, among various other things, as an equaliser and an inadvertent democratiser of technology.

.jpg)

.jpg)